A) $1,835.44 per unit

B) $1,917.91 per unit

C) $1,390.63 per unit

D) $985.39 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

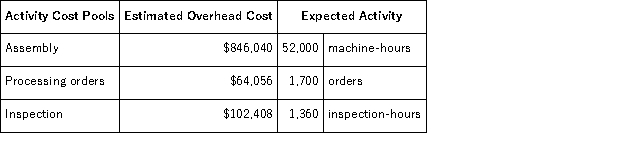

Paparo Corporation has provided the following data from its activity-based costing system:  Data concerning the company's product Q79Y appear below:

Data concerning the company's product Q79Y appear below:  According to the activity-based costing system,the unit product cost of product Q79Y is closest to:

According to the activity-based costing system,the unit product cost of product Q79Y is closest to:

A) $133.29 per unit

B) $85.03 per unit

C) $127.43 per unit

D) $129.94 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

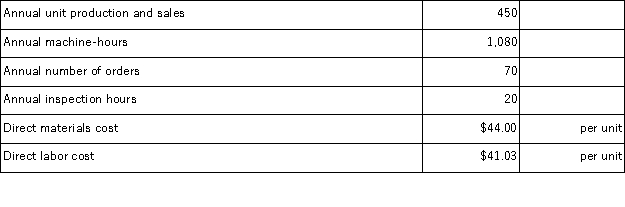

Kamerling,Inc. ,manufactures and sells two products: Product H0 and Product Q8.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $16.50 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $16.50 per DLH.The direct materials cost per unit for each product is given below:  The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company has an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product Q8 under activity-based costing is closest to:

The overhead applied to each unit of Product Q8 under activity-based costing is closest to:

A) $1,077.60 per unit

B) $320.16 per unit

C) $919.47 per unit

D) $996.75 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

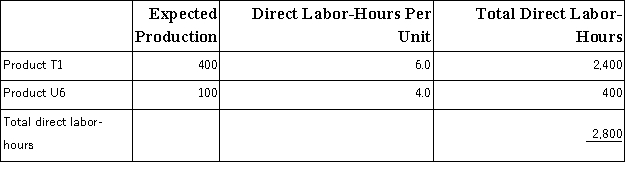

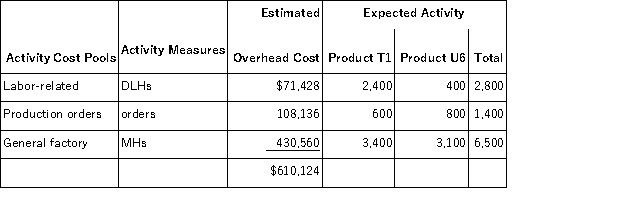

Pachero,Inc. ,manufactures and sells two products: Product T1 and Product U6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $15.90 per DLH.The direct materials cost per unit is $259.80 for Product T1 and $188.80 for Product U6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $15.90 per DLH.The direct materials cost per unit is $259.80 for Product T1 and $188.80 for Product U6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product U6 under activity-based costing is closest to:

The unit product cost of Product U6 under activity-based costing is closest to:

A) $2,305.84 per unit

B) $1,124.00 per unit

C) $1,472.65 per unit

D) $3,025.80 per unit

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor is an appropriate allocation base for overhead when overhead costs and direct labor are highly correlated.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

