A) $40 per direct labor hour

B) 4.5 square feet per unit

C) $0.95 per square foot

D) 0.5 direct labor hours per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will result in an unfavorable direct materials efficiency variance?

A) The actual cost per unit of direct materials exceeded the standard cost of direct materials.

B) The actual cost per unit of direct materials was less than the standard cost of direct materials.

C) The actual quantity of direct materials used per unit exceeded the standard quantity of direct materials allowed per unit.

D) The actual quantity of direct materials used per unit was less than the standard quantity of direct materials allowed per unit.

Correct Answer

verified

Correct Answer

verified

Essay

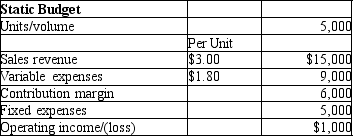

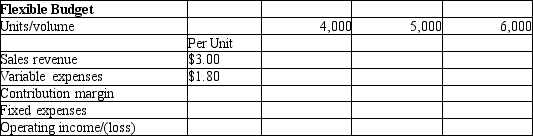

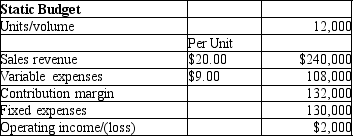

Portobello Company prepared the following static budget for the coming month:

Using the format below, please prepare a flexible budget including data at volumes of 4,000 and 6,000 units.

Using the format below, please prepare a flexible budget including data at volumes of 4,000 and 6,000 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

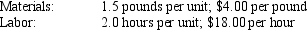

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:  During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the materials records showed that the company used 7,000 pounds of materials and actual total material costs were $29,750.

How much is the direct materials price variance?

During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the materials records showed that the company used 7,000 pounds of materials and actual total material costs were $29,750.

How much is the direct materials price variance?

A) $1,640 U

B) $2,000 F

C) $1,750 U

D) $2,020 F

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is one of the reasons why companies use standard costs?

A) To increase sales

B) To insure the accuracy of the financial records

C) To bolster good internal controls and prevent shrinkage

D) To make budgeting easier and more efficient

Correct Answer

verified

Correct Answer

verified

Multiple Choice

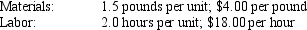

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:  During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the labor cost records showed that the company used 11,000 hours of direct labor and actual direct labor costs were $184,800. The direct labor efficiency variance was $18,000 U. Which of the following would be a logical explanation for this variance?

During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the labor cost records showed that the company used 11,000 hours of direct labor and actual direct labor costs were $184,800. The direct labor efficiency variance was $18,000 U. Which of the following would be a logical explanation for this variance?

A) The company used more labor hours than allowed by standards.

B) The company paid a higher rate for labor than allowed by standards.

C) The company used a higher quantity of materials than allowed by standards.

D) The company paid a higher price for the materials than allowed by standards.

Correct Answer

verified

Correct Answer

verified

Essay

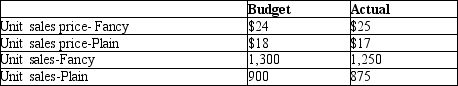

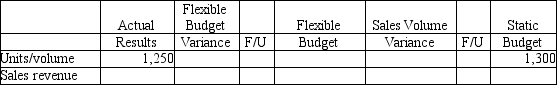

Shirt Fantasy produces and sells two types of tee shirtsFancy and Plain. Shirt Fantasy provides the following data:

Using the format below, compute the flexible budget variance for Fancy tee shirts for sales revenue only.

Using the format below, compute the flexible budget variance for Fancy tee shirts for sales revenue only.

Correct Answer

verified

Correct Answer

verified

True/False

Standard costs are developed by the cooperative effort of procurement, production, human resources, and accounting personnel.

Correct Answer

verified

Correct Answer

verified

True/False

In a standard costing system, each item has a price standard and a quantity standard.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is analyzing month-end results compared to both static and flexible budgets. This month the actual selling price was higher than projected in the static budget. What kind of variance would that produce?

