A) The capital structure that maximizes the stock price is generally the capital structure that also maximizes earnings per share.

B) All else equal, an increase in the corporate tax rate would tend to encourage a company to increase its debt ratio.

C) Since debt financing raises the firm's financial risk, increasing a company's debt ratio will always increase its WACC.

D) Since debt is cheaper than equity, increasing a company's debt ratio will always reduce its WACC.

E) When a company increases its debt ratio, the costs of equity and debt both increase. Therefore, the WACC must also increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT, holding other things constant?

A) An increase in the personal tax rate is likely to increase the debt ratio of the average corporation.

B) If changes in the bankruptcy code make bankruptcy less costly to corporations, then this would likely reduce the debt ratio of the average corporation.

C) An increase in the company's degree of operating leverage is likely to encourage a company to use more debt in its capital structure.

D) An increase in the corporate tax rate is likely to encourage a company to use more debt in its capital structure.

E) Firms whose assets are relatively liquid tend to have relatively low bankruptcy costs, hence they tend to use relatively little debt.

Correct Answer

verified

Correct Answer

verified

True/False

The trade-off theory states that the capital structure decision involves a tradeoff between the costs and benefits of debt financing.

Correct Answer

verified

Correct Answer

verified

True/False

A firm's capital structure does not affect its calculated free cash flows, because FCF reflects only operating cash flows.

Correct Answer

verified

Correct Answer

verified

True/False

The graphical probability distribution of ROE for a firm that uses financial leverage would tend to be more peaked than the distribution if the firm used no leverage, other things held constant.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cartwright Communications is considering making a change to its capital structure to reduce its cost of capital and increase firm value. Right now, Cartwright has a capital structure that consists of 20% debt and 80% equity, based on market values. (Its D/S ratio is 0.25.) The risk-free rate is 6% and the market risk premium, rM − rRF, is 5%. Currently the company's cost of equity, which is based on the CAPM, is 12% and its tax rate is 40%. What would be Cartwright's estimated cost of equity if it were to change its capital structure to 50% debt and 50% equity?

A) 13.00%

B) 13.64%

C) 14.35%

D) 14.72%

E) 15.60%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

VanMannen Foundations, Inc. (VF)

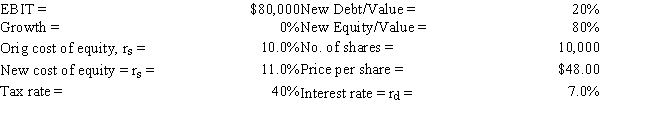

VanMannen Foundations, Inc. (VF) is a zero-growth company that currently has zero debt, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

-Refer to the data for VanMannen Foundations, Inc. (VF) . If this plan were carried out, what would be VF's new WACC and its new value of operations?

WACC Value

-Refer to the data for VanMannen Foundations, Inc. (VF) . If this plan were carried out, what would be VF's new WACC and its new value of operations?

WACC Value

A) 9.64% $497,925

B) 9.83% $507,884

C) 10.03% $518,041

D) 10.23% $528,402

E) 10.74% $538,970

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Best Bagels, Inc. (BB) Best Bagels, Inc. (BB) currently has zero debt. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. BB's current cost of equity is 13%, and its tax rate is 40%. The firm has 20,000 shares of common stock outstanding selling at a price per share of $23.08. -Refer to the data for Best Bagels, Inc. (BB) . Now assume that BB is considering changing from its original capital structure to a new capital structure with 45% debt and 55% equity. This results in a weighted average cost of capital equal to 10.4% and a new value of operations of $576,923. Assume BB raises $259,615 in new debt and purchases T-bills to hold until it makes the stock repurchase. BB then sells the T-bills and uses the proceeds to repurchase stock. How many shares remain after the repurchase, and what is the stock price per share immediately after the repurchase?

A) 11,001; $28.85

B) 12,711; $35.62

C) 13,901; $42.57

D) 15,220; $54.31

E) 17,105; $89.67

Correct Answer

verified

Correct Answer

verified

Multiple Choice

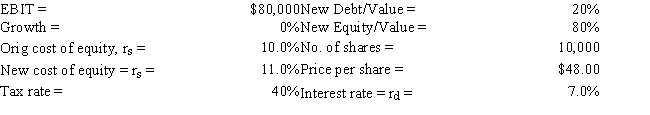

Pennewell Publishing Inc. (PP) Pennewell Publishing Inc. (PP) is a zero growth company. It currently has zero debt and its earnings before interest and taxes (EBIT) are $80,000. PP's current cost of equity is 10%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. -Refer to the data for Pennewell Publishing Inc. (PP) . Assume that PP is considering changing from its original capital structure to a new capital structure with 35% debt and 65% equity. This results in a weighted average cost of capital equal to 9.4% and a new value of operations of $510,638. Assume PP raises $178,723 in new debt and purchases T-bills to hold until it makes the stock repurchase. PP then sells the T-bills and uses the proceeds to repurchase stock. How many shares remain after the repurchase, and what is the stock price per share immediately after the repurchase?

