Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trade policies

A) affect a country's overall trade balance, but affect all firms and industries the same.

B) affect a country's overall trade balance, but affect some firms or industries differently than others.

C) do not affect a country's overall trade balance, but affect some firms or industries differently than others.

D) do not affect either a country's overall trade balance or specific firms or industries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

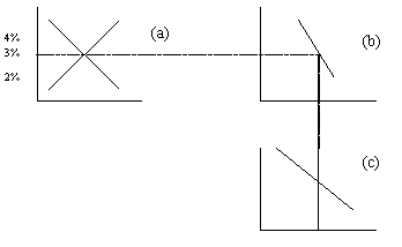

Figure 14-4

-Refer to Figure 14-5. Starting from r2 and E3, an increase in the budget surplus can be illustrated as a move to

-Refer to Figure 14-5. Starting from r2 and E3, an increase in the budget surplus can be illustrated as a move to

A) r3 and E4.

B) r3 and E2.

C) r1 and E4.

D) r1 and E2.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is a surplus in the U.S. loanable funds market, then

A) NCO > I.

B) NCO < I.

C) NCO + I > S.

D) NCO + I < S.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

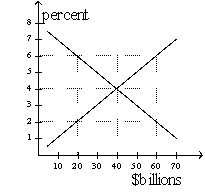

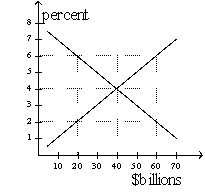

Figure 14-1

-Refer to Figure 14-1. In the Figure shown, if the real interest rate is 6 percent, the quantity of loanable funds demanded is

-Refer to Figure 14-1. In the Figure shown, if the real interest rate is 6 percent, the quantity of loanable funds demanded is

A) $20 billion, and the quantity supplied is $40 billion.

B) $20 billion, and the quantity supplied is $60 billion.

C) $60 billion, and the quantity supplied is $20 billion.

D) $60 billion, and the quantity supplied is $40 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a country imposes an import quota, its

A) imports fall and its net exports rise.

B) imports fall and its net exports are unchanged.

C) imports rise and its net exports are unchanged.

D) imports and exports are unchanged.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the budget deficit increases, then

A) an increase in the interest rate increases net capital outflow.

B) an increase in the interest rate decreases net capital outflow.

C) a decrease in the interest rate increases net capital outflow.

D) a decrease in the interest rate decreases net capital outflow.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the budget surplus

A) raises net exports and domestic investment.

B) raises net exports and reduces domestic investment.

C) reduces net exports and raises domestic investment.

D) reduces net exports and domestic investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct concerning the open-economy macroeconomic model?

A) The net-capital-outflow curve slopes downward.

B) The key determinant of net capital outflow is the real exchange rate.

C) The supply of dollars in the market for foreign-currency exchange is horizontal.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to increase exports?

A) a reduction in domestic political instability

B) ending investment tax credits

C) a reduction in the size of the government's budget surplus

D) None of the above will increase exports.

Correct Answer

verified

Correct Answer

verified

True/False

The key determinant of net capital outflow is the real interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1998 the Russian government defaulted on its bonds. According to the open-economy macroeconomic model, this should have

A) increased Russian interest rates and net exports.

B) reduced Russian interest rates and net exports.

C) increased Russian interest rates and reduced Russian net exports.

D) reduced Russian interest rates and increased Russian net exports.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government of Kenya implemented a policy that decreased national saving, its real exchange rate would

A) depreciate and Kenyan net exports would rise.

B) depreciate and Kenyan net exports would fall.

C) appreciate and Kenyan net exports would rise.

D) appreciate and Kenyan net exports would fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the demand for loanable funds shifts right, then

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantify of loanable funds falls.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 14-1

-Refer to Figure 14-1. In the Figure shown, if the real interest rate is 2 percent, there will be a

-Refer to Figure 14-1. In the Figure shown, if the real interest rate is 2 percent, there will be a

A) surplus of $20 billion.

B) surplus of $40 billion.

C) shortage of $20 billion.

D) shortage of $40 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply of dollars in the market for foreign-currency exchange shifts left, then the exchange rate

A) rises and the quantity of dollars exchanged falls.

B) rises and the quantity of dollars exchanged does not change.

C) rises and the quantity of dollars exchanged rises.

D) falls and the quantity of dollars exchanged does not change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the open-economy macroeconomic model, if net capital outflow increases then

A) the demand for dollars in the market for foreign-currency exchange shifts right.

B) the demand for dollars in the market for foreign-currency exchange shifts left.

C) the supply of dollars in the market for foreign-currency exchange shifts right.

D) the supply of dollars in the market for foreign-currency exchange shifts left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Mexico suffered from capital flight in 1994, Mexico's net exports

A) decreased.

B) did not change.

C) increased.

D) decreased until the peso appreciated, then increased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If net exports are positive, then

A) exports are greater than imports.

B) net capital outflow is negative.

C) Both of the above are correct.

D) Neither of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

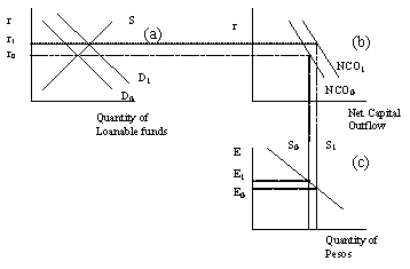

Figure 14-7

-Refer to Figure 14-7. Suppose the Mexican economy starts at r0 and E1. Which of the following new equilibrium is consistent with capital flight?

-Refer to Figure 14-7. Suppose the Mexican economy starts at r0 and E1. Which of the following new equilibrium is consistent with capital flight?

A) ro and E0

B) r1 and E0

C) r1 and E1

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 375

Related Exams