A) increase.

B) decrease.

C) remain unchanged.

D) become more difficult to predict.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some economists argue that the Fed should commit to keeping + fixed at a particular value,say 5%.How would this rule require the Fed to respond in the event of a negative spending shock? A negative real shock?

A) increase

;do nothing

B) increase

;increase

C) increase

;decrease

D) decrease

;increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The advocates of discretion for the Fed's role think that the Fed's adjustments on average push the economy in the:

A) wrong direction and lower GDP volatility.

B) right direction and lower GDP volatility.

C) wrong direction and increase GDP volatility.

D) right direction and increase GDP volatility.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most appropriate monetary policy response to an asset price bubble for a central bank is to:

A) react to asset price bubbles because they can easily be identified.

B) not react to asset price bubbles because its actions will lead to a recession.

C) react to asset price bubbles aggressively because they cannot be popped any other way.

D) not react to asset price bubbles because monetary policy can only affect aggregate demand,not demand in a specific market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the short run,a negative real shock will cause output growth to:

A) increase.

B) decrease.

C) remain unchanged.

D) become more difficult to predict.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which would be an example of running monetary policy by rules?

A) A 5% increase in money supply automatically leads to a 2% increase in real GDP.

B) An increase in money supply growth automatically leads to an increase in inflation.

C) The Fed will increase money growth to different levels,depending on the severity of the recession.

D) A 1% drop in real GDP growth will automatically elicit a 2% increase in money growth.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in money supply growth will cause the:

A) AD curve to shift to the left.

B) SRAS curve to shift to the left.

C) LRAS curve to shift to the left.

D) price level to fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To reduce inflation in response to a negative real shock,the Federal Reserve would:

A) decrease the money growth rate,which would lower both the inflation rate and economic growth rate.

B) decrease the money growth rate,which would increase both the inflation rate and economic growth rate.

C) increase the money growth rate,which would lower both the inflation rate and economic growth rate.

D) increase the money growth rate,which would increase both the inflation rate and economic growth rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shortly after September 11,2011,the Federal Reserve:

A) decreased its lending to banks.

B) increased its lending to banks.

C) decreased its lending to individuals.

D) increased its lending to individuals.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions

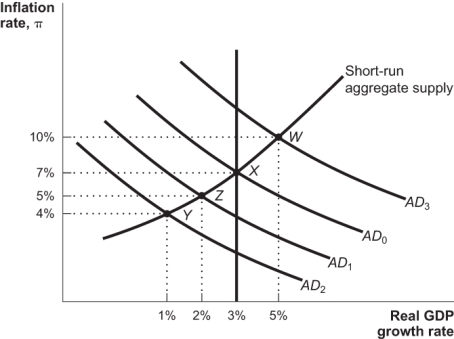

Figure: Monetary Policy  -(Figure: Monetary Policy) Refer to the figure.Assume that the economy is initially at point Y in the graph.In the best case scenario,the Fed will:

-(Figure: Monetary Policy) Refer to the figure.Assume that the economy is initially at point Y in the graph.In the best case scenario,the Fed will:

A) increase money supply to take the economy to point X.

B) decrease money supply to take the economy to point W.

C) increase money supply to take the economy to point W.

D) decrease money supply to take the economy to point X.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The BEST type of negative shock for the Federal Reserve to respond to is a negative shock to:

A) AD.

B) SRAS.

C) LRAS.

D) inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed increases to fight slower real growth after a negative real shock,which of the following should occur?

A) no change in real growth

B) lower real growth

C) lower inflation

D) higher inflation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In response to a negative spending shock,a condition of lower market confidence makes monetary policy easing:

A) more effective in raising real GDP growth.

B) less effective in raising real GDP growth.

C) just as effective in raising real GDP growth as higher market confidence.

D) lead to increases in both real GDP growth and inflation.

Correct Answer

verified

Correct Answer

verified

True/False

Monetary policy is much less effective at combating a real shock than a demand shock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the 1970s,the Fed often reacted to negative oil shocks by decreasing the money supply and focusing on:

A) increasing long-run growth in the economy.

B) reducing inflation.

C) reducing unemployment.

D) raising employment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When hit with a negative real shock,the Fed must pick a policy that chooses between:

A) a growth rate that's too low and an unemployment rate that's too high.

B) a growth rate that's too low and an inflation rate that's too high.

C) a growth rate that's too high and wages that are too low.

D) a growth rate that's too high and a savings rate that's too low.

Correct Answer

verified

Correct Answer

verified

True/False

At the time the Federal Reserve must make a decision,the actual state of the economy may be unknown.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nobel Prize-winner Milton Friedman advocated which of the following as an adequate monetary policy?

A) a discretionary rule in which the money supply should be adjusted to control the level of inflation rate

B) a discretionary rule in which the money supply should be adjusted to counteract aggregate demand shocks

C) a strict rule in which the money supply should grow 2% higher than the long-run economic growth rate

D) a strict rule in which the money supply should grow at the rate of the long-run economic growth rate

Correct Answer

verified

Correct Answer

verified

True/False

The Fed has been unable to offset the effects of negative real shocks with monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deflation is:

A) a decrease in prices;that is,a negative inflation rate.

B) a reduction in the rate of inflation.

C) an increase in prices.

D) an increase in the rate of inflation.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 242

Related Exams