Correct Answer

verified

An understated beginning inventory will ...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

Days' inventory on hand equals 365 divided by

A) inventory turnover.

B) cost of goods sold.

C) goods available for sale.

D) average inventory.

Correct Answer

verified

Correct Answer

verified

True/False

The FIFO inventory method does not produce the most up-to-date figure for ending inventory.

Correct Answer

verified

Correct Answer

verified

True/False

Under a periodic inventory system,cost of goods sold is not recorded until the end of the accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An overstatement of beginning inventory results in

A) no effect on the period's gross margin.

B) an overstatement of gross margin.

C) an understatement of gross margin.

D) a need to adjust purchases.

Correct Answer

verified

Correct Answer

verified

True/False

A major criticism of the FIFO method is that it magnifies the effects of the business cycle on business income.

Correct Answer

verified

Correct Answer

verified

True/False

The lower the inventory turnover,the lower the days' inventory on hand.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which costing method is used based on the reasoning that the fairest determination of income occurs if the current costs are matched against current sales prices?

A) Specific identification

B) FIFO

C) Average-cost

D) LIFO

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which costing method tends to level out the effects of cost increases or decreases?

A) Specific identification

B) FIFO

C) Average-cost

D) LIFO

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an inventory processing system?

A) Perpetual

B) Last-in,first-out

C) Lower-of-cost-or-market

D) Average-cost

Correct Answer

verified

Correct Answer

verified

True/False

Market is the amount that a merchandising company would pay at the present time for the same goods as are in the inventory and from the usual suppliers in the usual quantities

Correct Answer

verified

Correct Answer

verified

True/False

If prices were to never change,there would be no need for alternative inventory methods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When applying the retail method,which of the following would not be a component of the cost-to-retail percentage?

A) Purchases

B) Beginning inventory

C) Sales

D) Freight-in

Correct Answer

verified

Correct Answer

verified

True/False

Goods in transit shipped FOB destination should not be included in the buyer's ending inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory costing methods place primary reliance on assumptions about the flow of

A) costs.

B) goods.

C) resale prices.

D) values.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

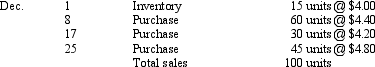

Use this information to answer the following question.  A periodic inventory system is used.

-Cost of goods sold under FIFO is

A periodic inventory system is used.

-Cost of goods sold under FIFO is

A) $429.

B) $426.

C) $452.

D) $237.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a period of declining prices,which of the following inventory methods generally results in the lowest balance sheet figure for inventory?

A) LIFO

B) Cannot tell without more information

C) FIFO

D) Average-cost

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An understatement of year 1's beginning inventory will

A) cause year 2's gross margin to be overstated.

B) cause year 1's cost of goods sold to be understated.

C) cause year 2's gross margin to be understated.

D) have no effect on year 1's gross margin.

Correct Answer

verified

Correct Answer

verified

True/False

When the average-cost method is applied to a perpetual inventory system,the sale of goods will not change the unit cost of the goods that remain in inventory.

Correct Answer

verified

Correct Answer

verified

True/False

Merchandise inventory is valued on the balance sheet at the expected resale price.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 162

Related Exams