Correct Answer

verified

Correct Answer

verified

True/False

AASB 136 Impairment of Assets requires disclosures about estimates and judgements made in the impairment testing process.

Correct Answer

verified

Correct Answer

verified

True/False

The recoverable amount of an asset is defined as the lower of the fair value less costs of disposal and value in use.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

According to AASB 136 Impairment of Assets,the recoverable amount of an asset or cash-generating asset is the:

A) lower of its fair value less costs of disposal and its value in use.

B) higher of its fair value less costs of disposal and its value in exchange.

C) lower of its fair value less costs of disposal and its value in exchange.

D) higher of its fair value less costs of disposal and its value in use.

Correct Answer

verified

D

Correct Answer

verified

True/False

A cash generating unit is defined in AASB 136 Impairment of Assets as the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets.

Correct Answer

verified

Correct Answer

verified

True/False

Where the carrying amount of an asset exceeds the fair value less costs of disposal,it is necessary to calculate the value in use of the asset to determine whether it is impaired.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kerri Limited recognised an impairment loss on an item of plant asset on the 30th June.The recoverable amount of the asset after the loss is $900 and the asset has an estimated useful life of 4 years.Accumulated depreciation was $250 at that date and the straight line depreciation method is used.The original cost of the asset was $2500.The future annual depreciation amount is:

A) $625.

B) $225.

C) $163.

D) $400.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

When an asset is measured at fair value,the appropriate journal entry to record an impairment loss will include which of the following entries?

A) DR Asset

B) DR Loss-downward revaluation of asset

C) DR Revaluation increment

D) DR Depreciation expense

Correct Answer

verified

Correct Answer

verified

True/False

Cash-generating units should be identified consistently from period to period for the same group of assets.

Correct Answer

verified

Correct Answer

verified

True/False

Intangible assets that are not yet available for use are not required to be tested for impairment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to AASB 136 Impairment of Assets,which of the following indicators assist in providing external evidence that an impairment loss has reversed?

A) Market interest rates have increased during the period.

B) Significant changes with an adverse effect on the entity have taken place.

C) Market interest rates have decreased during the period.

D) Internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The impairment test involves comparing the asset's:

A) carrying amount with its fair value.

B) carrying amount with its recoverable amount.

C) fair value with its residual value.

D) fair value with its replacement cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In allocating an impairment loss,an entity shall not reduce the carrying amount of an asset below the highest of:

A) value in use and zero.

B) present value and zero.

C) cost and market value.

D) initial cost and replacement cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In relation to the impairment of assets,AASB 136 Impairment of Assets requires which of the following disclosures for each class of assets? I The line item(s) of the income statement in which impairment losses are included. II The amount of reversals of impairment losses on revalued assets. III The amount of impairment losses recognised in profit or loss. IV The amount of impairment losses on revalued assets.

A) I,II,III and IV

B) I,II and III only

C) II and IV only

D) IV only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the guidelines in AASB 136 Impairment of Assets for identifying a cash-generating unit?

A) Consider how management makes decisions about continuing or disposing of the entity's assets and operations.

B) If the output of the group of assets can be sold internally,then these process can be used to measure the value in use of the group of assets.

C) If there is no active market for the output of the group of assets,the group constitutes a cash-generating unit.

D) Consider how management monitors the entity's operations,such as by product lines,business,individual locations,districts or regional areas.

Correct Answer

verified

Correct Answer

verified

Short Answer

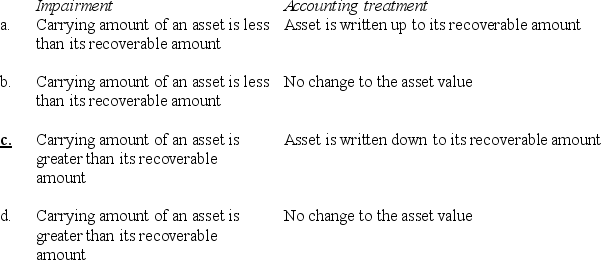

Under AASB 136 Impairment of Assets,impairment of an asset and the accounting treatment using the cost model are which of the following?

Correct Answer

verified

Correct Answer

verified

True/False

When a cash generating unit containing goodwill is impaired,the impairment loss is allocated on a pro-rata basis across all of the assets in the cash generating unit.

Correct Answer

verified

Correct Answer

verified

True/False

Any costs arising after the sale of an asset are included in the disposal costs of that asset.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount by which the carrying amount of an asset or a cash-generating unit exceeds its carrying amount is referred to as a/an:

A) depreciation expense.

B) amortisation cost.

C) impairment loss.

D) loss on disposal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets is referred to as a/an:

A) small-group unit.

B) cash-generating unit.

C) identifiable unit.

D) independent unit.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 49

Related Exams