A) Land purchase price

B) Property tax

C) General overhead such as personnel costs

D) Developer's profit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Each parcel of land in a new development is selling for $15,000 and the total project revenue is estimated to be $5,000,000.The project lender has stated that the loan should be paid off when 80% of the total project revenue has been earned.The total loan amount is $3,500,000.What is the release price for each parcel?

A) $8,400

B) $13,215

C) $18,750

D) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In order to obtain a land development loan,the developer is required usually to purchase title insurance

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is FALSE regarding the release price?

A) It is usually calculated to pay off the loan when the last lot is sold

B) It is usually calculated to pay off the loan before the last lot is sold

C) Increasing the release price usually lowers the lender's risk

D) Increasing the release price is likely to lower the investor's initial cash flow

Correct Answer

verified

Correct Answer

verified

True/False

The release price is the dollar amount of a loan that must be repaid when a lot is sold

Correct Answer

verified

Correct Answer

verified

True/False

It is illegal for the lender to hold back funds from the developer

Correct Answer

verified

Correct Answer

verified

Multiple Choice

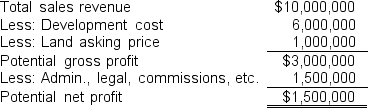

Refer to the information in the previous question.You have been advised that sales revenues may be 10 percent lower and/or development costs may be 10 percent higher.Performing a sensitivity analysis,you conclude:

A) A 10 percent decrease in sales revenues would have a bigger impact on returns than a 10 percent increase in development costs

B) A 10 percent increase in development costs would have a bigger impact on returns than a 10 percent decrease in sales revenues

C) A 10 percent increase in development costs and a 10 percent decrease in sales revenues would have opposite impacts on returns,canceling each other out and having no impact on returns

D) Both factors would have such a small impact,that there is no reason to be concerned about either a 10 percent increase in development costs or a 10 percent decrease in sales revenues![]()

Correct Answer

verified

Correct Answer

verified

True/False

It is proper to include an estimate for developer profit as a cost of development when projecting net cash flows and evaluating whether a required rate of return will be met

Correct Answer

verified

Correct Answer

verified

True/False

The release schedule refers to a schedule of expiring leases for existing tenants

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When financing land development,the lender generally requires the developer to submit which of the following?

A) A detailed breakdown of project cost

B) Required zoning changes

C) Bank references for the general contractor to be used on the project

D) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

It is common for a developer to hold back funds to be sure that subcontractors perform all work completely before making final payment

Correct Answer

verified

Correct Answer

verified

Showing 21 - 31 of 31

Related Exams