Correct Answer

verified

Correct Answer

verified

Multiple Choice

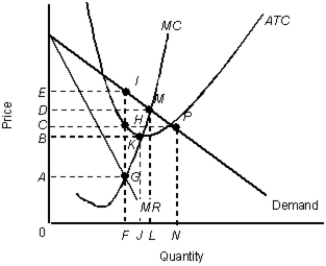

The figure given below shows the revenue and cost curves of a monopolistically competitive firm.Figure 12.4

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-If firms are successful in product differentiation:

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-If firms are successful in product differentiation:

A) their demand will become relatively elastic.

B) consumers will believe that the firms are producing more or less identical goods.

C) they can raise their prices without losing all of their customers to rivals.

D) they tend to face a horizontal demand curve.

E) they gradually emerge as price takers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

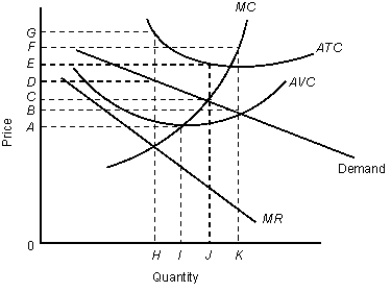

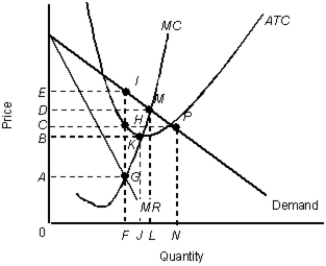

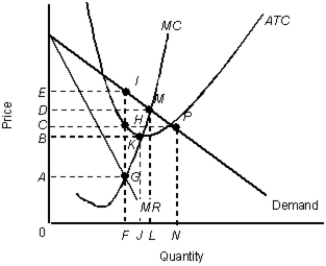

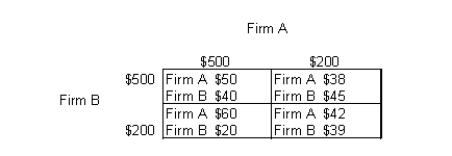

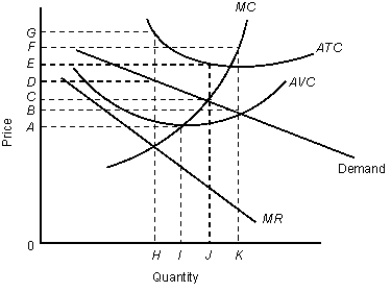

The figure given below shows revenue and cost curves of a monopolistically competitive firm.Figure: 12.1

In the figure,

MR: Marginal revenue curve

ATC: Average total cost curve

AVC: Average variable cost curve

MC: Marginal cost curve

-Consider the monopolistically competitive firm described in the Figure 12.1. The profit-maximizing output level and price are _____ and _____ respectively.

In the figure,

MR: Marginal revenue curve

ATC: Average total cost curve

AVC: Average variable cost curve

MC: Marginal cost curve

-Consider the monopolistically competitive firm described in the Figure 12.1. The profit-maximizing output level and price are _____ and _____ respectively.

A) 0; 0

B) H; D

C) I; A

D) J; C

E) J; E

Correct Answer

verified

Correct Answer

verified

Multiple Choice

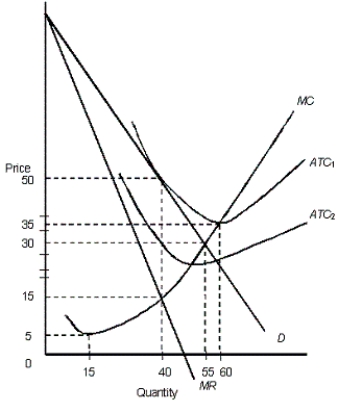

The figure below shows the revenue and cost curves of a monopolistically competitive firm.Figure: 12.2

In the figure,

D: Demand curve

MR: Marginal revenue curve

ATC1 and ATC2: Average total cost curves

MC: Marginal cost curve

-If economic losses exist in a monopolistically competitive market,

In the figure,

D: Demand curve

MR: Marginal revenue curve

ATC1 and ATC2: Average total cost curves

MC: Marginal cost curve

-If economic losses exist in a monopolistically competitive market,

A) new products will be introduced.

B) new firms will enter the market because they see potential for profit in the future.

C) firms will exit the market and the existing firms' demand curves will shift to the left.

D) the average total cost curve must lie below the demand curve.

