Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of January,Monroe Industries had completed 65,000

A) 1,600

B) 6,400

C) 4,800

D) 8,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a process costing system,when raw materials are moved into the mixing department,in which of the following balance sheet accounts is it recorded?

A) Raw materials inventory - mixing

B) Work in process inventory - mixing

C) Finished goods inventory - mixing

D) Cost of goods sold

Correct Answer

verified

Correct Answer

verified

True/False

Equivalent units EU of production is based on the percentage of completion for work in process inventory at the end of the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

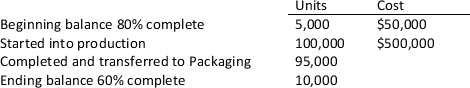

On December 31,Berry Company recorded the following information in the Mixing Department's Work in Process account:  Assume that the unfinished

Assume that the unfinished

A) $5.18

B) $5.23

C) $5.44

D) $5.55

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a difference between job order costing and process costing systems?

A) Companies that use a process costing system mass-produce identical products while companies that use a job order costing system produce many different types of products.

B) Companies that use a process costing system accumulate product costs throughout the production process while companies that use a job order costing system accumulate product cost only at the end of the production process.

C) Companies that use a process costing system accumulate direct material and manufacturing overhead,but not direct labor while companies that use a job order costing systems accumulate direct material,direct labor and manufacturing overhead.

D) Companies that use a job order costing system do not accumulate manufacturing overhead as part of the cost of production while companies that use a process costing system do include manufacturing overhead in product cost.

Correct Answer

verified

Correct Answer

verified

True/False

Companies that mass produce similar products or employ a continuous production process typically use a job order system.

Correct Answer

verified

Correct Answer

verified

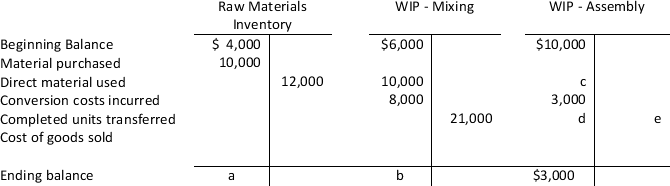

Essay

Fill in the missing data ignore indirect materials

Correct Answer

verified

Correct Answer

verified

True/False

Like process costing,job order costing makes no attempt to track an individual product's costs,all the products have similar costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To determine the equivalent

A) multiply the percentage of completion for each cost category by the number of physical units in the ending work in process inventory.

B) divide the percentage of completion for each cost category by the number of physical units in the ending work in process inventory.

C) add the cost of production to beginning work in process inventory and divide this total by the physical units transferred out.

D) multiply the number of physical

Correct Answer

verified

Correct Answer

verified

Showing 61 - 70 of 70

Related Exams