Correct Answer

verified

Correct Answer

verified

Multiple Choice

A treasurer is commonly responsible for handling ________.

A) tax management

B) corporate accounting

C) investing surplus funds

D) cost accounting

Correct Answer

verified

Correct Answer

verified

True/False

A higher earnings per share (EPS)does not necessarily translate into a higher stock price.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the risk of a stock investment increases,investors' ________.

A) return will increase

B) return will decrease

C) required rate of return will decrease

D) required rate of return will increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle of the time value of money basically says that ________.

A) because firms pay managers a great deal,managers need to use their time very effectively

B) money received today is more valuable than money received in the future because money in the future is more risky

C) money received today is more valuable than money received in the future because firms and individuals can invest money they have today and earn a return on that money

D) because of the principal-agent problem,investors cannot trust that money firms promise to pay in the future will ever arrive

Correct Answer

verified

Correct Answer

verified

True/False

The marginal tax rate paid on a firm's ordinary income can be calculated by dividing its taxes by its net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ decisions focus on how a company will spend its financial resources on long-term projects that ultimately determine whether the firm successfully creates value for its owners.

A) Investment

B) Financing

C) Working capital

D) Risk management

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a strength of a corporation?

A) low taxes

B) limited liability

C) low organization costs

D) less government regulation

Correct Answer

verified

Correct Answer

verified

True/False

Financing decisions deal with the left-hand side of the firm's balance sheet.

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's stockholders are risk averse,the firm can make its stockholders better off by earning the highest possible returns on its investments.

Correct Answer

verified

Correct Answer

verified

True/False

The marginal tax rate represents the rate at which the next dollar of income is taxed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of agency cost?

A) costs incurred for setting up an agency

B) failure to make an investment that would make shareholders wealthier

C) payment of income tax

D) payment of interest

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a reason that a firm that maximizes profits may fail to maximize shareholder wealth.

A) The timing of profits matters.Shareholders might prefer lower profits that arrive sooner.

B) Risk matters.Shareholders are risk averse,so they prefer less risky investments that generate lower profits.

C) Shareholder wealth depends on cash flow which is not the same as profit.

D) If a firm maximizes profits by engaging in unethical business practices,it's stock price may be adversely affected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a certain business pays 10% tax on its first $10,000 in come,12% tax on income above $10,000 but below $40,000,and 22% tax on income above $40,000.Suppose the business earns $50,000 in income this year.It's marginal tax rate is ________.

A) 10%

B) 12%

C) 22%

D) greater than 22%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Johnson,Inc.has just ended the calendar year making a sale in the amount of $10,000 of merchandise purchased during the year at a total cost of $7,000.Although the firm paid in full for the merchandise during the year,it is yet to collect at year end from the customer.The net profit and cash flow from this sale for the year are ________.

A) $3,000 and $10,000,respectively

B) $3,000 and -$7,000,respectively

C) $7,000 and -$3,000,respectively

D) $3,000 and $7,000,respectively

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax deductibility of various expenses such as general and administrative expenses ________.

A) increases their pretax cost

B) reduces their after-tax cost

C) has no effect on their after-tax cost

D) has an unpredictable effect on their after-tax cost

Correct Answer

verified

Correct Answer

verified

True/False

The accrual method recognizes revenue at the point of sale and recognizes expenses when incurred.

Correct Answer

verified

Correct Answer

verified

True/False

The treasurer typically manages a firm's cash,investing surplus funds when available and securing outside financing when needed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

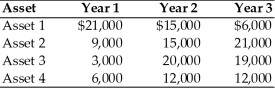

A financial manager must choose between four alternative Assets: 1,2,3,and 4.Each asset costs $35,000 and is expected to provide earnings over a three-year period as described below.  Based on the wealth maximization goal,the financial manager would choose ________.

Based on the wealth maximization goal,the financial manager would choose ________.

A) Asset 1

B) Asset 2

C) Asset 3

D) Asset 4

Correct Answer

verified

Correct Answer

verified

True/False

In finance we say that the goal of the firm ought to be to maximize profits.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 111

Related Exams