A) Increase in profits or losses from an investment

B) Use of one's own money in an investment

C) Use of borrowing money in order to magnify returns from an investment

D) Shifting of financial risk on to an insurer

Correct Answer

verified

Correct Answer

verified

True/False

The monetary multiplier can also be called the spending multiplier.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When people withdraw money from their deposits in the banking system, the:

A) Excess reserves of the banking system will decrease

B) Excess reserves of the banking system will increase

C) Excess reserves of the banking system will not be affected

D) Money supply will immediately decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commercial bank has excess reserves of $10,000 and a required reserve ratio of 20%. It grants a loan of $8,000 to a customer, who then writes out a check for $8,000 that is deposited in another bank. The first bank will find its reserves decrease by:

A) $2,000

B) $3,000

C) $1,600

D) $8,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commercial bank has excess reserves of $5000 and a required reserve ratio of 20 percent. It makes a loan of $6000 to a borrower. The borrower writes a check for $6000 that is deposited in another commercial bank. After the check clears, the first bank will be short of reserves in the amount of:

A) $1000

B) $1200

C) $5000

D) $6000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The commercial banking system has excess reserves of $200,000. Then new loans of $800,000 are subsequently made, and the system ends up just meeting its reserve requirements. The required reserve ratio must be:

A) 10 percent

B) 20 percent

C) 25 percent

D) 30 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank owns a 10-story office building. In the bank's balance sheet, this would be listed as part of:

A) Assets

B) Liabilities

C) Capital stock

D) Net worth

Correct Answer

verified

Correct Answer

verified

Multiple Choice

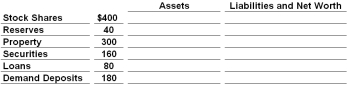

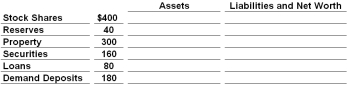

The figures in the table below are for a single commercial bank. All figures are in thousands of dollars.  Refer to the data given above. If the required reserve ratio is 10 percent, the bank has excess reserves of:

Refer to the data given above. If the required reserve ratio is 10 percent, the bank has excess reserves of:

A) $28,000

B) $22,000

C) $18,000

D) $16,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank's net worth is the:

A) Measure of its profitability

B) Value of its vault cash and loan portfolio

C) Claims of its owners against the bank's assets

D) Claims of its creditors against the bank's assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the Federal funds market, a bank that needs to meet reserve requirements can borrow reserves, usually for a period:

A) Overnight

B) Of a week

C) Of a month

D) Of six months

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank's required reserves can be calculated by:

A) Dividing its excess reserves by its required reserves

B) Dividing its required reserves by its excess reserves

C) Multiplying its checkable-deposit liabilities by the reserve ratio

D) Multiplying its checkable-deposit liabilities by its excess reserves

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commercial bank has checkable-deposit liabilities of $50,000 and a required-reserve ratio of 20 percent. What is the amount of required reserves?

A) $10,000

B) $50,000

C) $250,000

D) $1 million

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank's checkable deposits shrinks from $40 million to $33 million. What happens to its required reserves if the required reserve ratio is 3%?

A) They fall by about $1.2 million

B) They fall by about $10 million

C) They fall by about $7 million

D) They fall by about $0.2 million

Correct Answer

verified

Correct Answer

verified

True/False

When a bank accepts additional deposits, its required reserves and excess reserves will both increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When bankers hold excess reserves:

A) The size of the monetary multiplier increases

B) The money-creating potential of the banking system increases

C) The money-creating potential of the banking system decreases

D) There is no change in the money-creating potential of the banking system

Correct Answer

verified

Correct Answer

verified

Multiple Choice

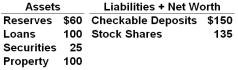

Answer the question based on the following consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars:  Refer to the above data. The claims of owners in the commercial banking system are equal to:

Refer to the above data. The claims of owners in the commercial banking system are equal to:

A) $60 billion

B) $100 billion

C) $135 billion

D) $150 billion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commercial bank has required reserves of $60 million and the reserve ratio is 20 percent. How much are the commercial bank's checkable-deposit liabilities?

A) $120 million

B) $900 million

C) $300 million

D) $1,200 million

Correct Answer

verified

Correct Answer

verified

True/False

When a bank's loan defaults, then the bank's reserves will decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank is in the position to make loans when required reserves:

A) Equal actual reserves

B) Equal excess reserves

C) Are less than actual reserves

D) Are greater than actual reserves

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The figures in the table below are for a single commercial bank. All figures are in thousands of dollars.  Refer to the data given above. This bank has liabilities and net worth totaling:

Refer to the data given above. This bank has liabilities and net worth totaling:

A) $400 million

B) $440 million

C) $550 million

D) $580 million

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 127

Related Exams