A) accounted for as fund-raising expense.

B) allocated to expenses for program services.

C) allocated between expenses for program services and fund-raising expense.

D) accounted for as management and general expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The transactions described in the following questions occurred in a voluntary health and welfare organization during the year ended December 31,20X8.For each transaction,indicate its effect(s) on the organization's statement of activities prepared for the year ended December 31,20X8.List all effects of transactions affecting more than one class of net assets.Indicate your choice(s) by entering the letter corresponding to the effects listed here: Effects of Transactions on Statement of Activities -Depreciation expense for the year was recorded.

A) Increases net assets with donor restrictions.

B) Decreases net assets with donor restrictions.

C) Increases net assets without donor restrictions.

D) Decreases net assets without donor restrictions.

E) Transaction is not reported on the statement of activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A donor agrees to contribute $5,000 per year at the end of each of the next five years to a voluntary health and welfare organization.The donor did not place any use restrictions on the amount pledged.The stream of the payments is discounted at 6 percent.The first payment of $5,000 is received at the end of the first year.The present value factor for a five-payment annuity due on June 30,20X9,at 6 percent is 4.2124.The present value factor for a four-payment annuity due on June 30,20X9,at 6 percent is 3.4651. -Based on the preceding information,the journal entry to recognize present value at the time the pledge is received includes:

A) a credit to Pledges Receivable-Temporarily Restricted for $25,000.

B) a debit to Contributions-Temporarily Restricted for $21,062.

C) a debit to Pledges Receivable-Temporarily Restricted for $21,062.

D) a credit to Contributions-Temporarily Restricted for $25,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The transactions described in the following questions occurred in a voluntary health and welfare organization during the year ended December 31,20X8.For each transaction,indicate its effect(s) on the organization's statement of activities prepared for the year ended December 31,20X8.List all effects of transactions affecting more than one class of net assets.Indicate your choice(s) by entering the letter corresponding to the effects listed here: Effects of Transactions on Statement of Activities -Income was earned from investments of assets that the board previously designated for plant expansion.

A) Increases net assets with donor restrictions.

B) Decreases net assets with donor restrictions.

C) Increases net assets without donor restrictions.

D) Decreases net assets without donor restrictions.

E) Transaction is not reported on the statement of activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

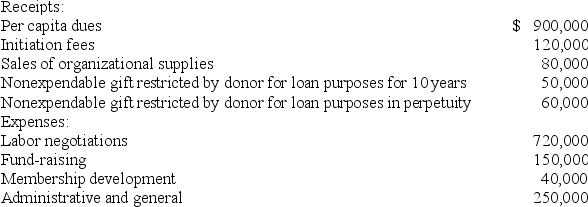

Golden Path,a labor union,had the following receipts and expenses for the year ended December 31,20X8:

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

-Based on the information provided,in Golden Path's statement of activities for the year ended December 31,20X8,what amount should be reported under the classification of supporting services?

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

-Based on the information provided,in Golden Path's statement of activities for the year ended December 31,20X8,what amount should be reported under the classification of supporting services?

A) $150,000

B) $720,000

C) $440,000

D) $290,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A private,not-for-profit hospital received a cash contribution of $100,000 from Samantha Hicks on November 14,20X8.Ms.Hicks specified the money be used to acquire equipment.On December 31,20X8,the hospital had not expended any of Ms.Hicks' contribution.On the statement of changes in net assets for the year ended December 31,20X8,the hospital should report the contribution as a $100,000 increase in:

A) net assets with donor restrictions.

B) net assets without donor restrictions.

C) fund balance.

D) deferred revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A voluntary health and welfare organization reports pledges receivable on its statement of financial position at the present value of the future cash collections.How is the increase in the present value of the pledges receivable,which is due to the passage of time,reported on the voluntary health and welfare organization's statement of activities?

A) As interest income-temporarily restricted.

B) As an increase in pledges receivable-temporarily restricted.

C) As an increase in contributions-temporarily restricted.

D) As an increase in deferred revenue-temporarily restricted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Good Care Hospital,which is operated by a religious organization,received contributions of $1,000,000 from donors who stipulated that the cash be used to construct an addition to the hospital.As of the balance sheet date,none of the contributions had been expended for construction.On the hospital's balance sheet,the cash contributions would be disclosed in which of the following classes of net assets?

A) Net assets with donor restrictions

B) Donor restricted net assets

C) Assets whose use is limited

D) Net assets without donor restrictions

Correct Answer

verified

Correct Answer

verified

Multiple Choice

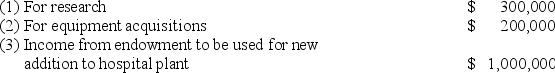

A private,not-for-profit hospital received the following restricted contributions and other receipts during the year ended December 31,20X8:

None of the contributions or other receipts were expended during the ended December 31,20X8.For the year ended December 31,20X8,what amount would be reported on the hospital's statement of changes in net assets as an increase in net assets with donor restrictions?

None of the contributions or other receipts were expended during the ended December 31,20X8.For the year ended December 31,20X8,what amount would be reported on the hospital's statement of changes in net assets as an increase in net assets with donor restrictions?

A) $1,500,000

B) $1,200,000

C) $500,000

D) $300,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a university,class cancellation refunds of tuition and fees should be recorded as: I.a reduction of revenue from tuition and fees. II.a reduction of accounts receivable.

A) I only

B) II only

C) Either I or II

D) Neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A private,not-for-profit hospital received a contribution of $40,000 on June 15,20X8.The donor restricted the contribution to funding research activities currently being performed by the hospital.For the year ended December 31,20X8,the hospital spent $30,000 of the contribution on research activities.The hospital expended the remaining $10,000 on research activities in January of 20X9. -Refer to the above information.On the statement of cash flows prepared for the year ended December 31,20X8,the events described would increase net cash flows provided by:

A) operating activities by $40,000.

