A) $5,000 (F)

B) $5,000 (U)

C) $10,000 (F)

D) $15,000 (F)

Correct Answer

verified

Correct Answer

verified

Essay

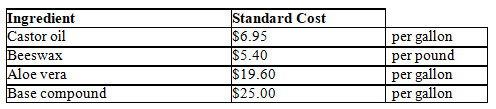

Fantastic Lips Inc.specializes in manufacturing lipstick.Racy Red,one of more than 75 shades produced by the company,is made from castor oil,beeswax,aloe vera,and a base compound.For the next 12 months,the company's purchasing agent believes that the cost of ingredients will be as follows:

The direct labor time standard is 4 hours per case at a standard direct labor rate of $11.00 per hour.The standard overhead rates are $15.00 per direct labor hour for the standard variable overhead rate and $13.00 per direct labor hour for the standard fixed overhead rate.

a.Using these production standards,compute the standard unit cost of direct materials per case of Racy Red if it takes 0.2 gallon of castor oil,0.5 pound of beeswax,0.3 gallon of aloe vera,and 1 gallon of base compound to produce one case.

b.Using the standard unit cost of direct materials per case determined in (a)and the production standards given for direct labor and overhead,compute the standard unit cost of one case of Racy Red lipstick.

The direct labor time standard is 4 hours per case at a standard direct labor rate of $11.00 per hour.The standard overhead rates are $15.00 per direct labor hour for the standard variable overhead rate and $13.00 per direct labor hour for the standard fixed overhead rate.

a.Using these production standards,compute the standard unit cost of direct materials per case of Racy Red if it takes 0.2 gallon of castor oil,0.5 pound of beeswax,0.3 gallon of aloe vera,and 1 gallon of base compound to produce one case.

b.Using the standard unit cost of direct materials per case determined in (a)and the production standards given for direct labor and overhead,compute the standard unit cost of one case of Racy Red lipstick.

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor time standards express the hourly labor cost per function or job classification that exists during the current accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of standard costing?

A) It uses estimates that are based only on past costs.

B) It is the same as normal costing.

C) It cannot be used to manage cost centers.

D) It can be used in any type of business.

Correct Answer

verified

Correct Answer

verified

True/False

Corrective action is necessary even if a variance is insignificant.

Correct Answer

verified

Correct Answer

verified

True/False

The direct materials price variance is the difference between the standard price and the actual price,multiplied by the actual quantity.

Correct Answer

verified

Correct Answer

verified

Essay

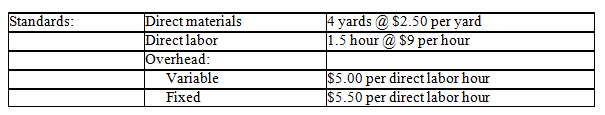

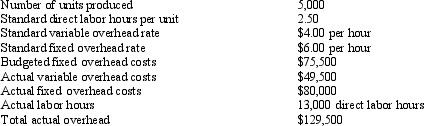

Sport Runner Inc. ,produces a complete line of men's running apparel.The nylon short set is a very popular item in the southern states.During June,the company's records revealed the following information about the production of the nylon shorts set:

Compute the standard unit cost for a nylon shorts set.

Compute the standard unit cost for a nylon shorts set.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following provides an explanation of why the variable overhead rate is separated from the fixed overhead rate in standard costing?

A) There is no justifiable reason;their separation is merely to simplify entries.

B) Both calculations divide by the same direct labor hours,but the numerator is different for each calculation.

C) The variable overhead rate is calculated using actual direct labor hours,whereas the fixed overhead rate is calculated using normal capacity direct labor hours.

D) The behavior of costs,used for computing variable overhead rate and fixed overhead rate,differs.

Correct Answer

verified

Correct Answer

verified

Essay

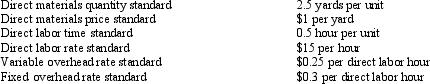

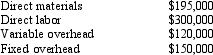

Using the information given below,determine the total standard unit cost.

