A) 12.04%

B) 12.83%

C) 13.07%

D) 15.89%

E) 17.91%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

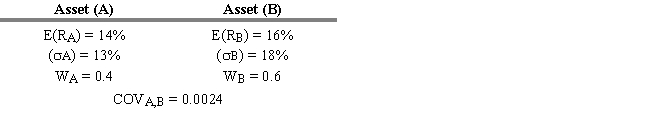

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.15. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

-Refer to Exhibit 6.15. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

A) 13.8%

B) 14.6%

C) 15.0%

D) 15.2%

E) 16.8%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.6. What is the standard deviation of this portfolio?

-Refer to Exhibit 6.6. What is the standard deviation of this portfolio?

A) 6.08%

B) 5.89%

C) 7.06%

D) 6.54%

E) 7.26%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

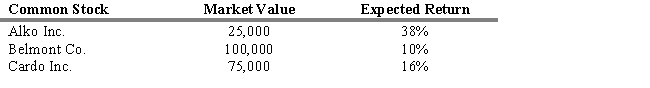

What is the expected return of the three-stock portfolio described below?

A) 21.33%

B) 12.50%

C) 32.00%

D) 15.75%

E) 16.80%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Markowitz model is based on several assumptions regarding investor behavior. Which of the following is NOT such any assumption?

A) Investors consider each investment alternative as being represented by a probability distribution of expected returns over some holding period.

B) Investors maximize one-period expected utility.

C) Investors estimate the risk of the portfolio on the basis of the variability of expected returns.

D) Investors base decisions solely on expected return and risk.

E) None of these are correct (that is, all are assumptions of the Markowitz model) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

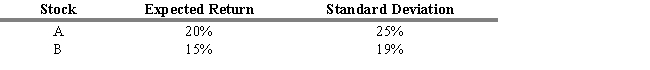

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What percentage of stock A should be invested to obtain the minimum risk portfolio that contains stock A and B?

-Refer to Exhibit 6.14. What percentage of stock A should be invested to obtain the minimum risk portfolio that contains stock A and B?

A) 35%

B) 42%

C) 58%

D) 65%

E) 72%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

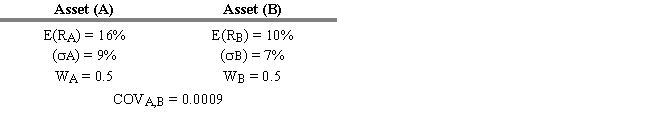

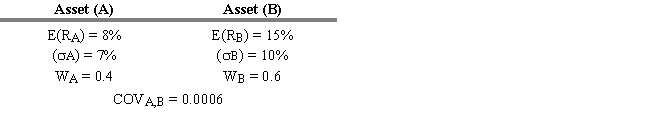

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.5. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

-Refer to Exhibit 6.5. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

A) 8.0%

B) 12.2%

C) 7.4%

D) 9.1%

E) 11.6%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

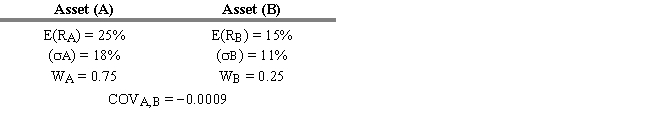

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.2. What is the standard deviation of this portfolio?

-Refer to Exhibit 6.2. What is the standard deviation of this portfolio?

A) 5.45%

B) 18.64%

C) 20.0%

D) 22.5%

E) 13.65%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the correlation coefficient is FALSE?

A) The values range between -1 to +1.

B) A value of +1 implies that the returns for the two stocks move together in a completely linear manner.

C) A value of -1 implies that the returns move in a completely opposite direction.

D) A value of zero means that the returns are independent.

E) A value of zero means that the returns had no linear relationship.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does WRF = - 0.50 mean?

A) The investor can borrow money at the risk-free rate.

B) The investor can lend money at the current market rate.

C) The investor can borrow money at the current market rate.

D) The investor can borrow money at the prime rate of interest.

E) The investor can lend money at the prime rate of interest.

Correct Answer

verified

Correct Answer

verified

True/False

The portfolios on the capital market line are combinations of the risk-free asset and the market portfolio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The correlation coefficient between the market return and a risk-free asset would

A) be + .

B) be - .

C) be +1.

D) be -1.

E) be zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All portfolios on the capital market line are

A) perfectly positively correlated.

B) perfectly negatively correlated.

C) unique from each other.

D) weakly correlated.

E) unrelated except that they contain the risk-free asset.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

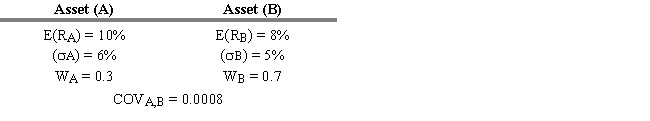

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.4. What is the standard deviation of this portfolio?

-Refer to Exhibit 6.4. What is the standard deviation of this portfolio?

A) 5.02%

B) 3.88%

C) 6.21%

D) 4.04%

E) 5.64%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market portfolio consists of all

A) New York Stock Exchange stocks.

B) high grade stocks and bonds.

C) stocks and bonds.

D) U.S. and non-U.S. stocks and bonds.

E) risky assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

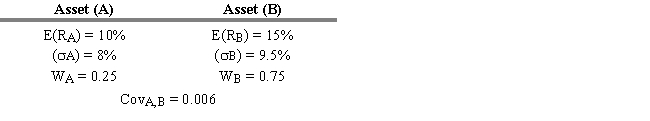

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.1. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

-Refer to Exhibit 6.1. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

A) 8.79%

B) 12.5%

C) 13.75%

D) 7.72%

E) 12%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a two-stock portfolio, if the correlation coefficient between two stocks were to decrease over time, everything else remaining constant, the portfolio's risk would

A) decrease.

B) remain constant.

C) increase.

D) fluctuate positively and negatively.

E) be a negative value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A completely diversified portfolio would have a correlation with the market portfolio that is

A) equal to zero because it has only unsystematic risk.

B) equal to one because it has only systematic risk.

C) less than zero because it has only systematic risk.

D) less than one because it has only unsystematic risk.

E) less than one because it has only systematic risk.

Correct Answer

verified

Correct Answer

verified

True/False

In a three-asset portfolio, the standard deviation of the portfolio is one-third of the square root of the sum of the individual standard deviations.

Correct Answer

verified

Correct Answer

verified

True/False

The capital market line is the tangent line between the risk-free rate of return and the efficient frontier.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 114

Related Exams