Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chandler Corporation has 1 million shares outstanding.The current price per share is $20.If the company decides to pay a $2 million dollar dividend,the company will have ________ shares outstanding worth approximately ________.

A) 900,000,$20 per share

B) 1,000,000,$20 per share.

C) 900,000,$22.22 per share.

D) 1,000,000,$18 per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm that maintains stable cash dividends will generally not increase the dividend unless:

A) a stock split occurs.

B) the firm merges with another profitable firm.

C) the firm is sure that a higher dividend level can be maintained.

D) the price-earnings (P/E) ratio increased steadily over the past five years.

Correct Answer

verified

Correct Answer

verified

True/False

Due to the strengthening of the stock market over the past 50 years,stock splits and stock dividends are more common than cash dividends.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dividend policy is influenced by:

A) a company's investment opportunities.

B) a firm's capital structure mix.

C) a company's availability of internally generated funds.

D) all of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the following question(s) .

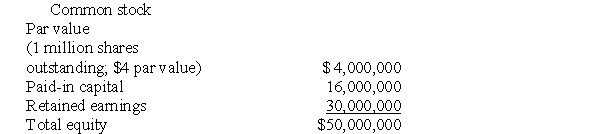

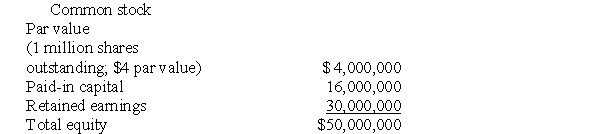

Your firm is planning a 2 for 1 stock split.The market price for the stock has been $84.The table below presents the equity portion of your firm's balance sheet before the split.

-Immediately after the stock split,an investor who owned 100 share before the split will own:

-Immediately after the stock split,an investor who owned 100 share before the split will own:

A) 100 shares worth a total of $4200.

B) 200 shares worth a total of $8400.

C) 200 shares worth a total of $16,800.

D) 200 shares with a par value of $8.00 each.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the following question(s) .

Your firm is planning a 2 for 1 stock split.The market price for the stock has been $84.The table below presents the equity portion of your firm's balance sheet before the split.

-Immediately after the stock split,the stock price will be approximately:

-Immediately after the stock split,the stock price will be approximately:

A) $42.

B) $84.

C) $2.00.

D) $8.00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If investor's expect a 15% rate of return on their investment,they will be indifferent between a $1.00 dividend received immediately or:

A) $1.15 received at the end of the year.

B) $1.00 received later.

C) $0.87 received at the end of the year.

D) $1.00 increase in the stock price a year later.

Correct Answer

verified

Correct Answer

verified

True/False

Dividends per share divided by earnings per share (EPS)equals the dividend retention date.

Correct Answer

verified

Correct Answer

verified

True/False

There is absolutely no difference on an economic basis between a stock dividend and a stock split.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In practice,firms tend to increase their dividend:

A) when the stock seems to be underpriced in the market.

B) Reducing cash to force executives to focus on efficient investment decisions.

C) only when they believe they can sustain the increased payout indefinitely.

D) when company is holding more cash than it would like.

Correct Answer

verified

Correct Answer

verified

True/False

As a firm's investment opportunities increase,the dividend payout ratio should increase.

Correct Answer

verified

Correct Answer

verified

Essay

You are considering the stock of two firms to add to your portfolio.The companies differ only with respect to their dividend policies.For both firms,investors expect EPS for each of the next two years to be $7 and dividends and ending price for each of the next two periods to be:  The required rate of return for the stock of Firm A is 14%.Ignore taxes or transaction fees.

a.How much would investors pay for the stock of Firm A?

b.How much would investors pay for the stock of Firm B?

c.For a less-than-perfect world,provide an argument for each of the following:

(1)Investors prefer the dividend policy of Firm A.

(2)Investors prefer the dividend policy of Firm B.

(3)Firms prefer the dividend policy of Firm A.

The required rate of return for the stock of Firm A is 14%.Ignore taxes or transaction fees.

a.How much would investors pay for the stock of Firm A?

b.How much would investors pay for the stock of Firm B?

c.For a less-than-perfect world,provide an argument for each of the following:

(1)Investors prefer the dividend policy of Firm A.

(2)Investors prefer the dividend policy of Firm B.

(3)Firms prefer the dividend policy of Firm A.

Correct Answer

verified

Correct Answer

verified

True/False

A stock dividend increases a firm's retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following dividend policies would cause dividends per share to fluctuate the most?

A) Residual dividend policy

B) Stable dollar dividend

C) Small,low,regular dividend plus a year-end extra

D) Small,low,regular dividend

Correct Answer

verified

Correct Answer

verified

True/False

The dividend declaration date is the date at which the stock transfer books are to be closed for determining the investor to receive the next dividend payment.

Correct Answer

verified

Correct Answer

verified

True/False

A firm with high profitability will always have the cash flow necessary to pay high dividends.

Correct Answer

verified

Correct Answer

verified

True/False

The timing of dividend payments will not matter if the firm's rate of return on equity and the investor's required rate of return are the same.

Correct Answer

verified

Correct Answer

verified

True/False

Unexpected dividend changes would cause investors to reassess their perceptions about a firm's stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock repurchase increases the:

A) retention ratio of earnings.

B) number of shares outstanding.

C) EPS.

D) both B and C.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 130

Related Exams