Correct Answer

verified

Correct Answer

verified

True/False

Accounts receivable represent the amount of cash owed to the company by its customers from the sale of products or services on account.

Correct Answer

verified

Correct Answer

verified

True/False

A sale on account for $1,000 offered with terms 2/10,n/30 means that the customers will get a $2 discount if payment is made within 10 days;otherwise,full payment is due within 30 days.

Correct Answer

verified

Correct Answer

verified

Essay

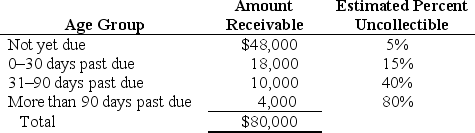

A company has the following balances on December 31,2015,before any year-end adjustments: Accounts Receivable = $80,000;Allowance for Uncollectible Accounts = $1,100 (credit).The company estimates uncollectible accounts based on an aging of accounts receivable as shown below:

Record the adjustment for uncollectible accounts on December 31,2015.

Record the adjustment for uncollectible accounts on December 31,2015.

Correct Answer

verified

Correct Answer

verified

True/False

A sales allowance is recorded as a debit to Accounts Receivable and a credit to Sales Allowances.

Correct Answer

verified

Correct Answer

verified

Essay

At the end of the year,a company reports a balance in its Allowance for Uncollectible Accounts of $1,400 (credit)before any year-end adjustment.The company estimates future uncollectible accounts to be 3% of credit sales for the year.Credit sales for the year total $280,000.Record the adjustment for the allowance for uncollectible accounts using the percentage-of-credit-sales method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true with respect to the percentage-of-credit-sales method for estimating uncollectible accounts?

A) The amount recorded for bad debt expense does not depend on the balance of the allowance for uncollectible accounts.

B) This method is referred to as the balance sheet approach.

C) This method does not allow for future uncollectible accounts.

D) Under this method,bad debt expense is recorded at the time of an actual bad debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beverage International reports net credit sales for the year of $240,000.The company's accounts receivable balance at the beginning of the year equaled $20,000 and the balance at the end of the year equaled $30,000.What is Beverage International's receivables turnover ratio?

A) 12.0.

B) 9.6.

C) 8.0.

D) 1.5.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At December 31,Amy Jo's Appliances had account balances in Accounts Receivable of $311,000 and $970 (debit) in Allowance for Uncollectible Accounts.An analysis of Amy Jo's December 31 accounts receivable suggests that the allowance for uncollectible accounts should be 2% of accounts receivable.Bad debt expense for the year should be:

A) $6,220.

B) $6,450.

C) $5,250.

D) $7,190.

Correct Answer

verified

D

Correct Answer

verified

Short Answer

At the beginning of the year,a company had an Allowance for Uncollectible Accounts of $22,000.By the end of the year,actual bad debts total $24,000.What is the balance of the Allowance for Uncollectible Accounts after the write-offs (before any year-end adjustment)?

Correct Answer

verified

$2,000 (or $2,000 debit)

Correct Answer

verified

Short Answer

A company reports the following amounts at the end of the year: Total sales = $500,000;sales discounts = $10,000;sales returns = $30,000;sales allowances = $20,000.Compute net revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using an aging method for estimating uncollectible accounts:

A) Older accounts are considered less likely to be collected.

B) The number of days the account is past due is not considered.

C) Older accounts are considered more likely to be collected.

D) No estimate of uncollectible accounts is made.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Under the direct write-off method,what adjustment is made at the end of the year to account for possible future bad debts?

A) Debit Bad Debt Expense.

B) Debit Allowance for Uncollectible Accounts.

C) Credit Accounts Receivable.

D) No adjustment is made.

Correct Answer

verified

Correct Answer

verified

True/False

Notes receivable are similar to accounts receivable but are more formal credit arrangements evidenced by a written debt instrument,or note.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When $2,500 of accounts receivable are determined to be uncollectible,which of the following should the company record to write off the accounts using the allowance method?

A) A debit to Bad Debt Expense and a credit to Allowance for Uncollectible Accounts.

B) A debit to Allowance for Uncollectible Accounts and a credit to Bad Debt Expense.

C) A debit to Bad Debt Expense and a credit to Accounts Receivable.

D) A debit to Allowance for Uncollectible Accounts and a credit to Accounts Receivable.

Correct Answer

verified

Correct Answer

verified

True/False

A sale on account is recorded as a debit to Service Revenue and a credit to Accounts Receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Listed below are ten terms followed by a list of phrases that describe or characterize five of the terms.Match each phrase with the best term placing the letter designating the term in the space provided. -_____ Recognizes bad debts when accounts become uncollectible.

A) Accounts receivable

B) Allowance method

C) No effect

D) Direct write-off method

E) Net realizable value

F) Aging method

G) Bad debt expense

H) Receivables written off

I) Decrease assets and increase expenses

J) Allowance for uncollectible accounts

Correct Answer

verified

Correct Answer

verified

True/False

The average collection period shows the approximate number of days the average accounts receivable balance is outstanding.

Correct Answer

verified

Correct Answer

verified

True/False

Under the allowance method,when a company writes off an account receivable as an actual bad debt,it reduces total assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable are normally reported at the:

A) Present value of future cash receipts.

B) Current value plus accrued interest.

C) Expected amount to be received.

D) Current value less expected collection costs.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 164

Related Exams