A) 4-fold increase.

B) 8-fold increase.

C) 12-fold increase.

D) 16-fold increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning the history of U.S. inflation is not correct?

A) Prices rose at an average annual rate of about 4 percent over the last 70 years.

B) There was about a 16-fold increase in the price level over the last 70 years.

C) Inflation in the 1970s was below the average over the last 70 years.

D) The United States has experienced periods of deflation.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

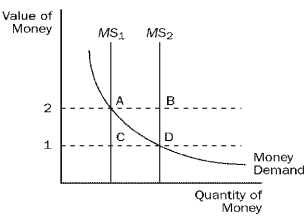

Figure 12-1

-Refer to Figure 12-1. If the money supply is MS2 and the value of money is 2, then there is an excess

-Refer to Figure 12-1. If the money supply is MS2 and the value of money is 2, then there is an excess

A) demand for money that is represented by the distance between points A and C.

B) demand for money that is represented by the distance between points A and B.

C) supply of money that is represented by the distance between points A and C.

D) supply of money that is represented by the distance between points A and B.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To explain the long-run determinants of the price level and the inflation rate, most economists today rely on the

A) quantity theory of money.

B) price-index theory of money.

C) theory of hyperinflation.

D) disequilibrium theory of money and inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In early 2008, the central bank of Zimbabwe announced the inflation rate in that country had reached

A) 60 percent.

B) 80 percent.

C) 220 percent.

D) 24,000 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the last 70 years, the average annual U.S. inflation rate was about

A) 2 percent, implying that prices have increased 10-fold.

B) 4 percent, implying that prices have increased 10-fold.

C) 2 percent, implying that prices have increased 16-fold.

D) 4 percent, implying that prices increased about 16-fold.

Correct Answer

verified

Correct Answer

verified

True/False

Nominal GDP measures output of final goods and services in physical terms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following combinations of real interest rates and inflation implies a nominal interest rate of 7 percent?

A) a real interest rate of 2.5 percent and an inflation rate of 2 percent

B) a real interest rate of 4 percent and an inflation rate of 11 percent

C) a real interest rate of 6 percent and an inflation rate of 1 percent

D) a real interest rate of 5.5 percent and an inflation rate of 3 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S., from the early 1980s through the early 1990s,

A) both inflation and nominal interest rates rose.

B) both inflation and nominal interest rates fell.

C) the inflation rate fell and the nominal interest rate rose.

D) the inflation rate rose and the nominal interest rate fell.

Correct Answer

verified

Correct Answer

verified

True/False

Even though monetary policy is neutral in the short run, it may have profound real effects in the long run.

Correct Answer

verified

Correct Answer

verified

True/False

If the real interest rate is 5% and the inflation rate is 3%, then the nominal interest rate is 8%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation can be measured by the

A) change in the consumer price index.

B) percentage change in the consumer price index.

C) percentage change in the price of a specific commodity.

D) change in the price of a specific commodity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banks advertise

A) the real interest rate, which is how fast the dollar value of savings grows.

B) the real interest rate, which is how fast the purchasing power of savings grows.

C) the nominal interest rate, which is how fast the dollar value of savings grows.

D) the nominal interest rate, which is how fast the purchasing power of savings grows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming the Fisher Effect holds, and given U.S. tax laws, an increase in inflation

A) increases the real interest rate and the after-tax real rate of interest.

B) increases the real interest rate and the after-tax real rate of interest

C) does not change the real interest rate but raises the after tax real rate of interest.

D) does not change the real interest rate but reduces the after-tax real rate of interest.

Correct Answer

verified

Correct Answer

verified

True/False

The United States has never had deflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If people had been expecting prices to rise but in fact prices fell, then who among the following would benefit?

A) lenders and people holding a lot of currency

B) lenders but not people holding a lot of currency

C) people holding a lot of currency but not lenders

D) neither lenders nor people holding a lot of currency

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tara deposits money into an account with a nominal interest rate of 6 percent. She expects inflation to be 2 percent. Her tax rate is 20 percent. Tara's after-tax real rate of interest

A) will be 2.8 percent if inflation turns out to be 2 percent; it will be higher if inflation turns out to be higher than 2 percent.

B) will be 2.8 percent if inflation turns out to be 2 percent; it will be lower if inflation turns out to be higher than 2 percent.

C) will be 3.2 percent if inflation turns out to be 2 percent; it will be higher if inflation turns out to be higher than 2 percent.

D) will be 3.2 percent if inflation turns out to be 2 percent; it will be lower if inflation turns out to be higher than 2 percent.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

According to the classical dichotomy, which of the following is affected by monetary factors?

A) nominal wages

B) the price level

C) nominal GDP

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the classical dichotomy, which of the following is not influenced by monetary factors?

A) nominal GDP and nominal interest rates

B) real wages and real GDP

C) the price level and nominal GDP

D) None of the above is correct.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The nominal interest rate is 5 percent and the real interest rate is 2 percent. What is the inflation rate?

A) 10 percent

B) 7 percent

C) 3 percent

D) 2.5 percent

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 384

Related Exams