A) $80.

B) $30.

C) $20.

D) $10.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes on labor have the effect of encouraging

A) workers to work more hours.

B) the elderly to postpone retirement.

C) second earners within a family to take a job.

D) unscrupulous people to take part in the underground economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct regarding the imposition of a tax on gasoline?

A) The incidence of the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

B) The incidence of the tax depends upon the price elasticities of demand and supply.

C) The amount of tax revenue raised by the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

D) The amount of tax revenue raised by the tax does not depend upon the amount of the tax per unit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

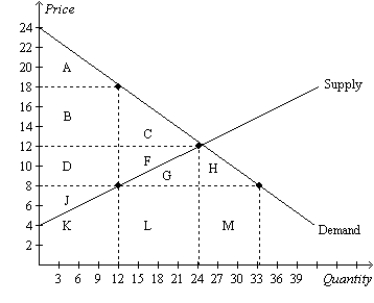

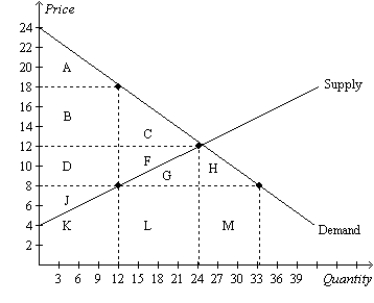

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8. The deadweight loss of the tax is the area

-Refer to Figure 8-8. The deadweight loss of the tax is the area

A) B+D.

B) C+F.

C) A+C+F+J.

D) B+C+D+F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

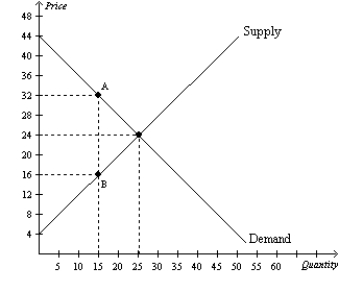

Figure 8-7

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-7. Which of the following statements is correct?

-Refer to Figure 8-7. Which of the following statements is correct?

A) Total surplus before the tax is imposed is $500.

B) After the tax is imposed, consumer surplus is 45 percent of its pre-tax value.

C) After the tax is imposed, producer surplus is 45 percent of its pre-tax value.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on a good,

A) neither buyers nor sellers are made worse off.

B) only sellers are made worse off.

C) only buyers are made worse off.

D) both buyers and sellers are made worse off.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

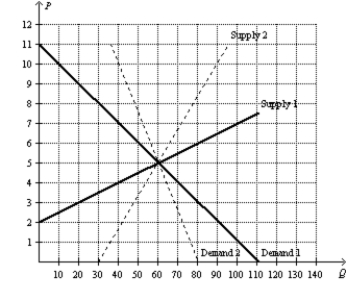

Figure 8-21  -Refer to Figure 8-21. Suppose the government places a $3 per-unit tax on this good. The largest deadweight loss from the tax would occur in a market where demand is represented by

-Refer to Figure 8-21. Suppose the government places a $3 per-unit tax on this good. The largest deadweight loss from the tax would occur in a market where demand is represented by

A) Demand 1, and supply is represented by Supply 1.

B) Demand 1, and supply is represented by Supply 2.

C) Demand 2, and supply is represented by Supply 1.

D) Demand 2, and supply is represented by Supply 2.

Correct Answer

verified

Correct Answer

verified

True/False

The more elastic are supply and demand in a market, the greater are the distortions caused by a tax on that market, and the more likely it is that a tax cut in that market will raise tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

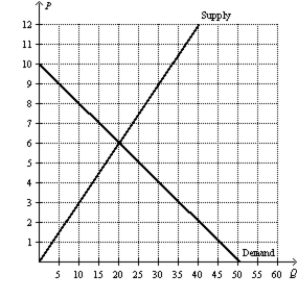

Figure 8-13  -Refer to Figure 8-13. Suppose the government places a $5 per-unit tax on this good. The amount of tax revenue collected by the government is

-Refer to Figure 8-13. Suppose the government places a $5 per-unit tax on this good. The amount of tax revenue collected by the government is

A) $120.

B) $80.

C) $50.

D) $30.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

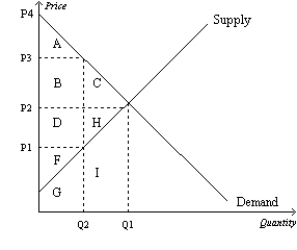

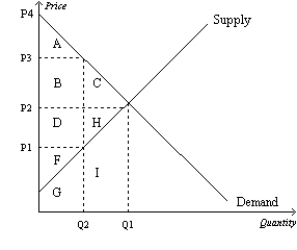

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5. After the tax is levied, producer surplus is represented by area

-Refer to Figure 8-5. After the tax is levied, producer surplus is represented by area

A) A.

B) A+B+C.

C) D+H+F.

D) F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

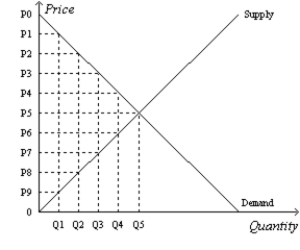

Figure 8-10  -Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. With the tax, the consumer surplus is

-Refer to Figure 8-10. Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2. With the tax, the consumer surplus is

A) P0-P2) x Q2.

B) 1/2 x P0-P2) x Q2.

C) P0-P5) x Q5.

D) 1/2 x P0-P5) x Q5.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a good that is taxed, the area on the relevant supplyanddemand graph that represents government's tax revenue is

A) smaller than the area that represents the loss of consumer surplus and producer surplus caused by the tax.

B) bounded by the supply curve, the demand curve, the effective price paid by buyers, and the effective price received by sellers.

C) a right triangle.

D) a triangle, but not necessarily a right triangle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The size of a tax and the deadweight loss that results from the tax are

A) positively related.

B) negatively related.

C) independent of each other.

D) equal to each other.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To fully understand how taxes affect economic well-being, we must compare the

A) consumer surplus to the producer surplus.

B) price paid by buyers to the price received by sellers.

C) reduced welfare of buyers and sellers to the revenue raised by the government.

D) consumer surplus to the deadweight loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $4 per unit is imposed on a good, and the tax causes the equilibrium quantity of the good to decrease from 2,000 units to 1,700 units. The tax decreases consumer surplus by $3,000 and decreases producer surplus by $4,400. The deadweight loss of the tax is

A) $200.

B) $400.

C) $600.

D) $1,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5. The total surplus with the tax is represented by area

-Refer to Figure 8-5. The total surplus with the tax is represented by area

A) C+H.

B) A+B+C.

C) D+H+F.

D) A+B+D+F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefit to buyers of participating in a market is measured by

A) the price elasticity of demand.

B) consumer surplus.

C) the maximum amount that buyers are willing to pay for the good.

D) the equilibrium price.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.  -Refer to Figure 8-8. The decrease in consumer and producer surpluses that is not offset by tax revenue is the area

-Refer to Figure 8-8. The decrease in consumer and producer surpluses that is not offset by tax revenue is the area

A) C.

B) F.

C) G.

D) C+F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ronald Reagan believed that reducing income tax rates would

A) do little, if anything, to encourage hard work.

B) result in large increases in deadweight losses.

C) raise economic well-being and perhaps even tax revenue.

D) lower economic well-being, even though tax revenue could possibly increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal tax rate on labor income for many workers in the United States is almost

A) 30 percent.

B) 40 percent.

C) 50 percent.

D) 65 percent.

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 514

Related Exams