A) (price × units sold) − (unit variable cost × units sold) − fixed cost

B) (price × units sold) + (unit variable cost × units sold) + fixed cost

C) (price + units sold) − (unit variable cost + units sold) − fixed cost

D) (price − units sold) + (unit variable cost − units sold) + fixed cost

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each item with the correct statement below. -The use of fixed costs to extract higher percentage changes in profits as sales activity changes

A) Break-even point

B) Common fixed expenses

C) Contribution margin

D) Direct fixed expenses

E) Margin of safety

F) Operating leverage

G) Degree of operating leverage

H) Sales mix

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Miss She makes dolls.The price of a doll is $15,and the variable expense is $7 per doll.What is the contribution margin ratio?

A) 37.5%

B) 40.0%

C) 53.0%

D) 60.0%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

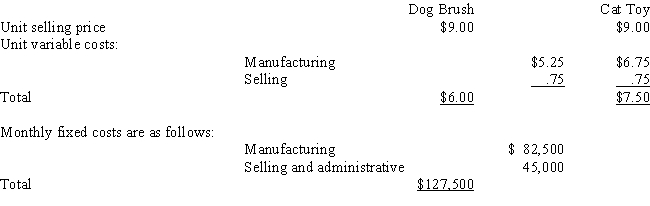

-Refer to the Figure.What is the variable cost ratio?

A) 33%

B) 40%

C) 50%

D) 60%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is total contribution margin divided by sales revenue?

A) the variable cost ratio

B) the fixed cost ratio

C) the sales ratio

D) the contribution margin ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the break-even point?

A) the point at which total sales are greater than total cost

B) the point at which total sales equal total cost

C) the point at which fixed costs equal variable costs

D) the point at which total sales are less than total cost

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to the Figure.What is the contribution margin ratio?

A) 36%

B) 40%

C) 44%

D) 50%

Correct Answer

verified

Correct Answer

verified

Essay

The HandyTool Manufacturing Company produces the following three products: Fixed costs are $76,000 per year. Of all units sold,50% are hammers,30% are screwdrivers,and 20% are saws. Required: Calculate the following values: A. Break-even point in total units B. Number of hammers that will be sold at break-even C. Total sales in units to obtain a before-tax profit of

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the result when actual sales equal break-even sales?

A) the margin of safety is negative

B) the margin of safety is positive

C) the margin of safety equals zero

D) the margin of safety is negative or positive

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the Figure.How many deluxe models are sold at break-even?

A) 220

B) 440

C) 660

D) 850

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What formula is used to calculate the degree of operating leverage?

A) contribution margin / profit

B) profit / fixed costs

C) profit / variable costs

D) total sales / profit

Correct Answer

verified

Correct Answer

verified

Essay

McKenzie Company expects to produce and sell 1000 units next month.Data on costs follows: A. What is the break-even point in units? B. What is the break-even point in sales dollars? C. What is the expected operating income for next month? D. What is the margin of safety in dollars? E. What is the break-even point in units if fixed manufacturing costs increase by ? F. What is the break-even point in units if variable manufacturing costs decrease by ?

Correct Answer

verified

Correct Answer

verified

True/False

To find the number of units to sell to earn a targeted income,it is quicker to simply adjust the break-even units equation by adding target income to the variable cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to the Figure.What is the break-even point in sales dollars?

A) $112,500

B) $150,000

C) $171,429

D) $400,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each item with the correct statement below. -Fixed costs that are directly traceable to a given segment and,consequently,disappear if the segment is eliminated

A) Break-even point

B) Common fixed expenses

C) Contribution margin

D) Direct fixed expenses

E) Margin of safety

F) Operating leverage

G) Degree of operating leverage

H) Sales mix

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the following information: How many units must be sold to generate a before-tax profit of $45,000?

A) 2,500 units

B) 3,000 units

C) 3,750 units

D) 5,900 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to the Figure.What is the break-even point in units?

A) 6,667

B) 10,000

C) 13,333

D) 20,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Information about the K-9 Salon's two products is as follows:  Suppose the sales mix in units is 70% Product X and 30% Product Y.What total monthly sales volume in units is required to break even?

Suppose the sales mix in units is 70% Product X and 30% Product Y.What total monthly sales volume in units is required to break even?

A) 8,333 units

B) 16,667 units

C) 50,000 units

D) 56,667 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By what amount can sales decline before losses are incurred?

A) by the contribution margin

B) by the margin of safety

C) by the degree of operating leverage

D) by the fixed costs

Correct Answer

verified

Correct Answer

verified

Essay

Smart Inc.expects to produce and sell 4,000 units next month.Data on costs follows: A. What is the variable cost per unit? B. What is contribution margin per unit? C. What is the variable cost ratio? D. What is the contribution margin ratio?

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 160

Related Exams