A) Favorable flexible budget variance for sales revenues

B) Favorable sales volume variance for sales revenues

C) Unfavorable flexible budget variance for sales revenues

D) Unfavorable sales volume variance for sales revenues

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is NOT a reason for using standard costs?

A) To set performance targets

B) To strengthen internal controls over inventory

C) To decrease accounting costs

D) To make budgeting easier

Correct Answer

verified

Correct Answer

verified

Multiple Choice

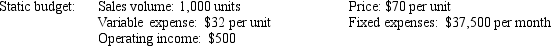

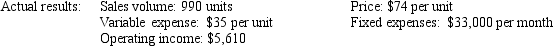

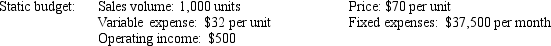

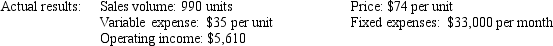

Onyx Company prepared a static budget at the beginning of the month. At the end of the month, the company is analyzing actual results versus budget using flexible budget methodology. Data are as follows:

Based on the above data, how much was the flexible budget variance for fixed expenses?

Based on the above data, how much was the flexible budget variance for fixed expenses?

A) $4,500 U

B) $4,500 F

C) $0

D) $5,490 F

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quality Brand Products uses standard costing to manage their direct costs and their overhead costs. Overhead costs are allocated based on direct labor hours. In the first quarter, Quality Brand had an unfavorable efficiency variance for their variable overhead costs. Which of the following scenarios would be a reasonable explanation for that variance?

A) The actual number of direct labor hours was lower than budgeted.

B) The actual costs were higher than budgeted.

C) The actual costs were lower than budgeted.

D) The actual number of direct labor hours was higher than budgeted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information describes a company's usage of direct labor in a recent period:  How much is the direct labor price variance?

How much is the direct labor price variance?

A) $84,000 favorable

B) $88,000 favorable

C) $88,000 unfavorable

D) $84,000 unfavorable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The production manager of a company, in an effort to gain a promotion, negotiated a new labor contract with her factory employees that required them to bear a greater percentage of benefit costs than before, thus bringing down the cost of direct labor to the company. Shortly afterward, several experienced and highly skilled workers resigned, and were replaced by new employees whose work was very slow during their training period. At the end of the quarter, the company's profits fell 10%. This situation could have produced which of the following variances?

A) Unfavorable materials price variance

B) Unfavorable labor price variance

C) Unfavorable labor efficiency variance

D) Favorable materials efficiency variance

Correct Answer

verified

Correct Answer

verified

True/False

When completing a standard costing income statement, unfavorable variances for direct materials or direct labor will go to reduce the "cost of goods sold at standard cost."

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ibis Company prepared the following static budget for the coming month:  If a flexible budget was prepared at a volume of 13,000 units, how much would the operating income be?

If a flexible budget was prepared at a volume of 13,000 units, how much would the operating income be?

A) $22,000

B) $17,500

C) $24,000

D) $13,000

Correct Answer

verified

Correct Answer

verified

True/False

When management is investigating overhead variances, they need to further determine whether cost increases were controllable or uncontrollable.

Correct Answer

verified

Correct Answer

verified

Essay

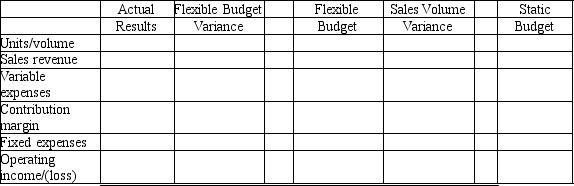

Onyx Company prepared a static budget at the beginning of the month. At the end of the month, the company is analyzing actual results versus budget using flexible budget methodology. Data are as follows:

Using the format below, please prepare an income statement performance report:

Using the format below, please prepare an income statement performance report:

Correct Answer

verified

Correct Answer

verified

True/False

When a company is using standard costs, only unfavorable variances need to be explained or investigated.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 166

Related Exams