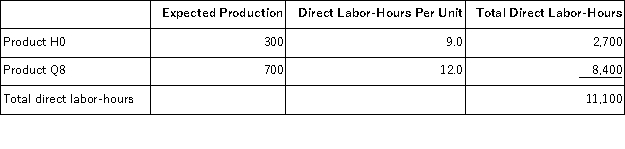

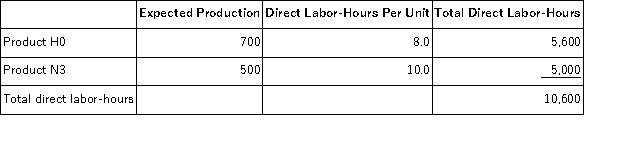

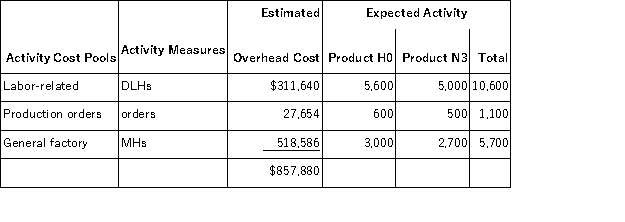

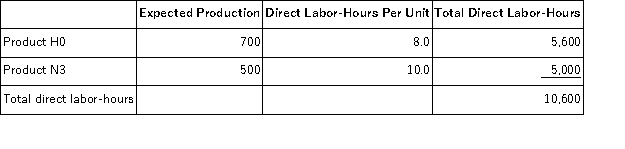

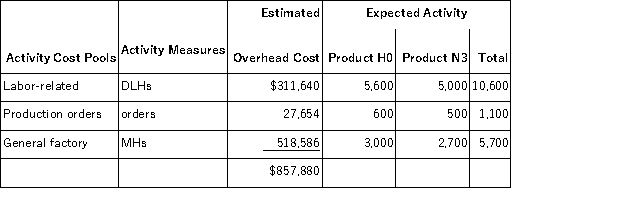

Frogge,Inc. ,manufactures and sells two products: Product H0 and Product N3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $23.60 per DLH.The direct materials cost per unit is $160.60 for Product H0 and $240.30 for Product N3. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $23.60 per DLH.The direct materials cost per unit is $160.60 for Product H0 and $240.30 for Product N3. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

A) $55.31 per DLH

B) $29.40 per DLH

C) $779.89 per DLH

D) $46.09 per DLH

Correct Answer

verified

Correct Answer

verified

Multiple Choice

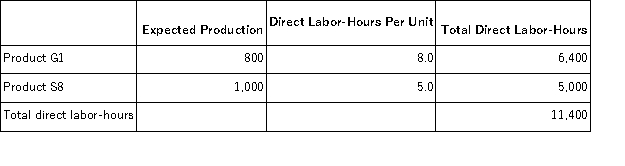

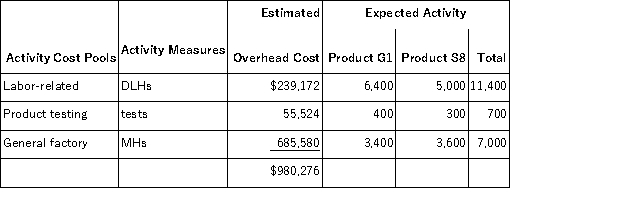

Molinas,Inc. ,manufactures and sells two products: Product G1 and Product S8.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the predetermined overhead rate would be closest to:

A) $85.99 per DLH

B) $20.98 per DLH

C) $97.94 per DLH

D) $79.32 per DLH

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Frogge,Inc. ,manufactures and sells two products: Product H0 and Product N3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $23.60 per DLH.The direct materials cost per unit is $160.60 for Product H0 and $240.30 for Product N3. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $23.60 per DLH.The direct materials cost per unit is $160.60 for Product H0 and $240.30 for Product N3. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product H0 under activity-based costing is closest to:

The overhead applied to each unit of Product H0 under activity-based costing is closest to:

A) $647.44 per unit

B) $646.66 per unit

C) $389.91 per unit

D) $714.90 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

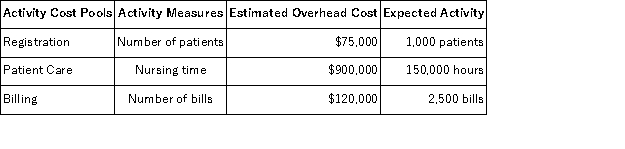

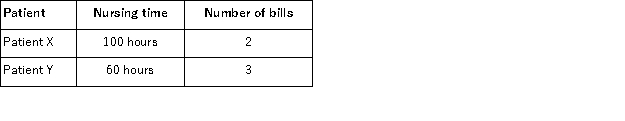

In the past,Hypochondriac Hospital allocated all of its overhead costs to patients based on nursing time.Hypochondriac has decided to switch to an activity based costing system using three activity cost pools.Information related to the new system is as follows:  Data concerning two patients follows:

Data concerning two patients follows:  Under the new activity-based costing system,how much overhead cost would be assigned to each patient?

Under the new activity-based costing system,how much overhead cost would be assigned to each patient?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

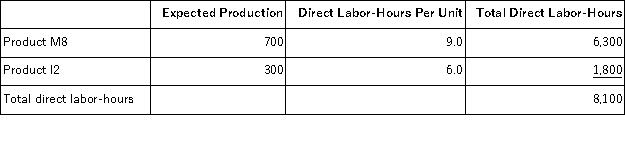

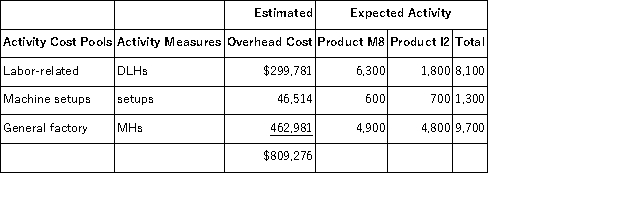

Karsten,Inc. ,manufactures and sells two products: Product M8 and Product I2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $21.20 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $21.20 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product I2 under activity-based costing is closest to:

The unit product cost of Product I2 under activity-based costing is closest to:

