Correct Answer

verified

Correct Answer

verified

True/False

Return on investment is a useful measure to evaluate the performance of a cost center manager.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

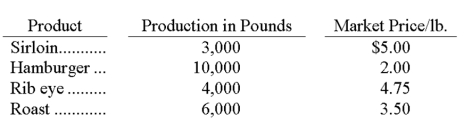

Breon Beef Company uses the relative market value method of allocating joint costs in its production of beef products. Relevant information for the current period follows:  The total joint cost for the current period was $43,000. How much of this cost should Breon Beef allocate to sirloin?

The total joint cost for the current period was $43,000. How much of this cost should Breon Beef allocate to sirloin?

A) $0.

B) $5,909.

C) $8,600.

D) $10,750.

E) $43,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An expense that does not require allocation between departments is a(n) :

A) Common expense.

B) Indirect expense.

C) Direct expense.

D) Administrative expense.

E) All of these.

Correct Answer

verified

Correct Answer

verified

Not Answered

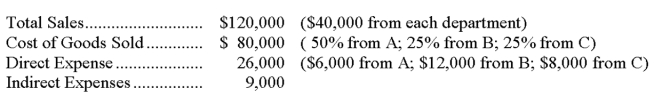

Vaughn Co. operates three separate departments (A, B, C). The data below is provided for the current year:  Required: Prepare an income statement showing the departmental contributions to overhead for the current year.

Required: Prepare an income statement showing the departmental contributions to overhead for the current year.

Correct Answer

verified

Correct Answer

verified

True/False

Controllable costs are the same as direct costs.

Correct Answer

verified

Correct Answer

verified

True/False

The number of hours that a department uses equipment and machinery is a reasonable basis for allocating depreciation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

General Chemical produced 10,000 gallons of Breon and 20,000 gallons of Baron. Joint costs incurred in producing the two products totaled $7,500. At the split-off point, Breon has a market value of $6.00 per gallon and Baron $2.00 per gallon. Compute the portion of the joint costs to be allocated to Breon if the value basis is used.

A) $2,500.

B) $3,000.

C) $4,500.

D) $5,625.

E) $1,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Responsibility accounting performance reports:

A) Become more detailed at higher levels of management.

B) Become less detailed at higher levels of management.

C) Are equally detailed at all levels of management.

D) Are useful in any format.

E) Are irrelevant.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A profit center:

A) Incurs costs, but does not directly generate revenues.

B) Incurs costs and directly generates revenues.

C) Has a manager who is evaluated solely on efficiency in controlling costs.

D) Incurs only indirect costs and directly generates revenues.

E) Incurs only indirect costs and generates revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Regardless of the system used in departmental cost analysis:

A) Direct costs are allocated, indirect costs are not.

B) Indirect costs are allocated, direct costs are not.

C) Both direct and indirect costs are allocated.

D) Neither direct nor indirect costs are allocated.

E) Total departmental costs will always be the same.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculating return on total assets for an investment center is defined by the following formula for an investment center:

A) Contribution margin/Ending assets.

B) Gross profit/Ending assets.

C) Net income/Ending assets.

D) Net income/Average invested assets.

E) Contribution margin/Average invested assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A college uses advisors who work with all students in all divisions of the college. The most useful allocation basis for the salaries of these employees would likely be

A) number of classes offered in each division.

B) student graduation rate.

C) square footage of each division.

D) number of students advised from each division.

E) relative salaries of division heads.

Correct Answer

verified

Correct Answer

verified

True/False

Direct costs require allocation across departments.

Correct Answer

verified

Correct Answer

verified

Short Answer

A ______________________ incurs costs without directly generating revenues.

