A) mutual agency for stockholders

B) unlimited liability for stockholders

C) corporations are subject to more governmental regulations

D) the ease of transfer of ownership

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stockholders must receive their current year dividends before the common stockholders can receive any dividends.

Correct Answer

verified

Correct Answer

verified

True/False

A stock split results in a transfer at market value from retained earnings to paid-in capital.

Correct Answer

verified

Correct Answer

verified

Essay

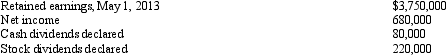

Morocco Inc. reported the following results for the year ending April 30, 2014:

Prepare a retained earnings statement for the fiscal year ended April 30, 2014.

Prepare a retained earnings statement for the fiscal year ended April 30, 2014.

Correct Answer

verified

Correct Answer

verified

True/False

The primary purpose of a stock split is to reduce the number of shares outstanding in order to encourage more investors to enter the market for the company's shares.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If common stock is issued for an amount greater than par value, the excess should be credited to

A) Retained Earnings.

B) Cash.

C) Legal Capital.

D) Paid-in Capital in Excess of Par Value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 30,000 shares were originally issued and 5,000 were subsequently reacquired. What is the number of shares outstanding?

A) 35,000

B) 70,000

C) 25,000

D) 30,000

Correct Answer

verified

Correct Answer

verified

True/False

If 100 shares of treasury stock were purchased for $50 per share and then sold at $60 per share, $1,000 of income is reported in the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock which was purchased for $3,000 is sold for $3,500. As a result of these two transactions combined

A) income will be increased by $500

B) stockholders' equity will be increased by $3,500

C) stockholders' equity will be increased by $500

D) stockholders' equity will not change

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company with 100,000 authorized shares of $4 par common stock issued 50,000 shares at $9. Subsequently, the company declared a 2% stock dividend on a date when the market price was $10 a share. The effect of the declaration and issuance of the stock dividend is to

A) decrease retained earnings, increase common stock, and increase paid-in capital

B) increase retained earnings, decrease common stock, and decrease paid-in capital

C) increase retained earnings, decrease common stock, and increase paid-in capital

D) decrease retained earnings, increase common stock, and decrease paid-in capital

Correct Answer

verified

Correct Answer

verified

True/False

The amount of capital paid in by the stockholders of the corporation is called legal capital.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Those most responsible for the major policy decisions of a corporation are the

A) management.

B) board of directors.

C) employees.

D) stockholders.

Correct Answer

verified

Correct Answer

verified

True/False

The retained earnings statement may be combined with the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

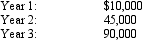

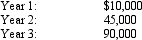

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:  Determine the dividends in arrears for preferred stock for the second year.

Determine the dividends in arrears for preferred stock for the second year.

A) $25,000

B) $10,000

C) $0

D) $30,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:  Determine the dividends per share for preferred and common stock for the third year.

Determine the dividends per share for preferred and common stock for the third year.

A) $4.50 and $0.25

B) $3.25 and $0.25

C) $4.50 and $0.90

D) $2.00 and $0.25

Correct Answer

verified

Correct Answer

verified

Essay

The dates of importance in connection with a cash dividend of $50,000 on a corporation's common stock are January 15, February 15, and March 15. Journalize the entries required on each date.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the corporate form of business organization

A) ownership rights are easily transferred.

B) a stockholder is personally liable for the debts of the corporation.

C) stockholders' acts can bind the corporation even though the stockholders have not been appointed as agents of the corporation.

D) stockholders wishing to sell their corporation shares must get the approval of other stockholders.

Correct Answer

verified

Correct Answer

verified

True/False

The cost method of accounting for the purchase and sale of treasury stock is a commonly used method.

Correct Answer

verified

Correct Answer

verified

Essay

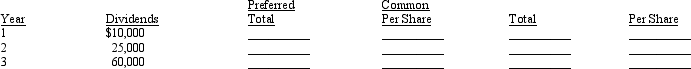

A company had stock outstanding as follows during each of its first three years of operations: 2,500 shares of $10, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total and per share dividends for each class of stock for each year by completing the schedule.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 40,000 shares were originally issued and 10,000 were subsequently reacquired. What is the number of shares outstanding?

A) 10,000

B) 40,000

C) 30,000

D) 50,000

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 165

Related Exams