A) $1,133.78 per unit

B) $1,179.38 per unit

C) $1,439.33 per unit

D) $969.56 per unit

Correct Answer

verified

C

Correct Answer

verified

True/False

A plantwide predetermined overhead rate based on direct labor-hours results in high overhead costs for products with a high direct labor-hour content and low overhead costs for products with a low direct labor-hour content.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

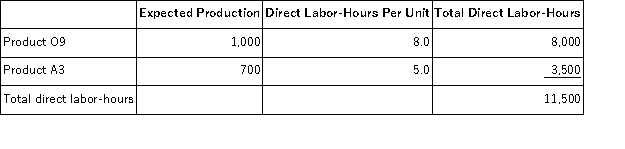

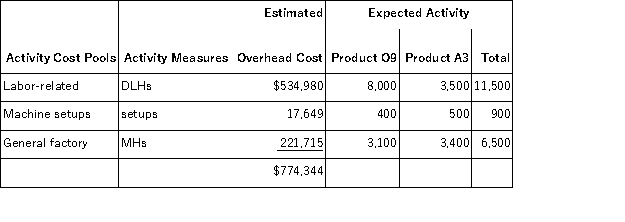

Abbe,Inc. ,manufactures and sells two products: Product O9 and Product A3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.40 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $24.40 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product O9 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product O9 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A) $544.48 per unit

B) $759.76 per unit

C) $660.48 per unit

D) $926.24 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

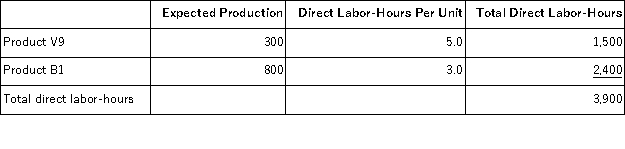

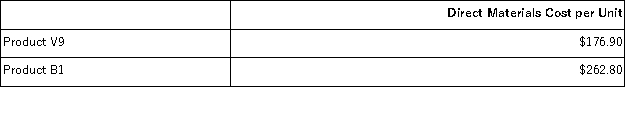

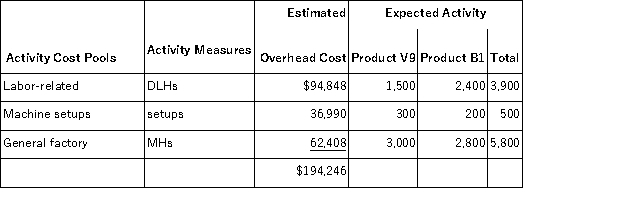

Sill,Inc. ,manufactures and sells two products: Product V9 and Product B1.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $27.40 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $27.40 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product V9 under activity-based costing is closest to:

The unit product cost of Product V9 under activity-based costing is closest to:

A) $490.49 per unit

B) $421.50 per unit

C) $562.95 per unit

D) $617.08 per unit

Correct Answer

verified

Correct Answer

verified

True/False

When a company changes from a traditional costing system to an activity-based costing system,the unit product costs of low-volume products typically change more than the unit product costs of high-volume products.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

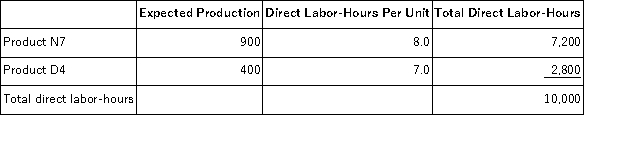

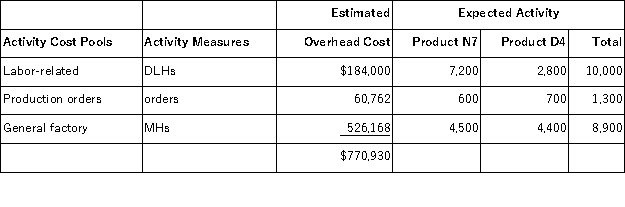

Sepulvado,Inc. ,manufactures and sells two products: Product N7 and Product D4.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $15.50 per DLH.The direct materials cost per unit is $197.00 for Product N7 and $290.50 for Product D4. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $15.50 per DLH.The direct materials cost per unit is $197.00 for Product N7 and $290.50 for Product D4. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product D4 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product D4 would be closest to:

A) $413.84 per unit

B) $539.63 per unit

C) $128.80 per unit

D) $327.18 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assembling a product is an example of a:

A) Unit-level activity.

B) Batch-level activity.

C) Product-level activity.

