A) Trade deficit

B) Trade surplus

C) Budget deficit

D) Budget surplus

Correct Answer

verified

Correct Answer

verified

Multiple Choice

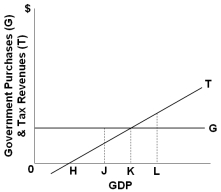

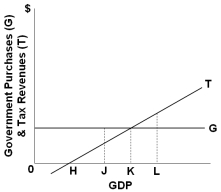

Refer to the graph above. Automatic stability in this economy could be enhanced by:

Refer to the graph above. Automatic stability in this economy could be enhanced by:

A) Changing the tax system so that the tax line has a steeper slope

B) Changing the tax system so that the tax line is shifted upward but parallel to its present position

C) Changing the government expenditures line so that it has a positive slope

D) Changing the tax system so that the tax line has a flatter slope

Correct Answer

verified

Correct Answer

verified

Multiple Choice

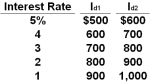

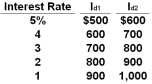

The table gives data on interest rates and investment demand (in billions of dollars) in a hypothetical economy.  Refer to the above table. Assume that the public debt is used to expand the capital stock of the economy and that, as a consequence, the investment-demand schedule changes from Id1 to Id2. At the same time, the interest rate rises from 3% to 4% as the government borrows money to finance the public debt. How much crowding out of private investment will occur in this case?

Refer to the above table. Assume that the public debt is used to expand the capital stock of the economy and that, as a consequence, the investment-demand schedule changes from Id1 to Id2. At the same time, the interest rate rises from 3% to 4% as the government borrows money to finance the public debt. How much crowding out of private investment will occur in this case?

A) $0

B) $100 billion

C) $600 billion

D) $700 billion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

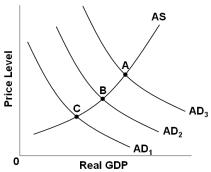

Refer to the figure above. The economy is at equilibrium at point C which is below potential output. What fiscal policy would increase real GDP?

Refer to the figure above. The economy is at equilibrium at point C which is below potential output. What fiscal policy would increase real GDP?

A) Shift aggregate demand by increasing taxes

B) Shift aggregate demand by decreasing transfer payments

C) Shift aggregate demand by decreasing government spending

D) Shift aggregate demand by increasing transfer payments

Correct Answer

verified

Correct Answer

verified

True/False

A budget deficit causes the government to issue or sell Treasury bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the graph above, tax revenues vary:

In the graph above, tax revenues vary:

A) Directly with the level of GDP

B) Inversely with the level of GDP

C) Directly with the level of government spending

D) Inversely with the level of government spending

Correct Answer

verified

Correct Answer

verified

True/False

The so-called crowding-out effect refers to government spending crowding out private investment spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wishes to increase the level of real GDP, it might reduce:

A) Taxes

B) Transfer payments

C) The size of the budget deficit

D) Its purchases of goods and services

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Proponents of the notion of a "political business cycle" suggest that:

A) The standardized budget is a better indicator of the state of the economy than the actual budget, for political reasons

B) Cyclical swings in the economy are produced by the inherent political instability found in capitalist economies

C) A possible cause of economic fluctuations is the use of fiscal policy by policy-makers for political purposes and goals

D) There is constant political trading among policy-makers that tends to make the economic policies of state and local governments procyclical

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The time which elapses between the beginning of a recession or an inflationary episode and the identification of the macroeconomic problem is referred to as a(n) :

A) Budget lag

B) Recognition lag

C) Operational lag

D) Administrative lag

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of built-in stability? As real GDP decreases, income tax revenues:

A) Increase and transfer payments decrease

B) Decrease and transfer payments increase

C) And transfer payments both decrease

D) And transfer payments both increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The so-called "negative taxes" are better known as:

A) Government spending

B) Transfer payments

C) Built-in stabilizers

D) Fiscal multipliers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The goal of expansionary fiscal policy is to increase:

A) The price level

B) Aggregate supply

C) Real GDP

D) Unemployment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two reasons why bankruptcy is a false concern about the public debt are:

A) Government spending and taxation

B) Refinancing and taxation

C) Investment and refinancing

D) Saving and investment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table gives data on interest rates and investment demand (in billions of dollars) in a hypothetical economy.  Refer to the above table. Using the Id1 schedule, assume that the government needs to finance the public debt and this public borrowing increases the interest rate from 3% to 4%. How much crowding out of private investment will occur?

Refer to the above table. Using the Id1 schedule, assume that the government needs to finance the public debt and this public borrowing increases the interest rate from 3% to 4%. How much crowding out of private investment will occur?

A) $100 billion

B) $200 billion

C) $600 billion

D) $700 billion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local governments are limited in their ability to respond to recessions because of:

A) Local politics and politicians

B) Their desire to always run budget surpluses

C) The lack of proper economic research and assistance

D) Constitutional and other requirements to balance their budgets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

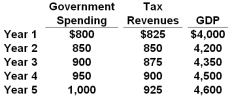

The following is budget information for a hypothetical economy. All data are in billions of dollars.  Refer to the above table. In which year is there a balanced budget?

Refer to the above table. In which year is there a balanced budget?

A) Year 1

B) Year 2

C) Year 3

D) Year 4

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discretionary fiscal policy is often initiated on the advice of the:

A) Congressional Budget Office

B) Council of Economic Advisers

C) Joint Economic Committee

D) Federal Reserve Board

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Without a change in discretionary fiscal policy, we would expect that if the economy goes into recession, then the:

A) Cyclically-adjusted deficit and the actual deficit would both increase

B) Cyclically-adjusted deficit and the actual deficit would both decrease

C) Cyclically-adjusted deficit would stay the same while the actual deficit would increase

D) Cyclically-adjusted deficit would increase while the actual deficit would stay the same

Correct Answer

verified

Correct Answer

verified

True/False

The payment of interest on the public debt in the U.S. mildly increases income inequality.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 164

Related Exams