Correct Answer

verified

Correct Answer

verified

Multiple Choice

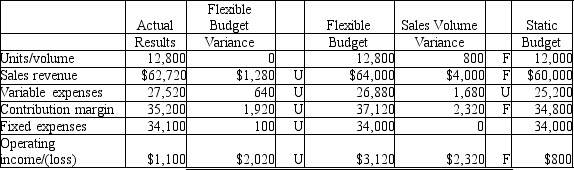

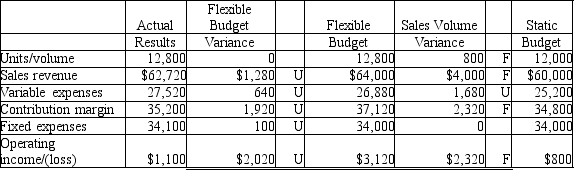

The Carolina Products Company has just completed a flexible budget analysis of 2nd quarter operating income, as shown here:  Based on the above data, which of the following statements would be a correct interpretation of the flexible budget variance for sales revenue?

Based on the above data, which of the following statements would be a correct interpretation of the flexible budget variance for sales revenue?

A) Decrease in price per unit

B) Increase in variable cost per unit

C) Increase in sales volume

D) Increase in fixed costs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Carolina Products Company has just completed a flexible budget analysis of 2nd quarter operating income, as shown here:  Based on the above data, which of the following statements would be a correct interpretation of the flexible budget variance for fixed expenses?

Based on the above data, which of the following statements would be a correct interpretation of the flexible budget variance for fixed expenses?

A) Decrease in price per unit

B) Increase in variable cost per unit

C) Increase in sales volume

D) Increase in fixed costs

Correct Answer

verified

Correct Answer

verified

True/False

The sales volume variance is the difference between the static budget and the flexible budget amounts, and is caused by actual sales volume being different than budgeted sales volume.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Global Engineering's actual operating income for the current year is $50,000. The flexible budget operating income for actual volume achieved is $40,000, while the static budget operating income is $53,000. What is the sales volume variance for operating income?

A) $13,000 favorable

B) $10,000 unfavorable

C) $13,000 unfavorable

D) $10,000 favorable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

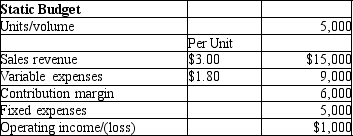

Portobello Company prepared the following static budget for the coming month:  If a flexible budget was prepared at a volume of 6,000, how much would the operating income be?

If a flexible budget was prepared at a volume of 6,000, how much would the operating income be?

A) ($200)

B) $500

C) $2,200

D) $1,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Georgia Custom Cabinet Company is setting standard costs for one of its products. The main material is cedar wood, sold by the board foot. The current cost of cedar wood is $2.00 per board foot from the supplier. Delivery costs are $0.25 per board foot. Carpenters' wages are $22.00 per hour. Payroll costs are $3.60 per hour and benefits are $3.00 per hour. How much is the direct materials price standard (per -board foot) ?

A) $2.25 per board foot

B) $2.00 per board foot

C) $1.75 per board foot

D) $22.00 per board foot

Correct Answer

verified

Correct Answer

verified

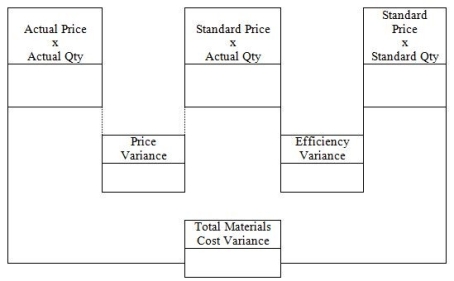

Essay

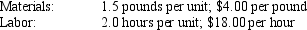

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:

During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the materials records showed that the company used 7,000 pounds of materials and actual total material costs were $29,750.

Using the format below, please prepare an analysis of the direct materials variances.

During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the materials records showed that the company used 7,000 pounds of materials and actual total material costs were $29,750.

Using the format below, please prepare an analysis of the direct materials variances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is TRUE about price variances and quantity (or efficiency) variances?

A) They pertain to the difference between the static budget and actual results.

B) They pertain to the difference between the flexible budget and actual results.

C) They pertain to the difference between the flexible budget and the static budget.

D) They pertain to the difference between the static budget and the previous year's actuals.

Correct Answer

verified

Correct Answer

verified

True/False

When a company is using standard costs, favorable variances are good news, and so the reasons for them do not need to be explained or investigated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:  During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the materials records showed that the company used 7,000 pounds of materials and actual total material costs were $29,750. The direct materials price variance was $1,750 U. Which of the following would be a logical explanation for this variance?

