A) buys U.S. Treasury bills from the federal government.

B) buys or sells foreign currency.

C) buys or sells existing U.S. Treasury bills.

D) sells U.S. Treasury bills to the federal government.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following assets is money?

A) a $20 bill

B) a work of art

C) a baseball signed by a famous player

D) shares of stock in a profitable company

Correct Answer

verified

Correct Answer

verified

True/False

Many S&Ls failed in the late 1970s and early 1980s when they lost most of their depositors to Fannie Mae and Freddie Mac.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In return for injecting capital into banks, the U.S. government received:

A) deposits at the bank.

B) loans at an interest rate below the prime rate.

C) bonds issued by the bank.

D) shares of stock in the bank.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest monetary aggregate is:

A) M1, because it contains all of the currency in circulation.

B) M2, because it contains currency in circulation, all bank deposits, other deposits, and deposit-like assets.

C) the reserves in the vaults of Federal Reserve banks, because they are the money multiplier.

D) the total volume of stocks and bonds, because they store most of the national wealth.

Correct Answer

verified

Correct Answer

verified

True/False

The Wall Street Reform and Consumer Protection Act, also called Dodd-Frank, was passed in the 1930s to correct the problems that led to the Great Depression.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of Regulation Q was to:

A) prevent commercial banks from trading stocks and bonds.

B) require investment banks to purchase deposit insurance.

C) prevent unhealthy competition between banks by limiting the number of customers each bank could serve.

D) prevent banks from paying interest on checking accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Reconstruction Finance Corporation:

A) was established to extract war reparations from the South after the Civil War.

B) supervised the government assistance to AIG and Lehman Brothers.

C) was established in the 1930s to make loans to banks and to buy their preferred stock.

D) supervised the rebuilding of Iraq.

Correct Answer

verified

Correct Answer

verified

True/False

The federal funds rate is determined by the demand and supply for bank reserves, both of which are strongly influenced by the Federal Reserve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiat money:

A) is currency from Italy.

B) can include currency backed by gold but not by silver.

C) is currency backed by the gold in Fort Knox.

D) has advantages over commodity-backed money.

Correct Answer

verified

Correct Answer

verified

True/False

Commodity-backed money's value is guaranteed by a promise that it can be converted to a useful good.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a bank has deposits of $100,000, loans of $75,000, cash on hand of $10,000, and $15,000 on deposit at the Federal Reserve, then its reserve ratio is:

A) 5%.

B) 10%.

C) 12.5%.

D) 25%.

Correct Answer

verified

Correct Answer

verified

True/False

High inflation rates in the 1970s were harmful to S&Ls because they decreased the value of the thrifts' long-term mortgages.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A private investment partnership open only to wealthy individuals and institutions is a(n) :

A) hedge fund.

B) investment bank.

C) savings and loan.

D) quasi-government agency.

Correct Answer

verified

Correct Answer

verified

True/False

The discount window is the branch of the Federal Reserve that monitors banks to be sure that they are meeting reserve and capital requirements.

Correct Answer

verified

Correct Answer

verified

True/False

At the end of each business day, the Federal Reserve requires banks to hold reserves equal to 10% of their checkable deposits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a bank lends excess reserves to a customer:

A) this does not affect the money supply.

B) the money supply is increased.

C) the money supply is decreased.

D) it has the same effect as when one customer writes a check to another customer at a different bank.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The double coincidence of wants problem can be solved by:

A) more resources.

B) more production.

C) money.

D) economic growth.

Correct Answer

verified

Correct Answer

verified

True/False

Money is unique because it is the only asset that can be used as a store of value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

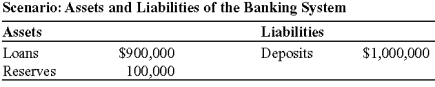

Use the following to answer questions :  -(Scenario: Assets and Liabilities of the Banking System) Look at the scenario Assets and Liabilities of the Banking System. Suppose that the reserve ratio is 10% and the Federal Reserve sells $11,000 worth of U.S. Treasury bills to the banking system. If the banking system does NOT want to hold any excess reserves, _____ will be _____ the money supply.

-(Scenario: Assets and Liabilities of the Banking System) Look at the scenario Assets and Liabilities of the Banking System. Suppose that the reserve ratio is 10% and the Federal Reserve sells $11,000 worth of U.S. Treasury bills to the banking system. If the banking system does NOT want to hold any excess reserves, _____ will be _____ the money supply.

A) $110,000; added to

B) $110,000; subtracted from

C) $250,000; subtracted from

D) $250,000; added to

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 468

Related Exams