E) firms will exit the market and existing firms' demand curves will shift to the right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

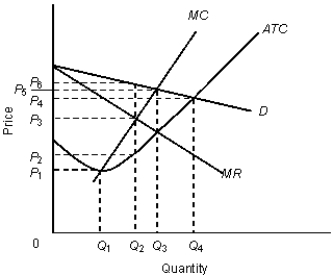

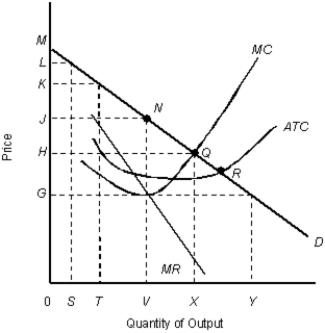

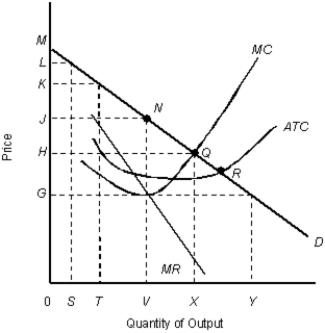

The figure given below shows the revenue and cost curves of a monopolistically competitive firm.Figure: 12.3

In the figure,

D: Demand curve

MR: Marginal revenue curve

MC: Marginal cost curve

ATC: Average total cost curve

-The monopolistically competitive firm, in Figure 12.3, will maximize profits (or minimize losses) by producing _____ levels of output at a price of _____.

In the figure,

D: Demand curve

MR: Marginal revenue curve

MC: Marginal cost curve

ATC: Average total cost curve

-The monopolistically competitive firm, in Figure 12.3, will maximize profits (or minimize losses) by producing _____ levels of output at a price of _____.

A) Q2; P6

B) Q1; P1

C) Q2; P2

D) Q3; P3

E) Q4; P5

Correct Answer

verified

Correct Answer

verified

Multiple Choice

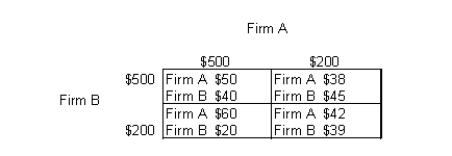

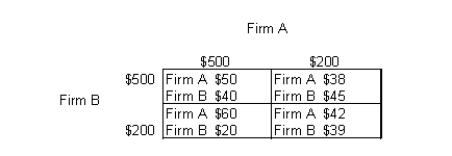

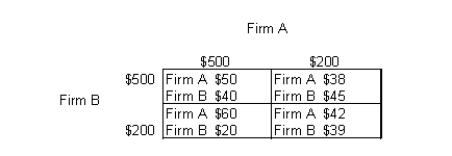

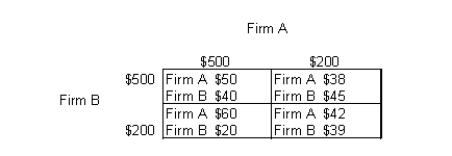

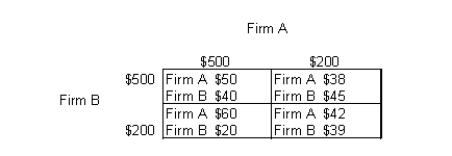

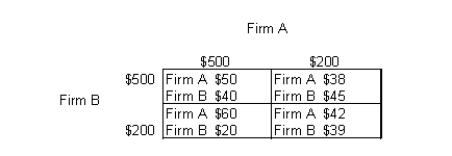

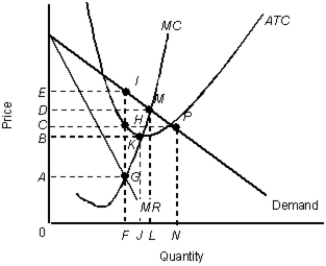

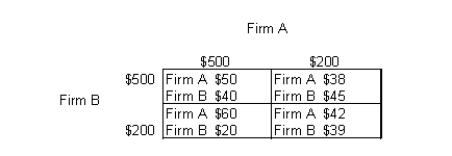

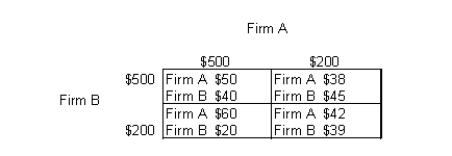

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms) .Table 12.2

-When firms use cost-plus pricing in a market,

-When firms use cost-plus pricing in a market,

A) each firm determines its price based on other firms' costs and prices.

B) it may appear as though firms are colluding in price when they actually are not.

C) prices of different firms diverge widely.

D) each firm falls short of maximizing profit as they charge the same price irrespective of their costs.

E) each firm sells only to its most-favored customer.

Correct Answer

verified

Correct Answer

verified

True/False

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms).Table 12.2

-Both monopolistically and perfectly competitive firms earn only normal profits in the long run.

-Both monopolistically and perfectly competitive firms earn only normal profits in the long run.

Correct Answer

verified

Correct Answer

verified

True/False

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms).Table 12.2

-If new firms enter a monopolistically competitive industry, the demand facing a typical firm increases.

-If new firms enter a monopolistically competitive industry, the demand facing a typical firm increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figure given below shows the revenue and cost curves of a monopolistically competitive firm.Figure 12.4

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-Which of the following theories applies to strategic behavior?

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-Which of the following theories applies to strategic behavior?

