A) $12,000

B) $16,000

C) $32,000

D) $30,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grace Company sold equipment for $40,000 cash.The equipment has cost $70,000 and had accumulated depreciation of $44,000 at the time of the sale.Based on this information alone,which of the following statements is true?

A) Cash flow from investing activities would be less if the sale of equipment is reported on the statement of cash flows under the direct method than if it is reported under the indirect method.

B) Cash flow from investing activities would be greater if the sale of equipment is reported on the statement of cash flows under the direct method than if it is reported under the indirect method.

C) Cash flow from investing activities would be the same regardless of whether the sale of equipment is reported on the statement of cash flows under the direct method or the indirect method.

D) The answer cannot be determined because the amount of the salvage value is unknown.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the year ended December 31,Year 1,Fields Company made cash payments of $50,000 for dividends,paid interest of $20,500,paid $30,000 cash to suppliers,and purchased equipment for $64,000 cash.What is the net cash used by investing activities for Year 1?

A) $114,000

B) $64,000

C) $20,500

D) $134,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Chisolm Company purchased equipment for $36,000 cash.On December 31,Year 1,depreciation of $9,000 was recorded.Which of the following correctly shows the combined effect of these two events on the income statement and statement of cash flows? Chisolm uses the direct method. Cash Flows Net Income Operating Investing Financing

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How are interest expense and interest paid reported?

A) Interest expense is reported as an operating item on the income statement and interest paid is reported as an investing activity on the statement of cash flows.

B) Interest paid is reported as an operating activity on the statement of cash flows and interest expense is reported as a nonoperating expense on the income statement.

C) Interest expense is reported as an operating expense on the income statement and interest paid is reported as a financing activity on the statement of cash flows.

D) Interest paid is reported as a financing activity on the statement of cash flows and interest expense is reported as an operating item on the income statement.

Correct Answer

verified

Correct Answer

verified

True/False

If a company sells equipment at a loss,the loss from selling the equipment is reported in the investing activities section of the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

True/False

Cash flow from operating activities is often less stable from year to year than the amount of net income reported on the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best explains the correct handling of depreciation on the statement of cash flows when using the indirect method?

A) Depreciation expense is a noncash expense that is added to net income to derive cash flows from operating activities.

B) Depreciation is subtracted in the cash flows from investing activities section because it reduces the book value of the corresponding plant asset.

C) Depreciation is subtracted from net income because it causes a loss when the related plant asset is sold.

D) Depreciation adds to the company's Cash account to help pay for new equipment.

Correct Answer

verified

Correct Answer

verified

True/False

In preparing the operating activities section of the statement of cash flows by the indirect method,decreases in noncash current liabilities are added to net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be reported in the body of the statement of cash flows?

A) The payment of a cash dividend

B) The issuance of preferred stock for cash

C) The purchase and retirement of treasury stock

D) A 2-for-1 stock split

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct sequence of the three sections that are presented on the statement of cash flows?

A) Operating,Investing,Financing

B) Investing,Operating,Financing

C) Operating,Financing,Investing

D) Financing,Investing,Operating

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What effect does depreciation expense have on net income and cash flows? Net Income Cash Flows

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How would the issuance of a mortgage note in exchange for a building be reported on the statement of cash flows?

A) Financing activity

B) Investing activity

C) Operating activity

D) Noncash financing and investing activity

Correct Answer

verified

Correct Answer

verified

True/False

A company experiencing rapid growth can be short of cash in spite of earning substantial net income.

Correct Answer

verified

Correct Answer

verified

True/False

In preparing the statement of cash flows by the indirect method,increases in noncash current assets are subtracted from net income.

Correct Answer

verified

Correct Answer

verified

True/False

Goodloe Corporation's credit sales for Year 1 were $500,000,and the balance in its accounts receivable increased by $26,000 during the year.In Year 1,Goodloe collected $526,000 in cash from its customers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the indirect method to complete the cash flows from operating activities section of the statement of cash flows,what is the proper disposition of a loss on disposal of equipment?

A) Disregard the loss because it relates to an investing activity.

B) Disregard the loss because it relates to a financing activity.

C) Add the loss to net income.

D) Subtract the loss from net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] During Year 1, El Paso Company had the following changes in account balances: The Accumulated Depreciation account had a beginning balance of $25,000 and an ending balance of $35,000. The increase was due to depreciation expense. The Long-Term Notes Payable account had a beginning balance of $40,000 and an ending balance of $15,000. The decrease was due to repayment of debt. The Equipment Account had a beginning balance of $25,000 and an ending balance of $92,500. The increase was due to the purchase of other operational assets. The Long-Term Investments Account (Marketable Securities) had a beginning balance of $18,000 and an ending balance of $12,500. The decrease was due to the sale of investments at cost. The Dividends Payable account had a beginning balance of $12,000 and an ending balance of $10,000. There were $20,000 of dividends declared during the period. The Interest Payable account had a beginning balance of $2,250 and an ending balance of $1,250. The difference was due to the payment of interest. -What is the net cash flow from investing activities?

A) $62,000 outflow

B) $62,000 inflow

C) $67,500 outflow

D) $73,000 outflow

Correct Answer

verified

Correct Answer

verified

Multiple Choice

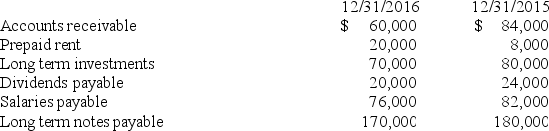

The following information is for Cleveland Company:

Additional data for the current year:

(1) Sales on account for the period were $80,000.

(2) Operating expenses for the period were $52,000.

Based on this limited information,what was the net cash inflow from operating activities?

Additional data for the current year:

(1) Sales on account for the period were $80,000.

(2) Operating expenses for the period were $52,000.

Based on this limited information,what was the net cash inflow from operating activities?

A) $18,000

B) $22,000

C) $28,000

D) $34,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On August 1, Year 1, Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9% to Galaxy Bank. Jackson accrues interest expense on December 31, Year 1, its calendar year-end. -What is the amount of interest expense and the cash outflow for interest during the year ending December 31,Year 1? Interest Expense Cash Outflow

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 88

Related Exams