A) the interest on bonds must be paid when due

B) the corporation must pay the bonds at maturity

C) the interest expense is deductible for tax purposes by the corporation

D) a higher earnings per share is guaranteed for existing common shareholders

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2011, $1,000,000, 5-year, 10% bonds, were issued for $960,000. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize discount on bonds payable, the semiannual amortization amount is

A) $8,000

B) $6,000

C) $4,000

D) $5,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The adjusting entry to record the amortization of a discount on bonds payable is

A) debit Discount on Bonds Payable, credit Interest Expense

B) debit Interest Expense, credit Discount on Bonds Payable

C) debit Interest Expense, credit Cash

D) debit Bonds Payable, credit Interest Expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest expense recorded on an interest payment date is increased

A) only if the market rate of interest is less than the stated rate of interest on that date.

B) by the amortization of premium on bonds payable.

C) by the amortization of discount on bonds payable.

D) only if the bonds were sold at face value.

Correct Answer

verified

Correct Answer

verified

True/False

When the market rate of interest is less than the contract rate for a bond, the bond will sell for a premium.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sinking Fund Cash would be classified on the balance sheet as

A) a current asset

B) a fixed asset

C) an intangible asset

D) an investment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the issuance of bonds when the contract rate and the market rate are the same is

A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

Correct Answer

verified

Correct Answer

verified

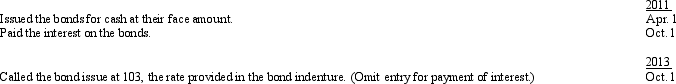

Essay

A company issued $2,000,000 of 30-year, 8% callable bonds on April 1, 2011, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If $1,000,000 of 8% bonds are issued at 103 1/2, the amount of cash received from the sale is

A) $1,080,000

B) $965,000

C) $1,000,000

D) $1,035,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $300,000 bond was redeemed at 98 when the carrying value of the bond was $295,000. The entry to record the redemption would include a

A) loss on bond redemption of $5,000.

B) gain on bond redemption of $5,000.

C) gain on bond redemption of $1,000.

D) loss on bond redemption of $1,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2011, Zero Company obtained a $52,000, four-year, 6.5% installment note from Regional Bank. The note requires annual payments of $15,179, beginning on December 31, 2011. The December 31, 2012 carrying amount in the amortization table for this installment note will be equal to:

A) $26,000

B) $27,635

C) $21,642

D) $28,402

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the issuance of bonds when the contract rate is less than the market rate would be

A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

Correct Answer

verified

Correct Answer

verified

True/False

The times interest earned ratio is calculated by dividing Bonds Payable by Interest Expense.

Correct Answer

verified

Correct Answer

verified

Essay

A $500,000 bond issue on which there is an unamortized discount of $20,000 is redeemed for $475,000. Journalize the redemption of the bonds.

Correct Answer

verified

Correct Answer

verified

True/False

Gains and losses on the redemption of bonds are reported as other income or other expense on the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the straight-line method of amortization of bond premium or discount is used, which of the following statements is true?

A) Annual interest expense will increase over the life of the bonds with the amortization of bond premium.

B) Annual interest expense will remain the same over the life of the bonds with the amortization of bond discount.

C) Annual interest expense will decrease over the life of the bonds with the amortization of bond discount.

D) Annual interest expense will increase over the life of the bonds with the amortization of bond discount.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds with a face amount $1,000,000, are sold at 98. The entry to record the issuance is

A) Cash 1,000,000 Premium on Bonds Payable 20,000

Bonds Payable 980,000

B) Cash 980,000 Premium on Bonds Payable 20,000

Bonds Payable 1,000,000

C) Cash 980,000 Discount on Bonds Payable 20,000

Bonds Payable 1,000,000

D) Cash 980,000 Bonds Payable 980,000

Correct Answer

verified

Correct Answer

verified

True/False

The unamortized Discount on Bonds Payable account is a contra-liability account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the effective-interest method is used, the amortization of the bond premium

A) increases interest expense each period

B) decreases interest expense each period

C) increases interest expense in some periods and decreases interest expense in other periods

D) has no effect on the interest expense in any period

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Numbers of times interest charges earned is computed as

A) Income before income taxes plus Interest Expense divided by Interest Expense

B) Income before income taxes less Interest Expense divided by Interest Expense

C) Income before income taxes divided by Interest Expense

D) Income before income taxes plus Interest Expense divided by Interest Revenue

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 181

Related Exams