A) Saving

B) Investment

C) Disposable income

D) The marginal propensity to consume

Correct Answer

verified

Correct Answer

verified

True/False

The multiplier will be larger, the steeper is the saving schedule.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

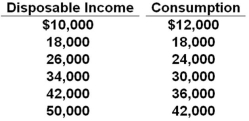

Refer to the consumption schedule above. If disposable income were $34,000, then the average propensity to save would be about:

Refer to the consumption schedule above. If disposable income were $34,000, then the average propensity to save would be about:

A) .75

B) .88

C) .25

D) .12

Correct Answer

verified

Correct Answer

verified

True/False

The multiplier effect magnifies the effect of a decrease in spending, resulting in a bigger decrease in real GDP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in household wealth that creates a wealth effect would shift the:

A) Consumption schedule and the saving schedule upward

B) Consumption schedule and the saving schedule downward

C) Consumption schedule upward and the saving schedule downward

D) Consumption schedule downward and the saving schedule upward

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The investment demand curve will shift to the left as the result of:

A) Business pessimism about future economic conditions

B) Limited available productive capacity

C) An increase in the interest rate

D) A decrease in business taxes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

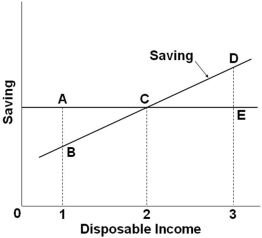

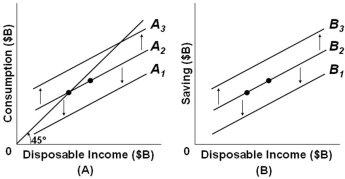

Refer to the saving schedule above. Dissaving occurs when disposable income is:

Refer to the saving schedule above. Dissaving occurs when disposable income is:

A) Equal to level 2

B) Less than level 2

C) Greater than level 2

D) Equal to level 3

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the slope of the consumption schedule or consumption line for a given economy?

A) APC

B) APS

C) 1 - MPC

D) 1 - MPS

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fraction, or percentage, of total income which is consumed is called the:

A) Break-even income

B) Consumption schedule

C) Marginal propensity to consume

D) Average propensity to consume

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors would decrease investment demand?

A) A decrease in business taxes

B) An increase in the cost of acquiring capital goods

C) An increase in the rate of technological change

D) A decrease in the stock of capital goods on hand

Correct Answer

verified

Correct Answer

verified

True/False

If the consumption schedule becomes steeper, then the saving schedule will become steeper also.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

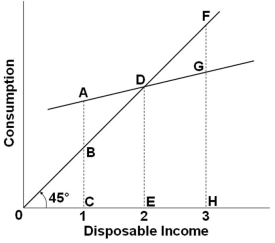

When the consumption schedule is plotted on a graph:

A) Consumption is on the horizontal axis and saving is on the vertical axis

B) Consumption is on the vertical axis and saving is on the horizontal axis

C) Consumption is on the horizontal axis and disposable income is on the vertical axis

D) Consumption is on the vertical axis and disposable income is on the horizontal axis

Correct Answer

verified

Correct Answer

verified

True/False

Investment is not affected by current profits; it is affected by expected future profits only.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If disposable income increases from $912 to $927 billion and MPC = 0.6, then consumption will increase by:

A) $6 billion

B) $9 billion

C) $54 billion

D) $56 billion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the consumption schedule above. At income level 1, the amount of saving is:

Refer to the consumption schedule above. At income level 1, the amount of saving is:

A) Positive

B) Negative

C) Zero

D) Not measurable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

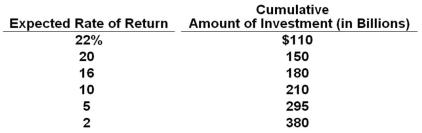

According to the cumulative investment table above:

According to the cumulative investment table above:

A) $150 billion worth of investments have expected rates of return exactly equal to 20%

B) $150 billion worth of investments have expected rates of return of 20% or lower

C) $40 billion worth of investments have expected rates of return between 20% and 22%

D) $260 billion worth of investments have expected rates of return higher than 20%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above figures with consumption schedules in figure (A) and saving schedules in figure (B) , which correspond to each other across different levels of disposable income. If, in figure (A) , consumption shifts from A2 to A3 because of a change in taxes, then in figure (B) line:

Refer to the above figures with consumption schedules in figure (A) and saving schedules in figure (B) , which correspond to each other across different levels of disposable income. If, in figure (A) , consumption shifts from A2 to A3 because of a change in taxes, then in figure (B) line:

A) B2 will shift to B3

B) B1 will shift to B2

C) B2 will shift to B1

D) B3 will shift to B2

Correct Answer

verified

Correct Answer

verified

True/False

If households do not spend any extra income they receive but instead save the entire extra amount, then the multiplier will be zero.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real interest rate increases:

A) The investment demand curve will shift to the right

B) The investment demand curve will shift to the left

C) There will be a movement upward along the investment demand curve

D) There will be a movement downward along the investment demand curve

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A change in the amount saved due to a change in income is represented by a:

A) Shift of the entire saving schedule

B) Movement along the saving schedule

C) Change in the marginal propensity to save

D) Change in the marginal propensity to consume

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 142

Related Exams