D) Facility-level activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

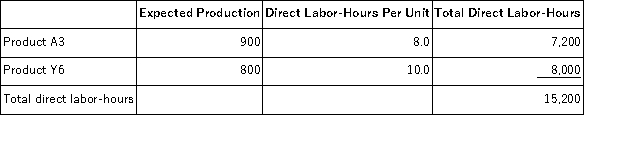

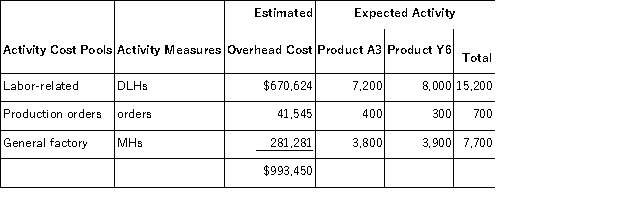

Mellencamp,Inc. ,manufactures and sells two products: Product A3 and Product Y6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.20 per DLH.The direct materials cost per unit is $146.60 for Product A3 and $256.20 for Product Y6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $24.20 per DLH.The direct materials cost per unit is $146.60 for Product A3 and $256.20 for Product Y6. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The unit product cost of Product A3 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product A3 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A) $632.44 per unit

B) $693.16 per unit

C) $815.00 per unit

D) $863.08 per unit

Correct Answer

verified

Correct Answer

verified

True/False

When designing an activity-based costing system,accountants should be tasked with identifying the activities they think are important and that consume most of the resources in the organization.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The plant manager's work is an example of a:

A) Unit-level activity.

B) Batch-level activity.

C) Product-level activity.

D) Facility-level activity.

Correct Answer

verified

Correct Answer

verified

Essay

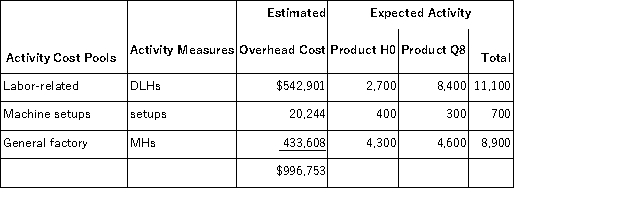

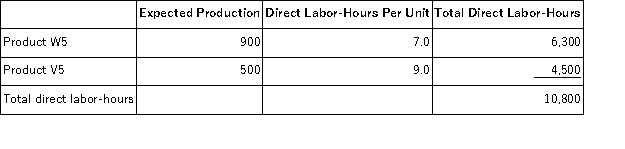

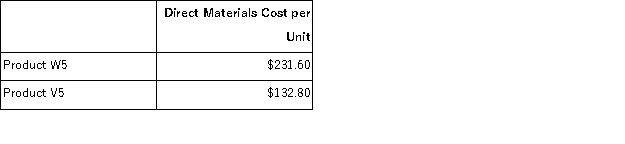

Parody,Inc. ,manufactures and sells two products: Product W5 and Product V5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $16.30 per DLH.The direct materials cost per unit for each product is given below:

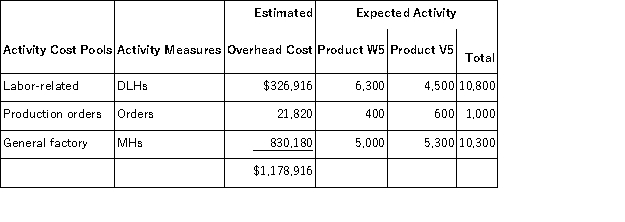

The direct labor rate is $16.30 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  Required:

In all computations involving dollars in the following requirements,round off your answer to the nearest whole cent.

a.The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours.Compute the company's predetermined overhead rate under this costing method.

b.How much overhead would be applied to each product under the company's traditional costing method?

c.Determine the unit product cost of each product under the company's traditional costing method.

d.Compute the activity rates under the activity-based costing system.

e.Determine how much overhead would be assigned to each product under the activity-based costing system.

f.Determine the unit product cost of each product under the activity-based costing method.

Required:

In all computations involving dollars in the following requirements,round off your answer to the nearest whole cent.

a.The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours.Compute the company's predetermined overhead rate under this costing method.

b.How much overhead would be applied to each product under the company's traditional costing method?

c.Determine the unit product cost of each product under the company's traditional costing method.

d.Compute the activity rates under the activity-based costing system.

e.Determine how much overhead would be assigned to each product under the activity-based costing system.

f.Determine the unit product cost of each product under the activity-based costing method.

Correct Answer

verified

a.Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $1,178,916 ÷ 10,800 DLHs = $109.16 per DLH (rounded)

b.Computation of overhead applied to each product: 11eaa3fe_3397_8568_908b_0b32b672c6dc_TB2461_00 c.Computation of traditional unit product costs: 11eaa3fe_3397_8569_908b_a7b48644051d_TB2461_00 d.Computation of activity rates: 11eaa3fe_3397_ac7a_908b_fd35d21baa5d_TB2461_00 e.Computation of the overhead cost per unit under activity-based costing. 11eaa3fe_3397_ac7b_908b_9fb131326b44_TB2461_00 f.Computation of unit product costs under activity-based costing. 11eaa3fe_3397_d38c_908b_3f2cb2265160_TB2461_00

Correct Answer

verified

Showing 1 - 20 of 199

Related Exams