Correct Answer

verified

Correct Answer

verified

True/False

It is possible to apply activity-based costing (ABC)to segments of an organization without applying it to the entire organization.ABC can be applied in a single portion or segment of an organization as well as the entire organization.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

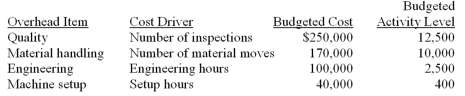

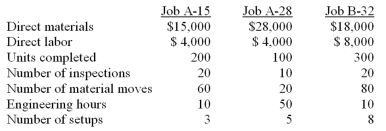

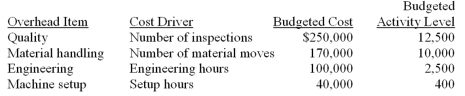

Scottso Enterprises has identified the following overhead costs and cost drivers for the coming year:  Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:

Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:  If the company uses activity-based costing (ABC) ,what is the cost of each unit of Job A-28?

If the company uses activity-based costing (ABC) ,what is the cost of each unit of Job A-28?

A) $320.00.

B) $30.40.

C) $187.40.

D) $350.40.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

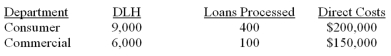

The Muskego National Bank is considering either a bankwide overhead rate or department overhead rates to allocate $250,000 of indirect costs.The bankwide rate could be based on either direct labor hours (DLH) or the number of loans processed.The departmental rates would be based on direct labor hours for Consumer Loans and a dual rate based on direct labor hours and the number of loans processed for Commercial Loans.The following information was gathered for the upcoming period:  If Muskego uses a bankwide rate based on the number of loans processed,what would be the total costs for the Consumer Department?

If Muskego uses a bankwide rate based on the number of loans processed,what would be the total costs for the Consumer Department?

A) $50,000.

B) $150,000.

C) $200,000.

D) $400,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is (are) true regarding the potential effects of using reported product costs for decision making? (A) Traditional product costing systems (e.g. ,job and process costing) are designed primarily to accumulate cost information for financial reporting.(B) If a single cost driver is used as the allocation base,applied manufacturing overhead for product costing purposes may lead to inappropriate managerial decisions.

A) Only A is true

B) Only B is true.

C) Both A and B are true.

D) Neither A nor B is true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) One of the lessons learned from activity-based costing (ABC) is that all costs are really a function of volume.

B) The primary purpose of the plantwide and department allocation methods is allocating direct costs to specific products.

C) A problem with activity-based costing (ABC) is that it requires more recordkeeping than other methods.

D) Direct cost allocations are required for the plantwide and department allocation methods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is (are) false regarding first-stage and second-stage cost allocation methods? (A) The basic difference between a first-stage cost allocation and a second-stage cost allocation is that cost pools are not used in first-stage cost allocations.(B) Predetermined overhead rates are used in first-stage cost allocations but not in second-stage cost allocations.

A) Only A is false.

B) Only B is false.

C) Neither A and B nor false.

D) Both A and B are false.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Activity-based costing (ABC) is a costing technique that uses a two stage allocation process.Which of the following statements best describes these two stages?

A) The costs are assigned to activities,and then to the products based upon their use of the activities.

B) The costs are assigned to departments,and then to the products based upon their use of activity resources.

C) Service department costs are allocated to the production departments,and then to the products based upon their use of the activities.

D) Indirect costs are assigned to activities,and then to the products based upon the direct cost resources used by the activities.

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing (ABC)is a two-stage cost allocation system that (1)allocates costs to activities and (2)then to products based on their use of the activities.This is a fundamental concept of ABC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scottso Enterprises has identified the following overhead costs and cost drivers for the coming year:  Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:

Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:  The company prices its products at 150% of cost.If the company uses activity-based costing (ABC) ,the price of each unit of Job B-32 would be:

The company prices its products at 150% of cost.If the company uses activity-based costing (ABC) ,the price of each unit of Job B-32 would be:

A) $96.53.

B) $144.80.

C) $130.00.

D) $226.53.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

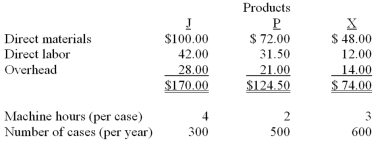

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  If Smelly changes its overhead allocation to departmental rates,what is the product cost per case for Product X assuming Departments C and D use direct labor hours and machine hours as their respective allocation bases?

