A) Sales salaries

B) Office salaries

C) Advertising expense

D) Sales salaries and Advertising expense

Correct Answer

verified

Correct Answer

verified

True/False

Most companies that prepare departmental income statements also prepare departmental balance sheets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the total gross profit of the company if there are three departments (A, B, and C) and the net sales are $200,000, $164,000, and $286,000, respectively, and cost of goods sold is $86,000, $92,000, and $82,000, respectively?

A) $390,000

B) $650,000

C) $400,000

D) $260,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If delivery expense is not traceable to a department, it would be considered a(n) :

A) direct expense.

B) indirect expense.

C) profit center issue.

D) cost center issue.

Correct Answer

verified

Correct Answer

verified

True/False

Indirect expenses are subjective in nature and may be allocated in a number of ways.

Correct Answer

verified

Correct Answer

verified

True/False

A department with sales of $120,000; cost of goods sold of $75,000; and operating expenses of $20,000 has a gross profit of $25,000.

Correct Answer

verified

Correct Answer

verified

Essay

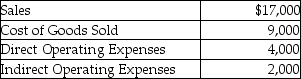

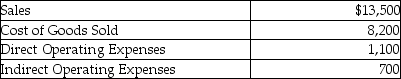

Hawkeye Golf is considering dropping the clothing department because it is not generating a profit as disclosed by the following data:

Note: None of the indirect expenses can be avoided by dropping the department.

Should Hawkeye drop the department? Show your computations.

Note: None of the indirect expenses can be avoided by dropping the department.

Should Hawkeye drop the department? Show your computations.

Correct Answer

verified

At this point the department is contribu...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

Indirect expenses are the same across departments and industries.

Correct Answer

verified

Correct Answer

verified

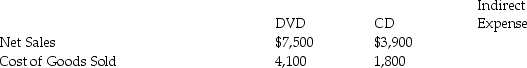

Essay

Given the following, calculate contribution margin and net income:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A line on the income statement that indicates what a department has left after covering cost of goods and sold and direct expenses is:

A) the gross margin.

B) the net income.

C) the contribution margin.

D) None of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A unit or department that incurs costs and generates revenues is a(n) :

A) expense center.

B) direct center.

C) cost center.

D) profit center.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute the contribution margin for the video department, when gross profit is $880,000, direct expenses $370,000, and indirect expenses are $190,000.

A) $320,000

B) $690,000

C) $510,000

D) $700,000

Correct Answer

verified

Correct Answer

verified

True/False

Departmental income statements would not be a useful to tool for management to determine the viability of a department.

Correct Answer

verified

Correct Answer

verified

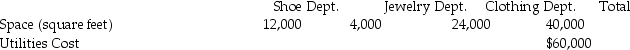

Essay

You have been hired by Jones to allocate his utilities to each department based on space (in square footage).

Complete the assignment.

Correct Answer

verified

Utilities Cost

Shoe: (12,000/4...View Answer

Show Answer

Correct Answer

verified

Shoe: (12,000/4...

View Answer

Multiple Choice

The espresso department experienced the following revenue and expenses during October:  The espresso departmental gross profit on sales is:

The espresso departmental gross profit on sales is:

A) $2,000.

B) $4,000.

C) $8,000.

D) $11,000.

Correct Answer

verified

Correct Answer

verified

Essay

Why would it be advisable for a company to keep separate accounting records for various departments?

Correct Answer

verified

Management needs to measure the efficien...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

If the property, plant, and equipment can be traced to a specific department, depreciation expense is a(n) :

A) direct expense.

B) indirect expense.

C) cash expense.

D) sales expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

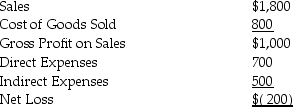

The candy department experienced the following revenue and expenses during October:  The candy departmental net income is:

The candy departmental net income is:

A) $6,400.

B) $3,500.

C) $4,200.

D) $5,300.

Correct Answer

verified

Correct Answer

verified

True/False

Direct expenses and indirect expenses are separated in determining contribution margin.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If gross sales for the tools department are $500,000 and gross sales for the appliances department are $300,000, what is the fraction used to apportion the indirect advertising for the appliances department if it is based on gross sales?

A) 1/2

B) 1/3

C) 3/8

D) 2/3

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 120

Related Exams