A) New York Exchange Index

B) Standard and Poor's Index

C) American Stock Exchange Index

D) NASDAQ Series Index

E) Wilshire Equity Index

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The actual index movements are typically based on the arithmetic mean of the percent changes in price or value for the stocks in the

A) equally-weighted index.

B) price-weighted index.

C) unweighted index.

D) value-weighted index.

E) over-weighted index.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the percentage return in the price weighted series for the period Dec 31, 2000 to Dec 31, 2004.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the percentage return in the price weighted series for the period Dec 31, 2000 to Dec 31, 2004.

A) 12.68 percent

B) 20.00 percent

C) 21.76 percent

D) 33.33 percent

E) 40.00 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

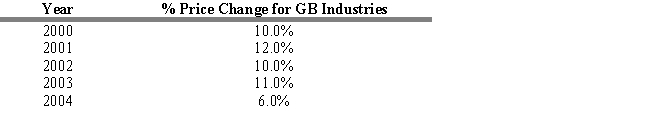

-Refer to Exhibit 4.3. Calculate the average annual rate of change for GB Industries for the five-year period using the arithmetic mean.

-Refer to Exhibit 4.3. Calculate the average annual rate of change for GB Industries for the five-year period using the arithmetic mean.

A) 0.098%

B) 9.80%

C) 8.50%

D) 8.00%

E) 89.00%

Correct Answer

verified

Correct Answer

verified

True/False

Exchange-Traded Funds (ETF) are depository receipts that give investors a pro rata claim on the capital gains and cash flows of securities held by financial institutions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

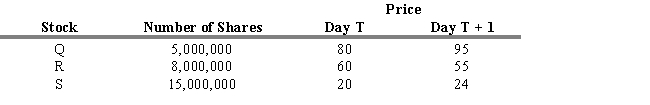

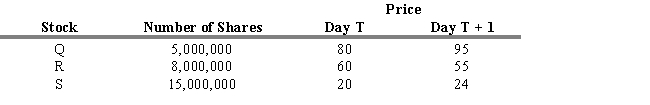

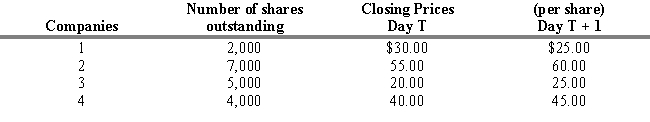

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.6. If an equal-weighted index is constructed on Day T with $10,000 in each stock, what is the percentage change in wealth for this index on Day T + 1? Assume a base index value of 100 on Day T.

-Refer to Exhibit 4.6. If an equal-weighted index is constructed on Day T with $10,000 in each stock, what is the percentage change in wealth for this index on Day T + 1? Assume a base index value of 100 on Day T.

A) 8.65 percent

B) 10.14 percent

C) 15.69 percent

D) 30.42 percent

E) 47.08 percent

Correct Answer

verified

Correct Answer

verified

True/False

A price weighted series is disproportionately influenced by larger capitalization companies.

Correct Answer

verified

Correct Answer

verified

True/False

The low correlations between the U.S. and Japan confirm the benefit of global diversification.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2003, prior to the splits.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2003, prior to the splits.

A) 81.69

B) 100.0

C) 72.5

D) 121.25

E) 119.25

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. What is the divisor at the beginning of January 14th?

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. What is the divisor at the beginning of January 14th?

A) 3.0

B) 2.5

C) 2.2734

D) 1.9375

E) 3.2852

Correct Answer

verified

Correct Answer

verified

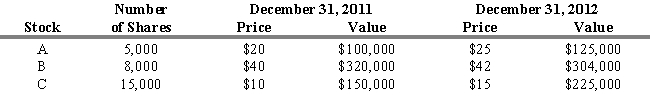

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.7. What would be the total percentage change in an equally weighted portfolio of ABC?

-Refer to Exhibit 4.7. What would be the total percentage change in an equally weighted portfolio of ABC?

A) 13.33 percent

B) 18.67 percent

C) 23.41 percent

D) 26.67 percent

E) 36.83 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is TRUE of the various market index series?

A) A low correlation exists between the U.S. indexes and those of Japan.

B) The NYSE series have higher rates of return and risk measures than the AMEX and OTC series.

C) A low correlation exists between alternative series that include almost all NYSE stocks.

D) A low correlation exists between alternative bond series.

E) None of these are correct.

Correct Answer

verified

Correct Answer

verified

True/False

The NYSE series should have higher rates of return and risk measures than the AMEX and OTC series.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.6. Compute the arithmetic mean of the price change of Stocks Q, R, and S from days T to T + 1.

-Refer to Exhibit 4.6. Compute the arithmetic mean of the price change of Stocks Q, R, and S from days T to T + 1.

A) 8.65 percent

B) 10.14 percent

C) 15.69 percent

D) 30.42 percent

E) 47.08 percent

Correct Answer

verified

Correct Answer

verified

True/False

An equally weighted indicator series is also known as an unweighted indicator series.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Ryan Treasury Index is an example of a

A) bond market indicator series.

B) stock market indicator series.

C) composite security market series.

D) world market series.

E) commodity market series.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.1. For a value-weighted series, assume that Day T is the base period and the base value is 100. What is the new index value for Day T + 1, and what is the percentage change in the index from Day T?

-Refer to Exhibit 4.1. For a value-weighted series, assume that Day T is the base period and the base value is 100. What is the new index value for Day T + 1, and what is the percentage change in the index from Day T?

A) 106.33, 6.33 percent

B) 107.48, 7.48 percent

C) 109.93, 9.93 percent

D) 108.7, 8.7 percent

E) 107.56, 7.3 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a price weighted average for January 16th.

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a price weighted average for January 16th.

A) 30

B) 32

C) 34

D) 36.13

E) No37

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2004. Assume a base index value of 100. The base year is Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2004. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 121.25

B) 100.0

C) 81.69

D) 72.5

E) 120.0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A properly selected sample for use in constructing a market indicator series will consider the sample's source, size, and

A) breadth.

B) average beta.

C) value.

D) variability.

E) dividend record.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 89

Related Exams