A) single plantwide rate

B) multiple departmental rates

C) factory costing

D) activity-based costing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Determine the activity rate for procurement per purchase order.

A) $43.53

B) $18.50

C) $15.42

D) $37.00

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing can only be used to allocate manufacturing factory overhead.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scoresby Co.uses 6 machine hours and 2 direct labor hours to produce Product X.It uses 8 machine hours and 16 direct labor hours to produce Product Y.Scoresby's Assembly and Finishing departments have factory overhead rates of $240 per machine hour and $160 per direct labor hour, respectively.How much overhead cost will be charged to the two products?

A) Product X = $3,200; Product Y = $9,600

B) Product X = $800; Product Y = $800

C) Product X = $1,760; Product Y = $4,480

D) Product X = $1,440; Product Y = $2,560

Correct Answer

verified

Correct Answer

verified

True/False

Use of a plantwide factory overhead rate assumes that the activities causing overhead costs are the same across all departments and products.

Correct Answer

verified

Correct Answer

verified

True/False

Use of a plantwide factory overhead rate assumes that the activities causing overhead costs are different across different departments and products.

Correct Answer

verified

Correct Answer

verified

True/False

In an effort to simplify the multiple production department factory overhead rate method, the same rate can be used for all departments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will Challenger Factory allocate to regular widget production if budgeted production for the period is 75,000 units and actual production for the period is 72,000 units?

A) $168,750

B) $324,000

C) $162,000

D) $337,500

Correct Answer

verified

Correct Answer

verified

Essay

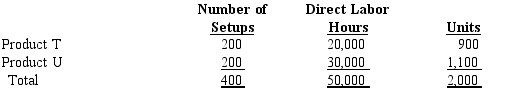

Tulip Company produces two products, T and U.The indirect labor costs include the following two items:

The following activity-base usage and unit production information is available for the two products:

The following activity-base usage and unit production information is available for the two products:

a Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

b Determine the factory overhead cost per unit for Products T and U, using the single plantwide factory overhead rate.

c Determine the activity rate for plant supervision and setup labor, assuming that the activity base for supervision is direct labor hours and the activity base for setup labor is number of setups.

d Determine the factory overhead cost per unit for Products T and U, using activity-based costing.

e Why is the factory overhead cost per unit different for the two products under the two methods?

a Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

b Determine the factory overhead cost per unit for Products T and U, using the single plantwide factory overhead rate.

c Determine the activity rate for plant supervision and setup labor, assuming that the activity base for supervision is direct labor hours and the activity base for setup labor is number of setups.

d Determine the factory overhead cost per unit for Products T and U, using activity-based costing.

e Why is the factory overhead cost per unit different for the two products under the two methods?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the budget estimates that a desk lamp will require 1 hours of finishing and 2 hours of production, how much factory overhead will the Kaumajet Factory allocate to each unit of desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours?

A) $11.10

B) $4.91

C) $5.00

D) $7.20

Correct Answer

verified

Correct Answer

verified

Essay

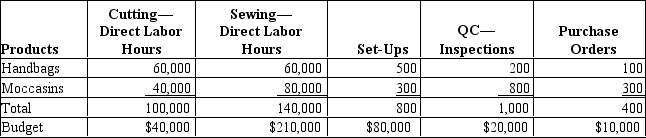

The Pikes Peak Leather Company manufactures leather handbags and moccasins.The company has been using the factory overhead rate method but has decided to evaluate activity based costing to allocate factory overhead.The factory overhead estimated per unit together with direct materials and direct labor will help determine selling prices.

Total budgeted factory overhead cost = $360,000

Calculate the amount of factory overhead to be allocated to each unit using activity based costing.The factory plans to produce 60,000 handbags and 40,000 moccasins.

Calculate the amount of factory overhead to be allocated to each unit using activity based costing.The factory plans to produce 60,000 handbags and 40,000 moccasins.

Correct Answer

verified

Correct Answer

verified

True/False

Multiple production department factory overhead rates are more accurate than are plantwide factory overhead rates.

Correct Answer

verified

Correct Answer

verified

True/False

When a plantwide factory overhead rate is used, overhead costs are applied to all products by a single rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shubelik Company is changing to an activity-based costing method.They have determined that they will use three cost pools: setups, inspections, and assembly.Which of the following would not be used as the activity base for any of these three activities?

A) number of units to be produced

B) number of setups

C) number of inspections

D) number of direct labor hours

Correct Answer

verified

Correct Answer

verified

Essay

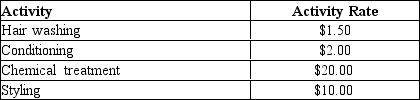

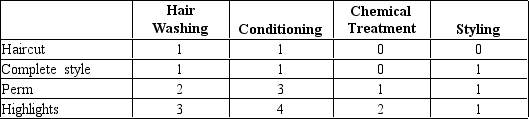

Transformations Hair Salon uses an activity-based costing system in its beauty salon to determine the cost of services.The salon has determined the costs of services by activity as follows:

a Using the information provided, determine the cost of services for each of the following services provided by the salon:

a Using the information provided, determine the cost of services for each of the following services provided by the salon:

b If the company budgets 10,000 haircuts, 4,000 complete styles, 3,500 perms, and 5,500 highlights, determine the budget for cost of services.

b If the company budgets 10,000 haircuts, 4,000 complete styles, 3,500 perms, and 5,500 highlights, determine the budget for cost of services.

Correct Answer

verified

Correct Answer

verified

True/False

Managers depend on product costing to make decisions regarding continuing operations and product mix.

Correct Answer

verified

Correct Answer

verified

True/False

Multiple production department factory overhead rates are less accurate than are plantwide factory overhead rates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the cost of services for a haircut.

A) $4.00

B) $7.50

C) $3.50

D) $11.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Determine the overhead from both production departments allocated to each unit of Product B if Blue Ridge Marketing Inc.uses a multiple department rate system.

A) $425.60 per unit

B) $115.20 per unit

C) $214.40 per unit

D) $320.00 per unit

Correct Answer

verified

Correct Answer

verified

True/False

A plantwide factory overhead rate assumes that all overhead is directly related to one activity representing the entire plant.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 110

Related Exams