Correct Answer

verified

Correct Answer

verified

Multiple Choice

The date of record for cash dividends is:

A) the date the board of directors pays a dividend.

B) the date established by the board of directors that determines who will receive dividends.

C) the date that creates a liability for the company.

D) None of these answers are correct.

Correct Answer

verified

B

Correct Answer

verified

True/False

A prior period adjustment is corrected to the ending balance of Retained Earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock was purchased and recorded as an asset. This error would cause:

A) the period end assets to be understated.

B) the period end liabilities to be overstated.

C) the period end stockholders' equity to be overstated.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To record the purchase of treasury stock:

A) debit Treasury Stock-Common (par value) ; credit Cash (same) .

B) debit Treasury Stock-Common (purchase price) ; credit Cash (same) .

C) debit Treasury Stock-Common (par value) ; debit any difference to Paid-in Capital; credit Cash (purchase price) .

D) None of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following in not true about retained earnings?

A) Declaring a stock split will have no effect on retained earnings.

B) Appropriating retained earnings will have no effect on total stockholders' equity.

C) Distributing stock dividends will have no effect on retained earnings.

D) Declaring cash dividends will increase retained earnings.

Correct Answer

verified

Correct Answer

verified

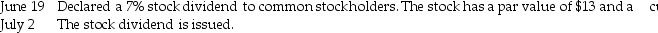

Essay

Prepare the following stock dividend journal entries for Tamera, Inc.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An exchange of one share of an old issue of stock for a multiple number of shares of a new issue of stock with reduced par value is known as a:

A) property dividend.

B) stock dividend.

C) stock split.

D) liquidating dividend.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the annual dividends on preferred stock, $20 par, 2,000 shares authorized, 700 shares issued, and a dividend rate of 5%?

A) $200

B) $20

C) $700

D) $70

Correct Answer

verified

Correct Answer

verified

True/False

Book value per share is found by dividing total assets by total stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

An appropriation to retained earnings reduces total assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The retained earnings section after a two-for-one stock split will:

A) be one-half as much after the split.

B) be double as much after the split.

C) not change after the split.

D) cannot be determined from the information given.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When treasury stock is purchased:

A) issued shares increase.

B) outstanding shares decrease.

C) authorized shares decrease.

D) None of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The board of Bogswell, Inc. declared a $2 per share cash dividend on common stock. The corporation has 4,000 shares of common stock outstanding. The entry required to distribute the dividend is:

A) debit Cash; credit Common Dividends Payable.

B) debit Common Dividends Payable; credit Cash.

C) debit Common Dividends Payable; credit Retained Earnings.

D) debit Cash Dividends; credit Common Dividends Payable.

Correct Answer

verified

Correct Answer

verified

True/False

Par value is the price per share a corporation pays to holders of stock when it is redeemed.

Correct Answer

verified

Correct Answer

verified

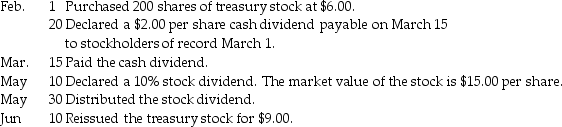

Essay

Baxter Corporation has 1,000 shares of $5 par value common stock issued and outstanding.

Journalize the following Baxter transactions for 20XX:

Correct Answer

verified

Correct Answer

verified

True/False

When treasury stock is sold, the Paid-in Capital in Excess of Par is returned.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Declaration of a cash dividend was recorded by debiting Operations Expense and crediting Cash. This error would cause:

A) the period end assets to be overstated.

B) the period end liabilities to be overstated.

C) the period end stockholders' equity to be understated.

D) None of the above are correct.

Correct Answer

verified

D

Correct Answer

verified

True/False

Common Stock Dividend Distributable is a liability account.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Ariel Investigations has total paid-in capital of $90,000 and retained earnings of $60,000. It has 200 shares of $100 par value common stock outstanding. The book value of each share of common stock is:

A) $750.

B) $450.

C) $300.

D) $600.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 123

Related Exams