Round your intermediate calculations and final answers to two decimal places.

Round your intermediate calculations and final answers to two decimal places.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robert Inc.uses the standard costing method.The company's main product is a fine-quality headphones that normally takes 0.5 hour to produce.Normal annual capacity is 5,000 direct labor hours,and budgeted fixed overhead costs for the year were $8,750.During the year,the company produced and sold 5,800 units.Actual fixed overhead costs were $6,000. Using the information provided for Robert Inc. -Compute the fixed overhead budget variance.

A) $925 (U)

B) $3,675 (U)

C) $2,750 (F)

D) $5,800 (U)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not included in performance reports?

A) Standard costs

B) Normal capacity

C) Total plantwide overhead costs

D) Budgeted costs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

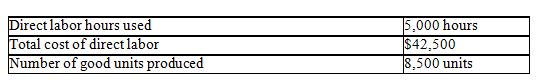

Choco Sweet Inc.gives you the following information: The standard labor time of 0.75 labor hour is required to produce one unit.The standard labor cost for a 10 pound bag of chocolate is $8 per labor hour.The following is data relating to the actual cost and usage data.

Using the above information provided for Choco Sweet.

-Compute the direct labor efficiency variance for Choco Sweet.

Using the above information provided for Choco Sweet.

-Compute the direct labor efficiency variance for Choco Sweet.

A) $8,500 (U)

B) $2,500 (F)

C) $11,000 (F)

D) $1,375 (U)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

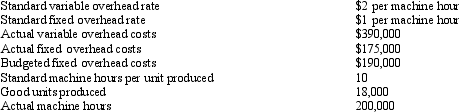

Good Sleep Inc.manufactures soft pillows.Its records revealed the following data:  -Using the above information provided for Good Sleep,the total fixed overhead variance is

-Using the above information provided for Good Sleep,the total fixed overhead variance is

A) $4,500 (U) .

B) $30,500 (U) .

C) $5,000 (U) .

D) $45,000 (U) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Underfoot Products uses standard costing.The following information about overhead was generated during May:  -Compute the fixed overhead variance.

-Compute the fixed overhead variance.

A) $5,000 (F)

B) $5,000 (U)

C) $10,000 (U)

D) $10,000 (F)

Correct Answer

verified

Correct Answer

verified

True/False

Variance analysis involves computing the difference between standard and actual costs.

Correct Answer

verified

Correct Answer

verified

True/False

The fixed overhead volume variance measures the use of existing facilities and capacity.

Correct Answer

verified

Correct Answer

verified

True/False

A flexible budget is a summary of expected costs for a range of activity levels and is geared to changes in the level of productive output.

Correct Answer

verified

Correct Answer

verified

Essay

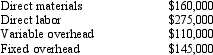

Crazy Cars Corporation's flexible budget for 30,000 units,for March,gives you the following information:

The company produced 25,000 units in March with the following actual costs:

The company produced 25,000 units in March with the following actual costs:

Prepare a performance report for March,to compare the data from Crazy Cars' flexible budget with the actual costs incurred.Also,find if the costs are under or over budgeted.

Prepare a performance report for March,to compare the data from Crazy Cars' flexible budget with the actual costs incurred.Also,find if the costs are under or over budgeted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following yields the standard direct material cost?

A) Multiplying the standard price of direct materials by the standard quantity for direct materials

B) Adding the standard price of direct materials to the standard quantity for direct materials

C) Multiplying the actual price of direct materials by the actual quantity for direct materials

D) Adding the actual price of direct materials to the actual quantity for direct materials

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures the difference between the quantity of materials actually used to make the product and what the design standard called for?

A) Direct labor efficiency variance.

B) Direct materials price variance.

C) Direct labor rate variance.

D) Direct materials usage variance.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 118

Related Exams