A) expansionary monetary policy

B) contractionary monetary policy

C) contractionary fiscal policy

D) expansionary fiscal policy

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the equation of exchange, an increase in M of 8 percent could be accompanied by changes in velocity, the price level and real GDP of:

A) -2%, 3%, 3%.

B) 4%, 0%, 4%.

C) 2%, 8%, 8%.

D) 8%, 8%, 4%.

E) 0%, 8%, 8%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The supply-of-money curve is almost perfectly inelastic because:

A) as interest rates rise, people will want to be supplied with more loans.

B) the Fed makes more money available in response to higher interest rates.

C) banks generally find loans more profitable than keeping their assets as cash in their vaults or reserve deposits at the Fed, whether interest rates are 4% or 40%.

D) the Fed lowers the discount rate as interest rates rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed raises the discount rate, it:

A) forces commercial banks to call in existing loans.

B) changes excess reserves into required reserves.

C) changes required reserves into excess reserves.

D) raises the money multiplier.

E) does none of the above.

Correct Answer

verified

Correct Answer

verified

True/False

The chief function of the Federal Reserve is to be the federal government's tax collection institution.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a function of the Federal Reserve System?

A) limiting the national debt

B) setting the required reserve ratio for the deposit holdings of depository institutions

C) buying and selling government bonds to control the size and growth rate of the money supply

D) controlling inflation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When money demand decreases, the Fed can choose between:

A) increasing interest rates or increasing the supply of money.

B) increasing interest rates or decreasing the supply of money.

C) decreasing interest rates or increasing the supply of money.

D) decreasing interest rates or decreasing the supply of money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed was to use all of its major domestic monetary control tools to increase the money supply, it would:

A) buy bonds, reduce the discount rate, and reduce reserve requirements.

B) sell bonds, reduce the discount rate, and reduce reserve requirements.

C) sell bonds, reduce the discount rate, and increase reserve requirements.

D) sell bonds, increase the discount rate, and increase reserve requirements.

Correct Answer

verified

Correct Answer

verified

True/False

Most of the key decisions of the Federal Reserve are actually made by its Federal Open Market Committee.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the money supply grew by 6 percent and velocity fell by 2 percent, nominal GDP would:

A) fall by 4 percent.

B) rise by 4 percent.

C) rise by 8 percent.

D) rise by 12 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

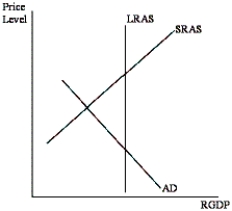

Based on the situation depicted in the graph below, which of the following would be an appropriate monetary policy response?

A) increase reserve requirements

B) increase the discount rate

C) sell government bonds

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the money supply:

A) will definitely result in inflation if unemployment is high and there is much unused industrial capacity.

B) shifts the aggregate demand curve to the left.

C) will probably result in inflation if the economy is fully employed.

D) causes interest rates to rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity of money demanded varies inversely with the ____ rate, but the supply of money is almost perfectly ____ with respect to interest rates.

A) prime; elastic

B) interest; elastic

C) interest; inelastic

D) prime; inelastic

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is false?

A) If the Fed wants to expand the money supply, it could lower the discount rate.

B) The discount rate is a relatively unimportant monetary policy tool, mainly because member banks do not rely heavily on the Fed for borrowed funds.

C) Changes in required reserve ratios are such a potent monetary policy tool that they are frequently used.

D) If the Federal Reserve wanted to induce monetary expansion, it could reduce reserve requirements, but it cannot force the banks to make loans, thereby creating new money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is potentially the most powerful tool available to the Fed to control the supply of money?

A) open market operations

B) moral suasion

C) changes in reserve requirements

D) discount rate changes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An open market purchase of government securities by the Fed will not tend to result in which of the following, other things being equal?

A) increased bond prices

B) a reduced volume of loans issued by the commercial banking system

C) decreased interest rates

D) an increase in the price level

E) an increase in real output

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would tend to increase AD?

A) a commercial bank using excess reserves to extend a loan to a customer

B) a commercial bank purchasing U.S. securities from the Fed as an investment

C) an increase in reserve requirements

D) an increase in the discount rate

E) a purchase of U.S. government securities by the Fed

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed sells a U.S.government bond to a bank, what is the effect on the money supply?

A) It will increase.

B) It will not change.

C) It will shrink only if the Fed takes no reserves as payment.

D) It will shrink only if the Fed takes reserves as payment.

E) It will shrink.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed sells bonds, the short-run impact of this policy will tend to include:

A) an increase in the inflation rate.

B) a reduction in unemployment.

C) an increase in real output.

D) an increase in real interest rates.

Correct Answer

verified

Correct Answer

verified

True/False

Open market operations directly change the rate of interest at which banks can borrow funds from the Fed.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 133

Related Exams