During the first quarter, Faas produced 5,000 units of this product. At the end of the quarter, an examination of the materials records showed that the company used 7,000 pounds of materials and actual total material costs were $29,750. The direct materials price variance was $1,750 U. Which of the following would be a logical explanation for this variance?

A) The company used more labor hours than allowed by standards.

B) The company paid a higher rate for labor than allowed by standards.

C) The company used greater quantity of materials than allowed by standards.

D) The company paid a higher price for the materials than allowed by standards.

Correct Answer

verified

Correct Answer

verified

True/False

The flexible budget is based on the actual number of outputs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

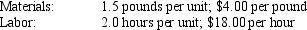

Atlantic Manufacturing Company uses standard costing methodology in their journal entries and accounts. Atlantic produced 3,000 units of product during the month. Data on standard costs and actuals are as follows:

The journal entry to transfer the cost to Finished goods from Work in process is to:

The journal entry to transfer the cost to Finished goods from Work in process is to:

A) debit WIP $117,600, credit Finished goods $117,600.

B) debit Finished goods $117,000, credit WIP $117,000.

C) debit WIP $117,600, credit Finished goods $117,000, credit WIP variance $600.

D) debit WIP $117,000, credit Finished goods $117,600, debit WIP variance $600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What do price variances measure?

A) The difference between the price the company pays and the price its competitors pay

B) The change in prices over time

C) The difference between actual and standard price

D) The volume discounts companies receive when ordering materials in large quantities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Faas Marine Stores Company manufactures decorative fittings for luxury yachts which require highly skilled labor, and special metallic materials. Faas uses standard costs to prepare its flexible budget. For the first quarter of 2011, direct material and direct labor standards for one of their popular products were as follows:  During the first quarter, Faas produced 5,000 units of this product. Actual direct materials costs were $29,750. Actual direct labor costs were $184,800.

For purposes of calculating the flexible budget variances, what is the direct labor cost variance?

During the first quarter, Faas produced 5,000 units of this product. Actual direct materials costs were $29,750. Actual direct labor costs were $184,800.

For purposes of calculating the flexible budget variances, what is the direct labor cost variance?

A) $3,200 F

B) $3,200 U

C) $4,800 F

D) $4,800 U

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following BEST describes sales volume variance?

A) Difference between actual amounts and the flexible budget due to differences in price and costs

B) Difference between the flexible budget and static budget due to differences in volumes

C) Difference between the static budget and actual amounts due to differences in price

D) Difference between the flexible budget and static budget due to differences in fixed expenses

Correct Answer

verified

Correct Answer

verified

Essay

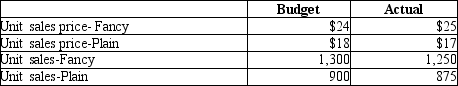

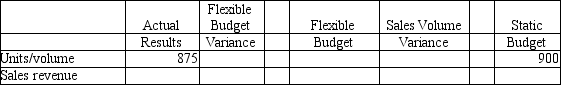

Shirt Fantasy produces and sells two types of tee shirtsFancy and Plain. Shirt Fantasy provides the following data:

Using the format below, compute the flexible budget variance for Plain tee shirts for sales revenue only.

Using the format below, compute the flexible budget variance for Plain tee shirts for sales revenue only.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following BEST describes flexible budget variance?

A) Difference between actual amounts and the flexible budget due to differences in price and costs

B) Difference between the flexible budget and static budget due to differences in volumes

C) Difference between the flexible budget and actual amounts due to differences in volumes

D) Difference between the flexible budget and static budget due to differences in fixed expenses

Correct Answer

verified

Correct Answer

verified

Multiple Choice

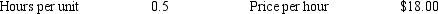

Atlantic Manufacturing Company uses standard costing methodology in their journal entries and accounts. Standards for direct labor are as follows:  Actual direct labor for the month: 1,200 hours for a total cost of $24,000

Planned production for the month: 3,000 units

The journal entry to record the usage of direct labor would be to:

Actual direct labor for the month: 1,200 hours for a total cost of $24,000

Planned production for the month: 3,000 units

The journal entry to record the usage of direct labor would be to:

A) debit WIP $27,000, credit Manufacturing wages $24,000, credit Labor efficiency variance $2,400.

B) debit WIP $21,600, credit Manufacturing wages $24,000, debit Labor price variance $2,400.

C) debit WIP $21,600, credit Manufacturing wages $27,000, debit Labor efficiency variance $5,400.

D) debit WIP $27,000, credit Manufacturing wages $21,600, credit Labor efficiency variance $5,400.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tiger's Golf Center reported actual operating income for the current year of $60,000. The flexible budget operating income for actual volume achieved is $55,000, while the static budget operating income is $58,000. What is the flexible budget variance for operating income?

A) $5,000 favorable

B) $3,000 unfavorable

C) $5,000 unfavorable

D) $2,000 favorable

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 166

Related Exams