A) deferral

B) accrual

C) dividend

D) revenue

Correct Answer

verified

Correct Answer

verified

True/False

Adjustments for accruals are needed to record a revenue that has been earned or an expense that has been incurred but not recorded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the balance of a fixed asset account and the related accumulated depreciation account is termed

A) historical cost

B) contra asset

C) book value

D) market value

Correct Answer

verified

Correct Answer

verified

Multiple Choice

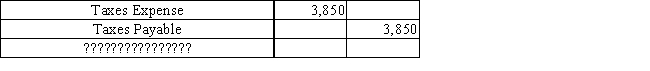

The following adjusting journal entry found in the journal is missing an explanation. Select the best explanation for the entry.

A) Record payment of taxes.

B) Record taxes expense incurred and to be paid in next period.

C) Record taxes paid in advance.

D) Record tax bill received from government.

Correct Answer

verified

B

Correct Answer

verified

True/False

A company receives $360 for a 12-month trade magazine subscription on August 1. The adjusting entry on December 31 is a debit to Unearned Subscription Revenue, $150, and a credit to Subscription Revenue, $150.

Correct Answer

verified

True

Correct Answer

verified

True/False

If the adjustment for accrued salaries at the end of the period is inadvertently omitted, both liabilities and stockholders' equity will be understated for the period.

Correct Answer

verified

Correct Answer

verified

Essay

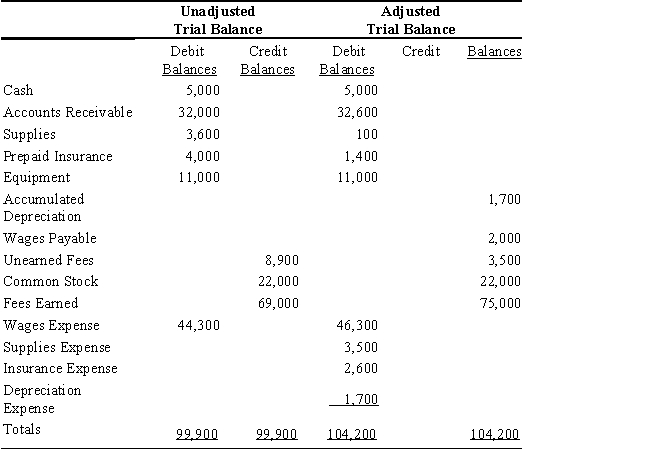

Journalize the six entries to adjust the accounts at December 31. (Hint: One of the accounts was affected by two different adjusting entries).

Correct Answer

verified

Correct Answer

verified

True/False

Even though GAAP requires the accrual basis of accounting, some businesses prefer using the cash basis of accounting.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to adjust the accounts for salaries accrued at the end of the accounting period is

A) debit Salaries Payable; credit Cash

B) debit Cash; credit Salaries Payable

C) debit Salaries Payable; credit Salaries Expense

D) debit Salaries Expense; credit Salaries Payable

Correct Answer

verified

Correct Answer

verified

Essay

The company determines that the interest expense on a note payable for the period ending December 31 is $775. This amount is payable on January 1. Prepare the journal entries required on December 31 and January 1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Data for an adjusting entry described as "accrued taxes, $950" requires a

A) debit to Taxes Expense and a credit to Unpaid Taxes Expense

B) debit to Retained Earnings and a credit to Taxes Expense

C) debit to Taxes Payable and a credit to Taxes Expense

D) debit to Taxes Expense and a credit to Taxes Payable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using accrual accounting, revenues are recorded

A) when cash is received without regard to when the services are performed or products have been delivered to customers

B) when a service has been performed or products have been delivered to customers without regard to when cash is received

C) when cash is received at the time services are performed or products have been delivered to customers

D) only if cash is received after the services are performed or products have been delivered to customers

Correct Answer

verified

Correct Answer

verified

True/False

At year-end, the balance in the prepaid insurance account, prior to any adjustments, is $6,000. The amount of the journal entry required to record insurance expense will be $4,000 if the amount of unexpired insurance applicable to future periods is $2,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The matching principle

A) addresses the relationship between the journal and the balance sheet

B) determines whether the normal balance of an account is a debit or credit

C) requires that the dollar amount of debits equal the dollar amount of credits on a trial balance

D) states that the revenues and related expenses should be reported in the same period

Correct Answer

verified

Correct Answer

verified

True/False

The matching principle supports matching expenses with the related revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is a balance in the prepaid rent account after adjusting entries are made, it represents a(n)

A) deferral

B) accrual

C) revenue

D) liability

Correct Answer

verified

Correct Answer

verified

Essay

At the end of April, the first month of the company's year, the usual adjusting entry transferring rent earned to a revenue account from the unearned rent account was omitted. Indicate which items will be incorrectly stated, because of the error, on (a) the income statement for April and (b) the balance sheet as of April 30. Also indicate whether the items in error will be overstated or understated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adjusting entries always include

A) only income statement accounts

B) only balance sheet accounts

C) the cash account

D) at least one income statement account and one balance sheet account

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business makes a loan payment on the 15th of each month. At the end of December, it has accrued 16 days worth of interest on the loan, which amounts to $450. The adjusting entry necessary at the end of the fiscal period ending December 31 would be recorded as a

A) debit to Interest Payable and a credit to Interest Expense of $450

B) debit to Prepaid Interest and a credit to Interest Expense of $450

C) debit to Interest Expense and a credit to Interest Payable of $450

D) debit to Interest Expense and a credit to Prepaid Interest of $450

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the fiscal year, the usual adjusting entry to prepaid insurance to record expired insurance was omitted. Which of the following statements is true?

A) total assets at the end of the year will be understated.

B) stockholders' equity at the end of the year will be understated.

C) net income for the year will be overstated.

D) insurance expense will be overstated

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 205

Related Exams