A) 6.64 percent

B) 8.96 percent

C) 10.23 percent

D) 12.47 percent

E) 13.27 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 6 percent,annual coupon bond is currently selling at a premium and matures in 7 years.The bond was originally issued 3 years ago at par.Which one of the following statements is accurate in respect to this bond today?

A) The face value of the bond today is greater than it was when the bond was issued.

B) The bond is worth less today than when it was issued.

C) The yield-to-maturity is less than the coupon rate.

D) The coupon rate is greater than the current yield.

E) The yield-to-maturity equals the current yield.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

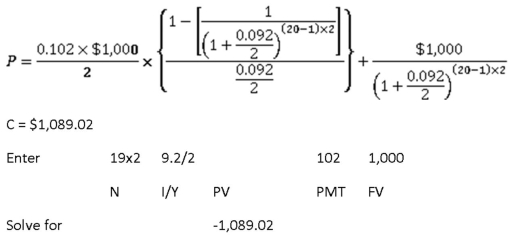

-Soo Lee Imports issued 17-year bonds 2 years ago at a coupon rate of 10.3 percent.The bonds make semiannual payments.These bonds currently sell for 102 percent of par value.What is the yield-to-maturity?

-Soo Lee Imports issued 17-year bonds 2 years ago at a coupon rate of 10.3 percent.The bonds make semiannual payments.These bonds currently sell for 102 percent of par value.What is the yield-to-maturity?

A) 9.98 percent

B) 10.04 percent

C) 10.13 percent

D) 10.27 percent

E) 10.42 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment offers a 10.5 percent total return over the coming year.Sam Bernanke thinks the total real return on this investment will be only 6.2 percent.What does Sam believe the inflation rate will be for the next year?

A) 5.60 percent

B) 5.67 percent

C) 4.05 percent

D) 6.00 percent

E) 6.21 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recently,you discovered a putable income bond that is convertible.If you purchase this bond,you will have the right to do which of the following? I.force the issuer to repurchase the bond prior to maturity II.choose when you wish to receive interest payments III.convert the bond into a TIPS IV.convert the bond into equity shares

A) I and III only

B) I and IV only

C) II and III only

D) III and IV only

E) I,II,and IV only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds issued by the U.S.government:

A) are considered to be free of interest rate risk.

B) generally have higher coupons than those issued by an individual state.

C) are considered to be free of default risk.

D) pay interest that is exempt from federal income taxes.

E) are called "munis".

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Atlas Entertainment has 15-year bonds outstanding.The interest payments on these bonds are sent directly to each of the individual bondholders.These direct payments are a clear indication that the bonds can accurately be defined as being issued:

A) at par.

B) in registered form.

C) in street form.

D) as debentures.

E) as callable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

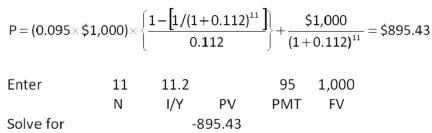

-Redesigned Computers has 6.5 percent coupon bonds outstanding with a current market price of $832.The yield to maturity is 16.28 percent and the face value is $1,000.Interest is paid semiannually.How many years is it until these bonds mature?

-Redesigned Computers has 6.5 percent coupon bonds outstanding with a current market price of $832.The yield to maturity is 16.28 percent and the face value is $1,000.Interest is paid semiannually.How many years is it until these bonds mature?

A) 2.10 years

B) 4.19 years

C) 7.41 years

D) 9.16 years

E) 18.32 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else constant,a bond will sell at _____ when the coupon rate is _____ the yield to maturity.

A) a premium;less than

B) a premium;equal to

C) a discount;less than

D) a discount;higher than

E) par;less than

Correct Answer

verified

Correct Answer

verified

Multiple Choice

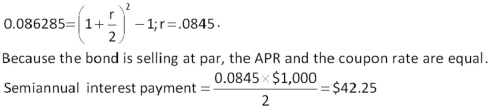

The semiannual,8-year bonds of Alto Music are selling at par and have an effective annual yield of 8.6285 percent.What is the amount of each interest payment if the face value of the bonds is $1,000?

A) $41.50

B) $42.25

C) $43.15

D) $85.00

E) $86.29

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A call-protected bond is a bond that:

A) is guaranteed to be called.