B) financing activities by $40,000.

C) financing activities by $10,000.

D) operating activities by $10,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the major objectives of ASC 958 is to:

A) emphasize the different fund structures that currently exist for all private,nonprofit organizations.

B) change the reporting for governmental organizations so that their reporting is comparable to that of private,nonprofit organizations.

C) report combined financial statements,instead of individual fund financial statements,for all private,nonprofit organizations.

D) bring about greater uniformity in the financial statements of all private,not-for-profit organizations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the fiscal year ended June 30,20X9,a private,not-for-profit hospital acquired equipment costing $75,000,with cash contributed by donors who restricted their contributions for this purpose.On the hospital's statement of cash flows for the year ended June 30,20X9,the equipment acquisition should be reported in which of the following sections? I.Operating activities II.Financing activities III.Investing activities

A) I

B) II

C) III

D) I,II,III

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reporting requirements of other not-for-profit entities (ONPOs) are similar to those of which of the following entities?

A) A public university

B) A voluntary health and welfare organization

C) An enterprise fund of a state or local government

D) A hospital operated by a county government

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The transactions listed in the following questions occurred in a private,not-for-profit hospital during 20X8.For each transaction,indicate its effect on the hospital's statement of operations for the year ended December 31,20X8. -Transaction: Depreciation expense was recorded for the year. Effect on Statement of Operations:

A) Increases operating income.

B) Decreases operating income.

C) The transaction is reported on the statement of operations,but there is no effect on operating income.

D) The transaction is not reported on the statement of operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

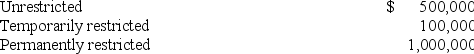

Local Services,a voluntary health and welfare organization had the following classes of net assets on July 1,20X8,the beginning of its fiscal year:

During the year ended June 30,20X9,the following events occurred:

(1) It purchased equipment,costing $100,000,with contributions restricted for this purpose.The contributions had been received from donors during June of 20X8.

(2) It received $130,000 of cash donations which were restricted for research activities.During the year ended June 30,20X9,$90,000 of the contributions were expended on research.

(3) It sold investments classified in the net assets with donor restrictions class for a loss of $40,000.Dividends and interest income earned on the investments amounted to $70,000.There were no restrictions on how investment income was to be used.

(4) It received cash contributions of $200,000 from donors who did not place either time or use restrictions upon their donations.

(5) Expenses,excluding depreciation expense,for program services and supporting services incurred during the year ended June 30,20X9,amounted to $260,000.

(6) Depreciation expense for the year ended June 30,20X9,was $80,000.

-Refer to the above information.On the statement of activities for the year ended June 30,20X9,net assets with donor restrictions:

During the year ended June 30,20X9,the following events occurred:

(1) It purchased equipment,costing $100,000,with contributions restricted for this purpose.The contributions had been received from donors during June of 20X8.

(2) It received $130,000 of cash donations which were restricted for research activities.During the year ended June 30,20X9,$90,000 of the contributions were expended on research.

(3) It sold investments classified in the net assets with donor restrictions class for a loss of $40,000.Dividends and interest income earned on the investments amounted to $70,000.There were no restrictions on how investment income was to be used.

(4) It received cash contributions of $200,000 from donors who did not place either time or use restrictions upon their donations.

(5) Expenses,excluding depreciation expense,for program services and supporting services incurred during the year ended June 30,20X9,amounted to $260,000.

(6) Depreciation expense for the year ended June 30,20X9,was $80,000.

-Refer to the above information.On the statement of activities for the year ended June 30,20X9,net assets with donor restrictions:

A) increased $130,000.

B) increased $40,000.

C) decreased $100,000.

D) decreased $60,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of activities for a private,not-for-profit literary society,expenses decrease which of the following classes of net assets? I.net assets with donor restrictions II.net assets without donor restrictions

A) I only

B) II only

C) Either I or II

D) Neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The transactions described in the following questions occurred in a voluntary health and welfare organization during the year ended December 31,20X8.For each transaction,indicate its effect(s) on the organization's statement of activities prepared for the year ended December 31,20X8.List all effects of transactions affecting more than one class of net assets.Indicate your choice(s) by entering the letter corresponding to the effects listed here: Effects of Transactions on Statement of Activities -Endowment income was earned.The donor specified that the income be used for community service.

A) Increases net assets with donor restrictions.

B) Decreases net assets with donor restrictions.

C) Increases net assets without donor restrictions.

D) Decreases net assets without donor restrictions.

E) Transaction is not reported on the statement of activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The transactions listed in the following questions occurred in a private,not-for-profit hospital during 20X8.For each transaction,indicate its effect on the hospital's statement of operations for the year ended December 31,20X8. -Transaction: Received tuition revenue from hospital nursing program and cash from sales of goods in the hospital gift shop. Effect on Statement of Operations:

A) Increases operating income.

B) Decreases operating income.

C) The transaction is reported on the statement of operations,but there is no effect on operating income.

D) The transaction is not reported on the statement of operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A donor agrees to contribute $5,000 per year at the end of each of the next five years to a voluntary health and welfare organization.The donor did not place any use restrictions on the amount pledged.The stream of the payments is discounted at 6 percent.The first payment of $5,000 is received at the end of the first year.The present value factor for a five-payment annuity due on June 30,20X9,at 6 percent is 4.2124.The present value factor for a four-payment annuity due on June 30,20X9,at 6 percent is 3.4651. -Based on the preceding information,the increase in present value of the contributions receivable recognized at the end of the first year equals:

A) $5,000.

B) $1,264.

C) $4,212.

D) $787.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 115

Related Exams