A) issues permits that enables the owners of the permit to pollute.

B) strictly mentions the amount of pollutants that can be emitted by a particular firm.

C) levies tax on the polluting firm.

D) gives subsidies to the firms who adopt clean production technologies.

E) takes legal actions against the firms who pollute beyond the specified level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The good for which neither the principle of mutual excludability nor the principle of rivalry applies is referred to as a:

A) public good.

B) commons good.

C) club good.

D) normal good.

E) private good.

Correct Answer

verified

Correct Answer

verified

True/False

When consumers have perfect information about the quality of the products they purchase, the problem of adverse selection is likely to arise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of following would help minimize moral hazard in the financial market?

A) Raising the interest rate on loans

B) Decreasing the down payment on a loan

C) Eliminating the need for a borrower to provide collateral

D) Requiring an insurance policyholder to carry a deductible

E) An insurance company increasing the premium and reducing the deductible

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Higher the economic freedom in a country:

A) lower is the standard of living of the people.

B) higher is the life expectancy.

C) greater is the bureaucratic freedom and red-tapism.

D) lower is the level of education due to lack of government schools.

E) lower is the literacy rate.

Correct Answer

verified

B

Correct Answer

verified

True/False

When negotiation is costly, it makes a difference where liability is placed in terms of reaching an efficient solution to a negative externality problem.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A good that is both excludable and rivalrous is a(n) :

A) public good.

B) club good.

C) private good.

D) inferior good.

E) necessary good.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The European Union Emission Trading Scheme is an example of:

A) a pollution tax.

B) a pollution subsidy.

C) a command approach.

D) cap and trade.

E) a direct government control on private firms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) In the case of positive externalities, a private market will produce too little of the good compared with the socially efficient level of output.

B) In the case of positive externalities, a private market will produce too much of the good compared with the socially efficient level of output.

C) Negative externalities occur when benefits accrue to individuals not directly involved in the transaction.

D) Positive externalities occur when costs are imposed on individuals not directly involved in the transaction.

E) In the case of negative externalities, a private market will produce too little of the good compared with the socially efficient level of output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The existence of externalities in a market implies that:

A) resources are being used efficiently.

B) there is no other allocation of resources that would make society as a whole better off.

C) consumers cannot be excluded from consuming the good once it is provided.

D) resources are not being used in their highest valued activity.

E) the societal welfare as a whole is maximized.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When economic activity imposes costs on others not directly involved in the transaction:

A) a negative externality exists.

B) a positive externality exists.

C) then the market, will produce too little of the good.

D) the tragedy of commons problem arises.

E) a free rider problem arises.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why are cows and chickens less prone to become extinct?

A) They are usually consumed in huge numbers

B) They are mainly privately owned

C) They are a part of common resources

D) Poaching these animals for their meat is banned by the government

E) They are not used for commercial purposes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why do externalities arise?

A) The costs of production are not borne by the producer

B) An economic activity imposes a burden on them who are not directly involved in it

C) An economic activity imposes a cost on them who are directly involved in it

D) The government produces such goods and services which are consumed by only a particular class of people

E) Goods of mass consumption are not produced as they do not yield profit for the producers

Correct Answer

verified

Correct Answer

verified

True/False

Benefits granted to powerful special interest groups in return for political support are known as rents.

Correct Answer

verified

True

Correct Answer

verified

True/False

Private costs exceed social cost when external benefits are created.

Correct Answer

verified

Correct Answer

verified

True/False

A tradable government permit for the atmospheric release of a ton of sulfur dioxide can help reduce acid rain.

Correct Answer

verified

Correct Answer

verified

True/False

In the case of automobile and medical insurance, adverse selection might mean that, as the cost of insurance rises, the good drivers and healthy people reduce their coverage while the poor drivers and unhealthy people maintain their coverage.

Correct Answer

verified

Correct Answer

verified

True/False

The major problem with common ownership is that, too much of the commonly owned is consumed, and not enough is produced.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

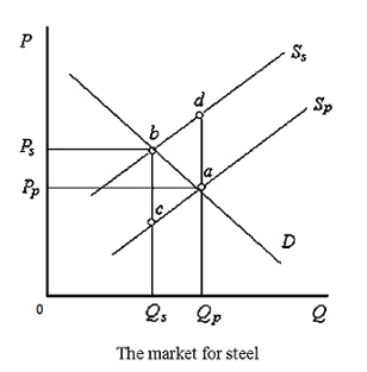

The figure given below shows the demand and supply curves of steel.Sp is the private supply curve, and Ss is the social supply curve that includes both private costs and external costs. Figure 13.2  In Figure 13.2, external costs are equal to _____.

In Figure 13.2, external costs are equal to _____.

A) Ps - Pp

B) da

C) Qp - Qs

D) ab

E) bc

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following is true of externality?

A) An externality enhances the efficiency of the market system.

B) An externality is not an economic problem because it is external to the market.

C) An externality is a cost borne by the people who are directly or indirectly involved in the production of a good or service.

D) An externality accrues to someone who had nothing to do with the production or consumption of a good or service.

E) An externality refers to some unexpected change in the equilibrium price or quantity of a product.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 121

Related Exams