A) Field Theory

B) Game Theory

C) Theory of Consumers' Behavior

D) Social Contract Theory

E) Rational Choice Theory

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figure given below shows the cost and revenue curves of a monopolist.Figure 11.9

D: Average revenue

MR: Marginal revenue

ATC: Average total cost

MC: Marginal cost

-In the short-run, a monopolistically competitive firm:

D: Average revenue

MR: Marginal revenue

ATC: Average total cost

MC: Marginal cost

-In the short-run, a monopolistically competitive firm:

A) can earn only a normal profit.

B) will produce at the point where marginal revenue is greater than marginal cost, in order to maximize profits.

C) will produce at the point at which price equals minimum ATC, to maximize profits.

D) will charge a price equal to its marginal revenue.

E) will shut down temporarily if price is less than AVC.

Correct Answer

verified

Correct Answer

verified

True/False

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms).Table 12.2

-The monopolistically competitive firm will charge a price which is more than that charged by a perfectly competitive firm.

-The monopolistically competitive firm will charge a price which is more than that charged by a perfectly competitive firm.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figure given below shows the revenue and cost curves of a monopolistically competitive firm.Figure 12.4

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-One major similarity between perfect competition and monopolistic competition is that:

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-One major similarity between perfect competition and monopolistic competition is that:

A) the firms earn above normal profits in the long run.

B) the firms are price makers.

C) the firms produce identical products.

D) the firms just break even in the long run.

E) entry of firms is barred in the long run.

Correct Answer

verified

Correct Answer

verified

True/False

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms).Table 12.2

-In a price-leadership oligopoly model, the oligopoly firms engage in price wars.

-In a price-leadership oligopoly model, the oligopoly firms engage in price wars.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms) .Table 12.2

-According to Table 12.2, if firm A follows its dominant strategy but firm B does not, then firm A earns a profit of:

-According to Table 12.2, if firm A follows its dominant strategy but firm B does not, then firm A earns a profit of:

A) $50.

B) $40.

C) $60.

D) $45.

E) $42.

Correct Answer

verified

Correct Answer

verified

True/False

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms).Table 12.2

-Firms develop brand names in order to make the demand for their product more elastic.

-Firms develop brand names in order to make the demand for their product more elastic.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figure given below shows the revenue and cost curves of a monopolistically competitive firm.Figure 12.4

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-Which of the following is true of the model of monopolistic competition?

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-Which of the following is true of the model of monopolistic competition?

A) Barriers to entry enable firms to enjoy positive profits in the long run.

B) The number of firms declines over time as a result of economies of scale.

C) The monopolistically competitive firms enjoy a greater market power than a monopolist.

D) Firms tend to locate near each other in order to minimize total travel costs for consumers.

E) The firms end up charging same prices for their individual products.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms) .Table 12.2

-The Gulf Cartel and Sinaloa Cartel are the two major cartels in illegal drug trade in Mexico. Although, each of these cartels are better off sharing the market, they have an incentive to try to take the entire market. In which of the following ways is cheating among these cartel members dealt with in this region?

-The Gulf Cartel and Sinaloa Cartel are the two major cartels in illegal drug trade in Mexico. Although, each of these cartels are better off sharing the market, they have an incentive to try to take the entire market. In which of the following ways is cheating among these cartel members dealt with in this region?

A) Through government taxation policy

B) Through legally enforceable contracts

C) Through restrictions on the supply of inputs used by the firms

D) Through output quota and price ceiling

E) Through violence and drug wars

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figure given below shows the cost and revenue curves of a monopolist.Figure 11.9

D: Average revenue

MR: Marginal revenue

ATC: Average total cost

MC: Marginal cost

-A monopolistically competitive firm's demand curve slopes downward because:

D: Average revenue

MR: Marginal revenue

ATC: Average total cost

MC: Marginal cost

-A monopolistically competitive firm's demand curve slopes downward because:

A) new firms are free to enter the market.

B) there are a large number of firms in the market.

C) a differentiated product gives the firm some monopoly power.

D) the firm has complete information about the market.

E) the firm sells a standardized product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figure given below shows revenue and cost curves of a monopolistically competitive firm.Figure: 12.1

In the figure,

MR: Marginal revenue curve

ATC: Average total cost curve

AVC: Average variable cost curve

MC: Marginal cost curve

-According to Figure 12.1, the profit-maximizing firm is making an average:

In the figure,

MR: Marginal revenue curve

ATC: Average total cost curve

AVC: Average variable cost curve

MC: Marginal cost curve

-According to Figure 12.1, the profit-maximizing firm is making an average:

A) profit on each unit produced, equal to the distance BG.

B) loss on each unit produced, equal to the distance BG.

C) profit on each unit produced, equal to the distance CE.

D) loss on each unit produced, equal to the distance DG.

E) loss on each unit produced, equal to the distance AC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms) .Table 12.2

-In order to survive, cartels must be able to enforce contracts. However, when a cartel is trading in an illegal commodity:

-In order to survive, cartels must be able to enforce contracts. However, when a cartel is trading in an illegal commodity:

A) it can use the judicial system to enforce contracts.

B) it relies on altruism of members to enforce contracts.

C) it is inherently stable because the market is underground.

D) violence becomes a means of contract enforcement.

E) authorities are effective in preventing the trade.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 114

Related Exams