Correct Answer

verified

Correct Answer

verified

Not Answered

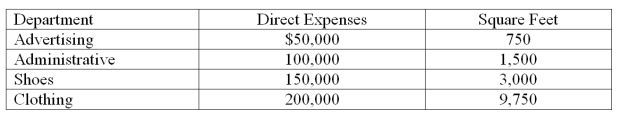

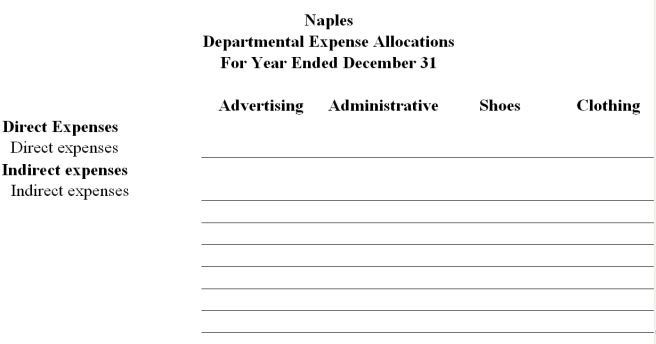

Naples operates a retail store and has two service departments and two operating departments, Shoes and Clothing. During the current year, the departments had the following direct expenses and occupied the flowing amount of floor space.  The advertising department developed and aired 150 spots. Of these spots, 60 spots were for Shoes and 90 spots were for Clothing. The store sold $1,500,000 of merchandise during the year; $675,000 in Shoes and $825,000 in Clothing. Indirect expenses include rent, utilities, and insurance expense. Total indirect expenses of $220,000 are allocated to all departments. Prepare a departmental expense allocation spreadsheet for Naples. The spreadsheet should assign (1) direct expenses to each of the four departments, (2) allocate the indirect expenses to each department on the basis of floor space occupied, (3) the advertising department's expenses to the two operating departments on the basis of ad spots placed promoting each department's products, (4) the administrative department's expenses based on the amount of sales. Complete the departmental expense allocation spreadsheet below. Provide supporting computations for the expense allocations below the spreadsheet.

The advertising department developed and aired 150 spots. Of these spots, 60 spots were for Shoes and 90 spots were for Clothing. The store sold $1,500,000 of merchandise during the year; $675,000 in Shoes and $825,000 in Clothing. Indirect expenses include rent, utilities, and insurance expense. Total indirect expenses of $220,000 are allocated to all departments. Prepare a departmental expense allocation spreadsheet for Naples. The spreadsheet should assign (1) direct expenses to each of the four departments, (2) allocate the indirect expenses to each department on the basis of floor space occupied, (3) the advertising department's expenses to the two operating departments on the basis of ad spots placed promoting each department's products, (4) the administrative department's expenses based on the amount of sales. Complete the departmental expense allocation spreadsheet below. Provide supporting computations for the expense allocations below the spreadsheet.

Correct Answer

verified

Correct Answer

verified

Not Answered

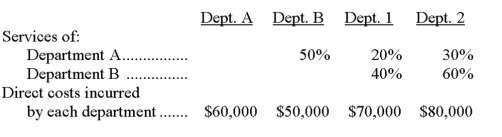

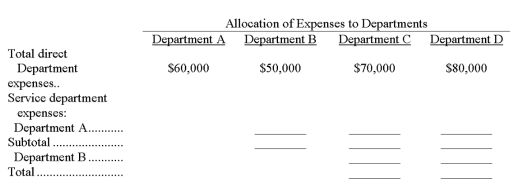

Blower Company is divided into four departments. Departments A and B are service departments and Departments 1 and 2 are operating (production) departments. The services of the two service departments are used by the other departments as follows:  Complete the following table:

Complete the following table:

Correct Answer

verified

Correct Answer

verified

Not Answered

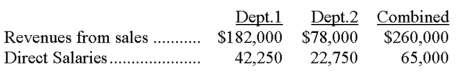

Eclectic Furniture Company allocates its indirect salaries of $12,500 on the basis of sales. Determine the indirect salaries allocated to Departments 1 and 2 using the following information.  Salaries allocated to Dept. 1 _______________

Salaries allocated to Dept. 2 _______________

Salaries allocated to Dept. 1 _______________

Salaries allocated to Dept. 2 _______________

Correct Answer

verified

Correct Answer

verified

Multiple Choice

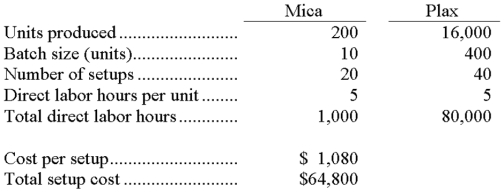

A firm produces and sells two products, Mica and Plax. The following information is available relating to setup costs (a part of factory overhead) :  Using number of setups as the activity base, the amount of setup cost allocated to each unit of product for Mica and Plax, respectively is:

Using number of setups as the activity base, the amount of setup cost allocated to each unit of product for Mica and Plax, respectively is:

A) $21.60; $.54.

B) $54.00; $27.00.

C) $60.00; $60.00.

D) $108.00; $2.70.

E) $200.00; $16,000.00

Correct Answer

verified

Correct Answer

verified

True/False

Departmental wage expenses are direct expenses of that department.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 170

Related Exams