A) 10%

B) 20%

C) 40%

D) 60%

E) 80%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Self-directed retirement accounts aimed at self-employed persons include:

A) Keogh plans.

B) SEPs.

C) 401(k) plans.

D) a and b

E) a,b,and c

Correct Answer

verified

Correct Answer

verified

Short Answer

Choose the word or phrase in [ ] which will correctly complete the statement.Select "a" for the first item,"b" for the second item,and "c" if neither item will correctly complete the statement. -The [Roth | traditional] IRA is typically recommended for people in their 30s or 40s.

Correct Answer

verified

Correct Answer

verified

True/False

Reduced early retirement Social Security benefits can be received at age 60.

Correct Answer

verified

Correct Answer

verified

True/False

Annuity proceeds are limited to the life of one person.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a type of plan where the amount the employee receives at retirement is dependent on investment performance is a:

A) defined contribution plan.

B) defined benefit plan.

C) cash balance plan.

D) a and b

E) a,b,and c

Correct Answer

verified

Correct Answer

verified

True/False

One can contribute up to $10,000 annually to a 401(k)plan.

Correct Answer

verified

Correct Answer

verified

True/False

With a noncontributory pension plan,the employer makes no financial contribution to the account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of benefits received at retirement from your defined contribution retirement portfolio will depend on:

A) the age at which you begin contributing.

B) the amount of money you deposit each month.

C) the rate of return on your savings.

D) all of the above

E) none of these really make much difference.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

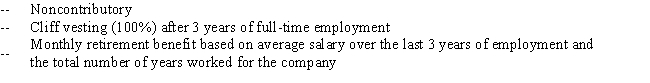

Melissa's retirement plan is described in her employee handbook as follows:  .Which of the following statements about this retirement plan is true?

.Which of the following statements about this retirement plan is true?

A) Melissa will have to contribute to the plan.

B) If Melissa leaves this company before working full-time for 3 years,she will not receive any benefits.

C) Melissa will have to make investment decisions regarding her retirement plan.

D) This is a defined contribution plan.

E) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Choose the word or phrase in [ ] which will correctly complete the statement.Select "a" for the first item,"b" for the second item,and "c" if neither item will correctly complete the statement. -A defined [contribution | benefit] retirement plan would usually be better for an older worker who has been employed for a long time with the same employer.

Correct Answer

verified

Correct Answer

verified

True/False

Eligibility requirements for pension and retirement plans are typically determined by the employee's age and years of service.

Correct Answer

verified

Correct Answer

verified

Short Answer

Choose the word or phrase in [ ] which will correctly complete the statement.Select "a" for the first item,"b" for the second item,and "c" if neither item will correctly complete the statement. -[Any gainfully employed person | Only certain employees] can put money into an IRA.

Correct Answer

verified

Correct Answer

verified

True/False

Qualified pension plans provide employees with tax benefits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following survivors of a fully insured worker,_____ would not be eligible for Social Security benefits.

A) spouse age 50,with dependent children

B) spouse age 47,no children

C) spouse age 65,with dependent children

D) spouse age 65,no children

E) spouse age 26,with dependent children

Correct Answer

verified

Correct Answer

verified

True/False

Single premium annuities result in single payment of proceeds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Employer matching contributions are common with _____ plans.

A) 401(k)

B) 403(b)

C) 457

D) a and b

E) a and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary Ann contributed $5,000 to her 401(k) plan.If Mary Ann is in the 15% marginal tax bracket,this retirement contribution saved her approximately _____ in federal income taxes.

A) $5,000

B) $4,250

C) $2,500

D) $ 750

E) $ 0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Henry has a defined benefit plan that promises an annual retirement benefit based on 2.5% of his final 5-year average annual salary for each year of service.At retirement Henry has 21 years of service and an average salary over the last 5 years of $95,000.What will his annual benefit be?

A) $95,000

B) $60,500

C) $49,875

D) $28,500

E) cannot determine

Correct Answer

verified

Correct Answer

verified

Multiple Choice

There are early withdrawal penalties for all of the following except:

A) Roth IRA contributions.

B) Traditional IRA contributions.

C) Annuity contributions.

D) SEP contributions.

E) 401(k) contributions.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 208

Related Exams