A) 3.32 times

B) 1.67 times

C) 1.66 times

D) 1.70 times

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement is correct regarding the quick ratio?

A) The numerator for the quick ratio is current assets minus inventory minus accounts receivable.

B) The numerator for the quick ratio is current assets.

C) The quick ratio is also called the working capital ratio.

D) The quick ratio is a more conservative variation of the current ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Year 1,Gant Corporation had a current ratio of 1.29,quick ratio of 1.05,and working capital of $18,000.The company uses a perpetual inventory system and sells merchandise for more than it cost.On January 1,Year 2,Gant issued common stock at par value for $10,000 cash.Which of the following statements is true?

A) Gant's current ratio will decrease.

B) Gant's current ratio will increase.

C) Gant's quick ratio will decrease.

D) Gant's working capital will decrease.

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis always involves comparing financial statement elements over a span of time.

Correct Answer

verified

Correct Answer

verified

True/False

In terms of solvency,the larger the number of times interest is earned,the better.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are considered to be measures of a company's short-term debt-paying ability except:

A) Current ratio.

B) Earnings per share.

C) Inventory turnover.

D) Average collection period.

Correct Answer

verified

Correct Answer

verified

True/False

The most frequently quoted measure of earnings performance is the stockholders' equity ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio would you use to examine a company's ability to pay its debts in the short-term?

A) Earnings per share

B) Acid-test ratio

C) Debt to assets ratio

D) Return on equity

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

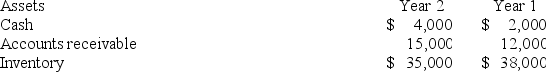

The following balance sheet information is provided for Gaynor Company:

Assuming Year 2 cost of goods sold is $153,300,what is the company's inventory turnover?

Assuming Year 2 cost of goods sold is $153,300,what is the company's inventory turnover?

A) 4.0 times

B) 4.4 times

C) 4.2 times

D) None of these answers is correct.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Milton Company has total current assets of $46,000,including inventory of $10,000,and current liabilities of $20,000.The company's current ratio is:

A) 0.4.

B) 1.8.

C) 2.8.

D) 2.3.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Year 1,Gant Corporation had a current ratio of 1.29,quick ratio of 1.05,and working capital of $18,000.The company uses a perpetual inventory system and sells merchandise for more than it cost.On January 1,Year 2,Gant collected $5,200 of accounts receivable.As a result of this transaction,Gant's working capital will:

A) Increase.

B) Decrease.

C) Remain the same.

D) Cannot be determined.

Correct Answer

verified

Correct Answer

verified

True/False

Financial analysis typically involves some form of comparison such as changes in the same item over a number of years.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio measures how effectively a company is using assets to generate revenue?

A) Net margin

B) Plant assets to long-term liabilities

C) Asset turnover

D) Inventory turnover

Correct Answer

verified

Correct Answer

verified

Multiple Choice

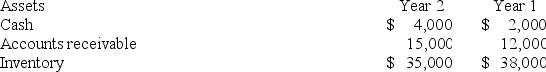

The following balance sheet information was provided by O'Connor Company:

Assuming that net credit sales for Year 2 totaled $270,000,what is the company's most recent accounts receivable turnover?

Assuming that net credit sales for Year 2 totaled $270,000,what is the company's most recent accounts receivable turnover?

A) 18 times

B) 20 times

C) 22.5 times

D) 7.7 times

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Knell Company paid its sales employees $15,000 in sales commissions.What impact will this transaction have on the firm's working capital?

A) No impact

B) Increase it

C) Decrease it

D) Not enough information is provided to answer the question.

Correct Answer

verified

Correct Answer

verified

True/False

When debt is used to finance the purchase of assets,the term or time span of the debt should always be shorter than the lifespan of the assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study of an individual financial statement item over several accounting periods is called:

A) Horizontal analysis.

B) Vertical analysis.

C) Ratio analysis.

D) Time and motion analysis.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Financial ratios can be used to assess which of the following aspects of a firm's performance?

A) Liquidity

B) Solvency

C) Profitability

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Short-term creditors are usually most interested in assessing:

A) Liquidity.

B) Solvency.

C) Managerial effectiveness.

D) Profitability.

Correct Answer

verified

Correct Answer

verified

True/False

Financial ratio analysis is a form of horizontal analysis in that comparisons are made between different accounts in the same set of financial statements.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 108

Related Exams