A) the dollar depreciates relative to the euro.

B) the euro appreciates relative to the dollar.

C) the euro depreciates relative to the dollar.

D) neither currency appreciates or depreciates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A market in which national currencies are traded by households,firms and governments,is referred to as a(n)

A) foreign exchange market.

B) fed funds market.

C) international reserves market.

D) gold certificate market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exchange rates that are allowed to fluctuate in the open market in response to changes in supply and demand are known as

A) fixed exchange rates.

B) gold exchange rates.

C) flexible exchange rates.

D) IMF exchange rates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current account transactions are payments and gifts that are related to the purchase or sale of

A) financial instruments only.

B) both goods and services.

C) goods only.

D) services only.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The foreign exchange rate describes the

A) balance of trade.

B) balance of payments.

C) law of comparative advantage.

D) price of foreign currency in terms of domestic currency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the Bretton Woods conference,all currencies were given

A) a fixed value.

B) a variable value.

C) a par value.

D) a floating value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currency reserves on account with the International Monetary Fund used to settle accounts between countries are known as

A) federal reserves.

B) official reserve account transactions.

C) unilateral transfer.

D) special drawing rights.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The demand for foreign currency in the United States is a

A) direct demand.

B) derived demand based on the demand for U.S.products.

C) derived demand based on the demand for foreign products.

D) direct demand based on the demand for U.S.dollars.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A country's balance of payments shows a

A) detailed record of the import and export of services for the country.

B) detailed record of the country's imports.

C) summary record of international financial assistance received by the country.

D) summary record of a country's economic transactions with foreign residents and governments over a year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the foreign exchange rate for 1 Hungarian forint is 0.5 cent,then

A) a dinner priced at 400 forints will cost $20.

B) a wine that sells for 600 forints will cost $3,000.

C) a Big Mac hamburger priced at 50 forints will cost $1.

D) a hotel room renting for 40,000 forints will cost $200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

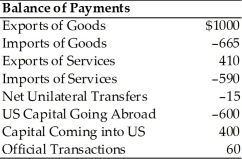

-Refer to the above table.The capital account balance is

-Refer to the above table.The capital account balance is

A) 0.

B) -$260.

C) -$200.

D) -$155.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An appreciation of the U.S.dollar relative to the Japanese yen causes

A) A lower dollar-price of Japanese goods which induces the U.S.to increase their purchasing of Japanese goods.

B) the quantity demanded of U.S.dollars to increase because the Japanese want to buy more U.S.goods.

C) the Japanese to buy more U.S.goods,causing the dollars to appreciate further.

D) the U.S.to buy less Japanese goods,causing the U.S.to depreciate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One source of the supply of dollars in the foreign exchange market is

A) U.S.companies importing foreign goods.

B) foreign citizens buying U.S.goods.

C) SDRs being converted into dollars.

D) the U.S.Mint buying dollars from the Bank of England.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

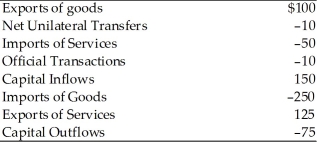

Country X-2013 Transactions (billions of dollars)  -In the above table,the fact that there is a minus sign before the number for unilateral transfers means that

-In the above table,the fact that there is a minus sign before the number for unilateral transfers means that

A) Country X has significant inflation.

B) Country X imported more goods than it exported.

C) Country X received more in foreign aid than it gave in foreign aid.

D) Country X gave more to foreign residents than foreign residents gave to Country X.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a unilateral transfer is

A) a gift to a relative who lives abroad.

B) a check received in payment for an import.

C) gold payments to foreign companies.

D) SDR payments to world creditors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of one nation's currency in terms of the currency of another nation is called the

A) IMF rate.

B) fed funds ratio.

C) exchange rate.

D) discount rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When there is a negative entry for unilateral transfers in the balance of payments,it means that

A) there must be an offsetting positive sign in the capital account.

B) U.S.residents gave more to foreign residents than foreign residents gave to U.S.residents.

C) U.S.residents purchased less services from foreign countries than foreign countries purchased from U.S.residents.

D) U.S.residents purchased more services from foreign countries than foreign countries purchased from U.S.residents.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

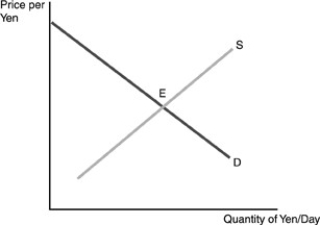

-Refer to the above figure.Suppose E is the original equilibrium.An increase in the demand for dollars will be reflected in this figure by

-Refer to the above figure.Suppose E is the original equilibrium.An increase in the demand for dollars will be reflected in this figure by

A) an increase in the demand for yen as both imports and exports increase.

B) a decrease in the demand for yen as the U.S.balance of payments improves.

C) an increase in the supply of yen as Japan tries to buy more U.S.goods.

D) a decrease in the supply of yen as Japan is able to pay less for U.S.goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A problem with the operation of the gold standard in the world economy was that

A) it involved too much government intervention in the economy.

B) the world economy was subject to too much inflation.

C) a country did not have control of its domestic monetary policy.

D) it caused the Great Depression.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a deficit item on the U.S.balance of payments accounts?

A) A U.S.firm sells a product to a Mexican firm.

B) An Italian tourist in Miami purchases a beach ball.

C) A Spaniard buys 100 shares of Ford stock.

D) A U.S.resident buys gold from the Japanese central bank.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 300

Related Exams