A) 7,500; $71.49

B) 7,000; $59.57

C) 6,500; $51.06

D) 6,649; $53.33

E) 6,959; $58.78

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Electric utilities generally have very high common equity ratios because their revenues are more volatile than those of firms in most other industries.

B) Drug companies (prescription, not illegal!) generally have high debt-to-equity ratios because their earnings are very stable and, thus, they can cover the high interest costs associated with high debt levels.

C) Wide variations in capital structures exist both between industries and among individual firms within given industries. These differences are caused by differing business risks and also managerial attitudes.

D) Since most stocks sell at or very close to their book values, book value capital structures are almost always adequate for use in estimating firms' costs of capital.

E) Generally, debt-to-total-assets ratios do not vary much among different industries, although they do vary among firms within a given industry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After an intensive research and development effort, two methods for producing playing cards have been identified by the Turner Company. One method involves using a machine having a fixed cost of $10,000 and variable costs of $1.00 per deck of cards. The other method would use a less expensive machine (fixed cost = $5,000) , but it would require greater variable costs ($1.50 per deck of cards) . If the selling price per deck of cards will be the same under each method, at what level of output will the two methods produce the same net operating income (EBIT) ?

A) 5,000 decks

B) 10,000 decks

C) 15,000 decks

D) 20,000 decks

E) 25,000 decks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

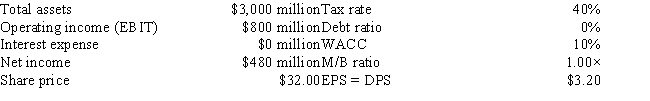

The following information has been presented to you about the Gibson Corporation. The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) . The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

A) $3,200

B) $3,600

C) $4,000

D) $4,200

E) $4,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? As a firm increases the operating leverage used to produce a given quantity of output, this will

A) normally lead to a decrease in its business risk.

B) normally lead to a decrease in the standard deviation of its expected EBIT.

C) normally lead to a decrease in the variability of its expected EPS.

D) normally lead to a reduction in its fixed assets turnover ratio.

E) normally lead to an increase in its fixed assets turnover ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have identical tax rates, total assets, and return on invested capital (ROIC) , and their ROIC exceeds their after-tax cost of debt, (1-T) rd. However, Company HD has a higher debt ratio and thus more interest expense than Company LD. Which of the following statements is CORRECT?

A) Company HD has a lower ROA than Company LD.

B) Company HD has a lower ROE than Company LD.

C) The two companies have the same ROA.

D) The two companies have the same ROE.

E) Company HD has a higher net income than Company LD.

Correct Answer

verified

Correct Answer

verified

True/False

The Miller model begins with the MM model without corporate taxes and then adds personal taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eccles Inc. Eccles Inc., a zero growth firm, has an expected EBIT of $100,000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%. -Refer to the data for Eccles Inc.What is the value of the firm according to MM with corporate taxes?

A) $475,875

B) $528,750

C) $587,500

D) $646,250

E) $710,875

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT associated with (or does not contribute to) business risk? Recall that business risk is affected by a firm's operations.

A) Sales price variability.

B) The extent to which operating costs are fixed.

C) The extent to which interest rates on the firm's debt fluctuate.

D) Input price variability.

E) Demand variability.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

VanMannen Foundations, Inc. (VF)

VanMannen Foundations, Inc. (VF) is a zero-growth company that currently has zero debt, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

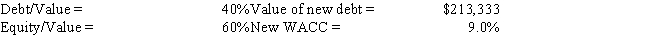

-Refer to the data for VanMannen Foundations, Inc. (VF) . Now assume that VF is considering changing from its original zero debt capital structure to a new capital structure with even more debt. This results in changes in the cost of debt and equity, and thus to a new WACC and a new value of operations. Assume VF raises the amount of new debt indicated below and uses the funds to purchase and hold T-bills until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

-Refer to the data for VanMannen Foundations, Inc. (VF) . Now assume that VF is considering changing from its original zero debt capital structure to a new capital structure with even more debt. This results in changes in the cost of debt and equity, and thus to a new WACC and a new value of operations. Assume VF raises the amount of new debt indicated below and uses the funds to purchase and hold T-bills until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $50.67

B) $53.33

C) $56.00

D) $58.80

E) $61.74

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The world-famous discounter, Fernwood Booksellers, specializes in selling paperbacks for $7 each. The variable cost per book is $5. At current annual sales of 200,000 books, the publisher is just breaking even. It is estimated that if the authors' royalties are reduced, the variable cost per book will drop by $1. Assume authors' royalties are reduced and sales remain constant; how much more money can the publisher put into advertising (a fixed cost) and still break even?

A) $600,000

B) $466,667

C) $333,333

D) $200,000

E) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anson Jackson Court Company (AJC) The Anson Jackson Court Company (AJC) currently has $200,000 market value (and book value) of perpetual debt outstanding carrying a coupon rate of 6%. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. AJC's current cost of equity is 8.8%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $60.00. -Refer to the data for the Anson Jackson Court Company (AJC) . What is AJC's current total market value and weighted average cost of capital?

A) $600,000; 7.5%

B) $600,000; 8.0%

C) $800,000; 7.0%

D) $800,000; 7.5%

E) $800,000; 8.0%

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 87

Related Exams