If Smelly changes its overhead allocation to departmental rates,what is the product cost per case for Product X assuming Departments C and D use direct labor hours and machine hours as their respective allocation bases?

A) $79.50.

B) $80.48.

C) $74.00.

D) $78.50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

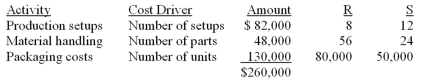

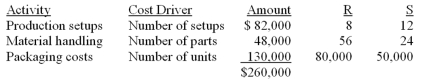

RS Company manufactures and distributes two products,R and S.Overhead costs are currently allocated using the number of units produced as the allocation base.The controller has recommended changing to an activity-based costing (ABC) system.She has collected the following information:  What is the total overhead allocated to Product S using the current system?

What is the total overhead allocated to Product S using the current system?

A) $113,600.

B) $100,000.

C) $146,400.

D) $160,000.

Correct Answer

verified

Correct Answer

verified

True/False

The basic difference between a first-stage cost allocation and a second-stage cost allocation is that cost pools are not used in first-stage cost allocations.Cost pools are used in both first-stage and second-stage cost allocations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

RS Company manufactures and distributes two products,R and S.Overhead costs are currently allocated using the number of units produced as the allocation base.The controller has recommended changing to an activity-based costing (ABC) system.She has collected the following information:  What is the total overhead per unit allocated to Product R using activity-based costing (ABC) ?

What is the total overhead per unit allocated to Product R using activity-based costing (ABC) ?

A) $2.60.

B) $2.27.

C) $2.00.

D) $1.83.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is (are) true? (1) Activity-based costs per unit are always greater than volume-based costs per unit.(2) Volume-based costing has typically resulted in lower gross margins for high volume products and higher gross margins for low volume products.

A) Only 1 is true.

B) Only 2 is true.

C) Both 1 and 2 are true.

D) Neither 1 nor 2 is true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scottso Enterprises has identified the following overhead costs and cost drivers for the coming year:  Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:

Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:  If the company uses activity-based costing (ABC) ,how much overhead cost should be assigned to Job A-15?

If the company uses activity-based costing (ABC) ,how much overhead cost should be assigned to Job A-15?

A) $2,120.

B) $11,200.

C) $1,600.

D) $2,050.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

RS Company manufactures and distributes two products,R and S.Overhead costs are currently allocated using the number of units produced as the allocation base.The controller has recommended changing to an activity-based costing (ABC) system.She has collected the following information:  What is the total overhead allocated to Product R using the current system?

What is the total overhead allocated to Product R using the current system?

A) $113,600.

B) $130,000.

C) $146,400.

D) $160,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

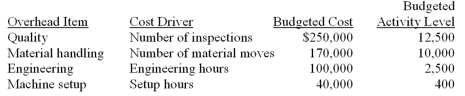

The LMN Company recently switched to activity-based costing (ABC) from the department allocation method.The department method allocated overhead costs at a rate of $60 per machine hour.The cost accountant for Department XZ has gathered the following data:  During April,LMN purchased and used $100,000 of direct materials at $20 per ton.There were eight (8) production runs using a total of 12,000 machine hours in April.The manager of Department XZ needed 12 inspections.Actual overhead costs totaled $820,000 for the month.How much overhead costs were applied to the Work-in-Process Inventory during April using traditional costing?

During April,LMN purchased and used $100,000 of direct materials at $20 per ton.There were eight (8) production runs using a total of 12,000 machine hours in April.The manager of Department XZ needed 12 inspections.Actual overhead costs totaled $820,000 for the month.How much overhead costs were applied to the Work-in-Process Inventory during April using traditional costing?

A) $536,000.

B) $720,000.

C) $736,000.

D) $820,000.

Correct Answer

verified

Correct Answer

verified

True/False

Using direct labor costs to allocate overhead costs in an activity-based costing (ABC)system will encourage management to reduce labor costs.Allocating overhead on the basis of direct labor sends signals that direct labor is more expensive than it really is.This also creates tremendous incentives to reduce the labor content of products.

Correct Answer

verified

Correct Answer

verified

True/False

Predetermined overhead rates are used in first-stage cost allocations but not in second-stage cost allocations.Predetermined overhead rates are used in both first-stage and second-stage cost allocations.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 87

Related Exams