A) filing status

B) types of earnings

C) gross pay

D) number of exemptions

Correct Answer

verified

Correct Answer

verified

Essay

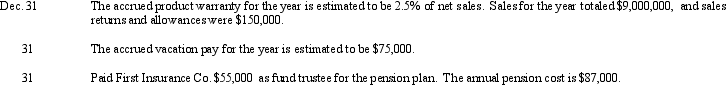

Journalize the following transactions for Riley Corporation:

Correct Answer

verified

Correct Answer

verified

True/False

Medicare taxes are withheld from an employee's pay only until the employee has earned a specific amount each year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grayson Bank agrees to lend the Trust Company $120,000 on January 1. Trust Company signs a $120,000, 8%, 9-month note. The entry made by Trust Company on January 1 to record the proceeds and issuance of the note is:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Essay

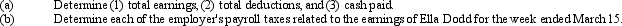

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour, with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% on maximum earnings of $100,000. Medicare tax:

1.5% on all earnings.

State unemployment: 3.4% on maximum earnings of $7,000; on employer

Federal unemployment: 0.8% on maximum earnings of $7,000; on employer

Correct Answer

verified

Correct Answer

verified

True/False

The amount of money a borrower receives from the lender is called discount rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prior to the last weekly payroll period of the calendar year, the cumulative earnings of employees A and B are $99,350 and $91,000 respectively. Their earnings for the last completed payroll period of the year are $850 each. The maximum amount of earnings subject to social security tax at 6% is $100,000. All earnings are subject to Medicare tax of 1.5%. Assuming that the payroll will be paid on December 29, what will be the employer's total FICA tax for this payroll period on the two salary amounts of $850 each?

A) $127.50

B) $115.50

C) $112.50

D) $0

Correct Answer

verified

Correct Answer

verified

True/False

Interest expense is reported in the operating expense section of the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll entries are made with data from the

A) wage and tax statement

B) employee's earning record

C) employer's quarterly federal tax return

D) payroll register

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 8, Alton Co. issued an $95,000, 6%, 120-day note payable to Seller Co. What is the due date of the note?

A) October 8

B) October 7

C) October 6

D) October 5

Correct Answer

verified

Correct Answer

verified

True/False

The payroll register is a multicolumn form used to assemble the data related for all employees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most desirable quick ratio?

A) 1.20

B) 1.00

C) 0.95

D) 0.50

Correct Answer

verified

Correct Answer

verified

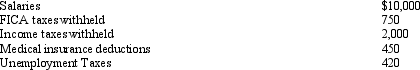

Essay

An employee receives an hourly rate of $45, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $950; Social security tax rate, 6.5% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings; state unemployment compensation tax, 3.4% on the first $7,000; federal unemployment compensation tax, .8% on the first $7,000. Calculate the employer's payroll tax expense if: a. this is the first payroll of the year and the employee has no cumulative earnings for the year to date. b. the employee's cumulative earnings for the year prior to this week equal $6,200. c. the employee's cumulative earnings for the year prior to this week equal $98,700. Employee wages = (40 x $45 + 8 x $67.50) $2,340

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record accrued vacation privileges for its employees at the end of the year is

A) debit Vacation Pay Expense; credit Vacation Pay Payable

B) debit Vacation Pay Payable; credit Vacation Pay Expense

C) debit Salary Expense; credit Cash

D) debit Salary Expense; credit Salaries Payable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following totals for the month of April were taken from the payroll register of Magnum Company.  The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $1,170

B) debit to FICA Taxes Payable for $1,500

C) credit to Payroll Tax Expense for $420

D) debit to Payroll Tax Expense for $1,620

Correct Answer

verified

Correct Answer

verified

Essay

The payroll summary for December 31 for Waters Co. revealed total earnings of $80,000. Earnings subject to 6% social security tax were $60,000; earnings subject to 1.5% Medicare tax were $80,000; and earnings of $3,000 were subject to 4.3% state and 0.8% federal unemployment compensation tax. Journalize the entry to record the accrual of payroll taxes.

Correct Answer

verified

Correct Answer

verified

True/False

Like many taxes deducted from employee earnings, federal income taxes are subject to a maximum amount per employee per year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Elgin Company sells merchandise with a one year warranty. Sales consisted of 2,500 units in 2012 and 2,000 units in 2013. It is estimated that warranty repairs will average $10 per unit sold, and 30% of the repairs will be made in 2012 and 70% in 2013 for the 2012 sales. Similarly, 30% of repairs will be made in 2013 and 70% in 2014 for the 2013 sales. In the 2013 income statement, how much of the warranty expense shown will be due to 2012 sales?

A) $7,500

B) $17,500

C) $25,000

D) $0

Correct Answer

verified

Correct Answer

verified

True/False

Depending upon when an unfunded pension liability is to be paid, it will be classified on the balance sheet as either a long-term or a current liability.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Proper payroll accounting methods are important for a business for all the reasons below except

A) good employee morale requires timely and accurate payroll payments.

B) payroll is subject to various federal and state regulations.

C) to help a business with cash flow problems by delayed payments of payroll taxes to federal and state agencies.

D) payroll and related payroll taxes have a significant effect on the net income of most businesses.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 174

Related Exams