Correct Answer

verified

Correct Answer

verified

True/False

The only condition under which risk can be reduced to zero is to find securities that are perfectly negatively correlated (ρ = −1.0) with each other.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Here are the expected returns on two stocks:  If you form a 50−50 portfolio of the two stocks, what is the portfolio's standard deviation?

If you form a 50−50 portfolio of the two stocks, what is the portfolio's standard deviation?

A) 8.1%

B) 10.5%

C) 13.4%

D) 16.5%

E) 20.0%

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

For markets to be in equilibrium, that is, for there to be no strong pressure for prices to depart from their current levels,

A) The expected rate of return must be equal to the required rate of return; that is, ![]() .

.

B) The past realized rate of return must be equal to the expected rate of return; that is, ![]() .

.

C) The required rate of return must equal the realized rate of return; that is, ![]() .

.

D) All three of the above statements must hold for equilibrium to exist; that is, ![]() .

.

E) None of the above statements is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You hold a diversified portfolio consisting of a $5,000 investment in each of 20 different common stocks.The portfolio beta is equal to 1.15.You have decided to sell one of your stocks, a lead mining stock whose β = 1.0, for $5,000 net and to use the proceeds to buy $5,000 of stock in a steel company whose β = 2.0.What will be the new beta of the portfolio?

A) 1.12

B) 1.20

C) 1.22

D) 1.10

E) 1.15

Correct Answer

verified

Correct Answer

verified

True/False

We will generally find that the beta of a diversified portfolio is more stable over time than the beta of a single security.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) The SML relates required returns to firms' systematic (or market) risk.The slope and intercept of this line cannot be controlled by the financial manager.

B) The slope of the SML is determined by the value of beta.

C) If you plotted the returns of a given stock against those of the market, and you found that the slope of the regression line was negative, the CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor, assuming that the observed relationship is expected to continue on into the future.

D) If investors become less risk averse, the slope of the Security Market Line will increase.

E) Statements a and c are both true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are an investor in common stock, and you currently hold a well-diversified portfolio which has an expected return of 12 percent, a beta of 1.2, and a total value of $9,000.You plan to increase your portfolio by buying 100 shares of AT&E at $10 a share.AT&E has an expected return of 20 percent with a beta of 2.0.What will be the expected return and the beta of your portfolio after you purchase the new stock?

A) ![]() = 20.0%; βp = 2.00

= 20.0%; βp = 2.00

B) ![]() = 12.8%; βp = 1.28

= 12.8%; βp = 1.28

C) ![]() = 12.0%; βp = 1.20

= 12.0%; βp = 1.20

D) ![]() = 13.2%; βp = 1.40

= 13.2%; βp = 1.40

E) ![]() = 14.0%; βp = 1.32

= 14.0%; βp = 1.32

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) An increase in expected inflation could be expected to increase the required return on a riskless asset and on an average stock by the same amount, other things held constant.

B) A graph of the SML would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

C) If two "normal" or "typical" stocks were combined to form a 2-stock portfolio, the portfolio's expected return would be a weighted average of the stocks' expected returns, but the portfolio's standard deviation would probably be greater than the average of the stocks' standard deviations.

D) If investors became more averse to risk, then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks.

E) The CAPM has been thoroughly tested, and the theory has been confirmed beyond any reasonable doubt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a difficulty concerning beta and its estimation?

A) Sometimes a security or project does not have a past history which can be used as a basis for calculating beta.

B) Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different than the "true" or "expected future" beta.

C) The beta of an "average stock," or "the market," can change over time, sometimes drastically.

D) Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed.

E) All of the above are potentially serious difficulties.

Correct Answer

verified

Correct Answer

verified

True/False

Investment risk can be measured by the variability of all the investment's returns, both "good" and "bad."

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A complete probability distribution is always an objective listing of all possible events.Since it is impossible to list all the possible outcomes from a single event, probability distributions are of limited benefit in assessing risk.

B) A peaked probability distribution centered around the expected value will make a stock more desirable, thereby increasing its expected return.

C) In the real world, there are an infinite number of possible states or outcomes that can occur.Thus, probability distributions actually are continuous; however, for simplicity, financial managers typically reduce the number of states for analysis to a manageable number.

D) Risk refers to the chance that some unfavorable event will occur while a probability distribution is completely described as a listing of the likelihood of unfavorable events.

E) The higher the probability that the return from an investment will pay off its average promised value the lower will be the expected return, regardless of the distribution of the investment's returns.

Correct Answer

verified

Correct Answer

verified

True/False

When comparing two stocks with the same standard deviation but the different expected returns, you must compute the coefficient of variation to determine which stock is preferred.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Berg Inc.has just paid a dividend of $2.00.Its stock is now selling for $48 per share.The firm is half as risky as the market.The expected return on the market is 14 percent, and the yield on U.S.Treasury bonds is 11 percent.If the market is in equilibrium, what rate of growth is expected?

A) 13%

B) 10%

C) 4%

D) 8%

E) −2%

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

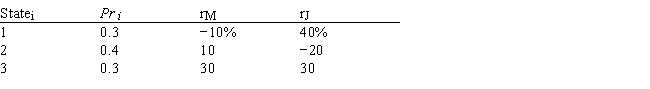

Given the following probability distributions, what are the expected returns for the Market and for Security J?

A) 10.0%; 11.3%

B) 9.5%; 13.0%

C) 10.0%; 9.5%

D) 10.0%; 13.0%

E) 13.0%; 10.0%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given the following information, determine which beta coefficient for Stock A is consistent with equilibrium:rs = 11.3%; rRF = 5%; rM = 10%

A) 0.86

B) 1.26

C) 1.10

D) 0.80

E) 1.35

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk averse investors require ____ rates of return for investments with ____ risk.

A) higher; lower

B) lower; higher

C) lower; lower

D) higher; higher

E) both c and d are correct

Correct Answer

verified

Correct Answer

verified

True/False

In a market dominated by risk-averse investors, riskier securities must have higher expected returns, as estimated by the average investor, than less risky securities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) If the returns from two stocks are perfectly positively correlated and the two stocks have equal variance, an equally weighted portfolio of the two stocks will have a variance which is less than that of the individual stocks.

B) If a stock has a negative beta, its expected return must be negative.

C) According to the CAPM, stocks with higher standard deviations of returns will have higher expected returns.

D) A portfolio with a large number of randomly selected stocks will have less market risk than a single stock which has a beta equal to 0.5.

E) None of the above statements is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Risk aversion implies that some securities will go unpurchased in the market even if a large risk premium is paid to investors.

B) When investors require higher rates of return for investments that demonstrate higher variability of returns, this is evidence of risk aversion.

C) Risk aversion implies a general dislike for risk, thus, the lower the expected return the higher the risk premium.

D) In comparing two firms that differ from each other only with respect to risk, the expected returns on the stock of the firms should be equal.

E) None of the above statements is correct.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 104

Related Exams