Filters

Question type

A) Sales volume.

B) Machine hours.

C) Material costs.

D) Direct labor cost.

Correct Answer

verified

Correct Answer

verified

Question 52

Multiple Choice

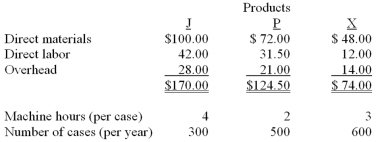

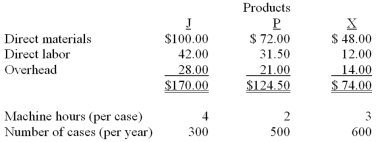

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses a plantwide rate based on direct labor hours,what is the revised product cost per case for Product X?

Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses a plantwide rate based on direct labor hours,what is the revised product cost per case for Product X?

A) $82.50.

B) $74.00.

C) $79.50.

D) $69.50.

Correct Answer

verified

Correct Answer

verified

Question 53

Multiple Choice

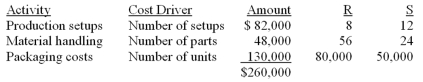

RS Company manufactures and distributes two products,R and S.Overhead costs are currently allocated using the number of units produced as the allocation base.The controller has recommended changing to an activity-based costing (ABC) system.She has collected the following information:  What is the total overhead per unit allocated to Product S using activity-based costing (ABC) ?

What is the total overhead per unit allocated to Product S using activity-based costing (ABC) ?

A) $2.60.

B) $2.27.

C) $2.00.

D) $1.83.

Correct Answer

verified

Correct Answer

verified

Question 54

True/False

When overhead is applied based on the volume of output,high-volume products tend to "subsidize" low-volume products.When overhead is applied based on the volume of output,high-volume products are allocated relatively more overhead than are low-volume products.High-volume products "subsidize" low-volume products.

Correct Answer

verified

Correct Answer

verified

Question 55

Multiple Choice

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  If Smelly changes its allocation basis to machine hours,what is the total product cost per case for Product P?

If Smelly changes its allocation basis to machine hours,what is the total product cost per case for Product P?

A) $163.50.

B) $144.00.

C) $138.15.

D) $117.15.

Correct Answer

verified

Correct Answer

verified

Question 56

True/False

Activity-based costing (ABC)provides more detailed measures of costs than do plantwide or department allocation methods.This is due to ABC using more causal relationships that are not limited to the production floor.

Correct Answer

verified

Correct Answer

verified

Question 57

Multiple Choice

Personnel administration is an example of a:

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) organization-sustaining activity.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 87 of 87

Related Exams