A) improving the prospects for a large profit from new investment

B) enabling firms to ignore the opportunity costs of financing new investment

C) increasing the opportunity cost of the investment

D) reducing the cost of the investment

E) signaling the existence of eager buyers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Johanna purchases a bond for $4,500 that promises to pay her $5,000 one year later,what is the interest rate on the bond?

A) 5.3 percent

B) 5.6 percent

C) 10.0 percent

D) 11.1 percent

E) 10.5 percent

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the money supply will increase both the amount of money demanded and output.

Correct Answer

verified

Correct Answer

verified

True/False

The money market is in equilibrium when there is no excess supply of or excess demand for bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal funds rate is closely tied to many interest rates on many types of loans.Which one is the exception?

A) Auto loan rates

B) Adjustable rate mortgages

C) Adjustable rate home equity loans

D) 30-year Treasury bonds

E) Business loans

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An excess supply of money implies an excess

A) supply of corporate stock

B) demand for bonds

C) supply of bonds

D) demand for corporate stock

E) demand for goods and services

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the aggregate expenditure line has shifted downward,which of the following is the most likely cause?

A) There have been reports of good economic news.

B) The Fed has conducted an open market sale of bonds.

C) Income tax rates have been lowered.

D) The Fed has conducted an open market purchase of bonds.

E) Exports have increased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of wealth that an individual wishes to hold as money is determined by

A) the price level

B) the price level and real income

C) real income

D) real income and the interest rate

E) the price level,real income,and the interest rate

Correct Answer

verified

Correct Answer

verified

True/False

An excess demand for money exists if the interest rate is below the equilibrium rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed reduces the money supply,there will be a decline in

A) government purchases

B) unemployment

C) purchases of consumer durables

D) demand for bonds

E) deflationary pressures

Correct Answer

verified

Correct Answer

verified

True/False

If there is an excess supply of money in the money market,there must be an excess supply of bonds in the bond market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed wants to lower the interest rate,it will

A) buy bonds and decrease the money supply.

B) buy bonds and increase the money supply.

C) sell bonds and decrease the money supply.

D) sell bonds and increase the money supply.

E) sell bonds and decrease money demand.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal funds rate is

A) determined in a market but targeted by the Fed.

B) chosen by the Fed and enforced on the banks.

C) chosen by Congress and enforced on the Fed.

D) chosen by Congress and enforced on the banks.

E) determined in the market and beyond the control of the Fed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Open market sales of bonds by the Federal Reserve drain reserves from the banking system and shift

A) the allocation of wealth between bonds and stocks

B) the economy toward a trough in the business cycle

C) the money supply curve leftward

D) reserves to nonmember banks

E) the demand for money curve leftward

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate decreases,there will be

A) a movement leftward from one point on the money demand curve to another point on the same curve

B) no change in the quantity of money demanded

C) a leftward shift of the entire money demand curve caused by a demand shock

D) a rightward shift of the entire money demand curve

E) a movement rightward from one point on the money demand curve to another point on the same curve

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed conducted an open market sale of bonds,what would most likely happen in the bond market?

A) The excess demand for bonds would cause the price of bonds to fall.

B) The excess supply of bonds could cause the price of bonds to rise.

C) There would be no effect in the bond market.

D) The excess supply of bonds would cause the price of bonds to fall.

E) The excess demand for bonds would cause the price of bonds to rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is an excess supply of money in the economy,

A) there is also an excess demand for money

B) there is also an excess demand for bonds

C) there is also an excess supply of bonds

D) the interest rate will rise

E) the Fed must intervene to restore equilibrium

Correct Answer

verified

Correct Answer

verified

True/False

If the price of a bond increases,the interest rate (or rate of return on the bond)decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

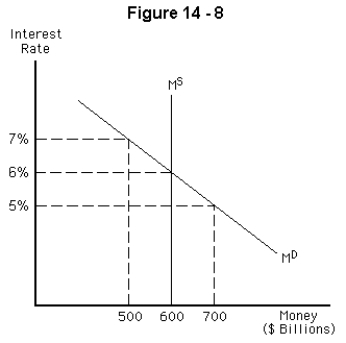

-Refer to Figure 14-8 above.If the interest rate is currently 5%,

-Refer to Figure 14-8 above.If the interest rate is currently 5%,

A) the interest rate must fall to restore equilibrium.

B) the interest rate will not change.

C) the interest rate must rise to restore equilibrium.

D) there is an excess supply of money.

E) the excess demand for money is $200 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the equilibrium interest rate is 4% but the current interest rate is 6%,

A) bond prices will rise.

B) money demand will decrease.

C) money demand will increase.

D) bond prices will fall.

E) the money supply will decrease.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 146

Related Exams