B) can never be called.

C) is currently being called.

D) is callable at any time.

E) cannot be called during a certain period of time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-The 7 percent,semi-annual coupon bonds offered by House Renovators are callable in 2 years at $1,054.What is the amount of the call premium on a $1,000 par value bond?

-The 7 percent,semi-annual coupon bonds offered by House Renovators are callable in 2 years at $1,054.What is the amount of the call premium on a $1,000 par value bond?

A) $52

B) $54

C) $72

D) $84

E) $89

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fisher effect is defined as the relationship between which of the following variables?

A) default risk premium,inflation risk premium,and real rates

B) nominal rates,real rates,and interest rate risk premium

C) interest rate risk premium,real rates,and default risk premium

D) real rates,inflation rates,and nominal rates

E) real rates,interest rate risk premium,and nominal rates

Correct Answer

verified

Correct Answer

verified

Multiple Choice

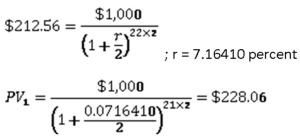

-Northern Warehouses wants to raise $11.4 million to expand its business.To accomplish this,it plans to sell 40-year,$1,000 face value,zero-coupon bonds.The bonds will be priced to yield 8.75 percent.What is the minimum number of bonds it must sell to raise the $11.4 million it needs?

-Northern Warehouses wants to raise $11.4 million to expand its business.To accomplish this,it plans to sell 40-year,$1,000 face value,zero-coupon bonds.The bonds will be priced to yield 8.75 percent.What is the minimum number of bonds it must sell to raise the $11.4 million it needs?

A) 210,411

B) 239,800

C) 254,907

D) 326,029

E) 350,448

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-A bond that pays interest annually yielded 7.47 percent last year.The inflation rate for the same period was 4 percent.What was the actual real rate of return on this bond for last year?

-A bond that pays interest annually yielded 7.47 percent last year.The inflation rate for the same period was 4 percent.What was the actual real rate of return on this bond for last year?

A) 2.19 percent

B) 2.25 percent

C) 3.34 percent

D) 3.41 percent

E) 3.49 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Al is retired and enjoys his daily life.His one concern is that his bonds provide a steady stream of income that will continue to allow him to have the money he desires to continue his active lifestyle without lowering his present standard of living.Although he has sufficient principal to live on,he only wants to spend the interest income provided by his holdings and thus is concerned about the purchasing power of that income.Which one of the following bonds should best ease Al's concerns?

A) 6-year,putable,high coupon bond

B) 5-year TIPS

C) 10-year AAA coupon bond

D) 5-year municipal bond

E) 7- year income bond

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond has a market price that exceeds its face value.Which of the following features currently apply to this bond? I.discounted price II.premium price III.yield-to-maturity that exceeds the coupon rate IV.yield-to-maturity that is less than the coupon rate

A) III only

B) I and III only

C) I and IV only

D) II and III only

E) II and IV only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

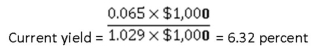

A corporate bond was quoted yesterday at 102.16 while today's quote is 102.19.What is the change in the value of a bond that has a face value of $5,000?

A) $0.30

B) $1.50

C) $3.00

D) $15.00

E) $30.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct concerning the term structure of interest rates? I.Expectations of lower inflation rates in the future tend to lower the slope of the term structure of interest rates. II.The term structure of interest rates includes both an inflation premium and an interest rate risk premium. III.The real rate of return has minimal,if any,affect on the slope of the term structure of interest rates. IV.The term structure of interest rates and the time to maturity are always directly related.

A) I and II only

B) II and IV only

C) I,II,and III only

D) II,III,and IV only

E) I,II,and IV only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A deferred call provision is which one of the following?

A) requirement that a bond issuer pay the current market price,plus accrued interest,should the firm decide to call a bond

B) ability of a bond issuer to delay repaying a bond until after the maturity date should the issuer so opt

C) prohibition placed on an issuer which prevents that issuer from ever redeeming bonds prior to maturity

D) prohibition which prevents bond issuers from redeeming callable bonds prior to a specified date

E) requirement that a bond issuer pay a call premium which is equal to or greater than one year's coupon should that issuer decide to call a bond

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 128

Related Exams