A) demand curve for tuxedoes downward, decreasing the price received by sellers of tuxedoes and causing the quantity of tuxedoes to increase.

B) demand curve for tuxedoes downward, decreasing the price received by sellers of tuxedoes and causing the quantity of tuxedoes to decrease.

C) supply curve for tuxedoes upward, decreasing the effective price paid by buyers of tuxedoes and causing the quantity of tuxedoes to increase.

D) supply curve for tuxedoes upward, increasing the effective price paid by buyers of tuxedoes and causing the quantity of tuxedoes to decrease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anger over British taxes played a significant role in bringing about the

A) election of John Adams as the second American president.

B) American Revolution.

C) War of 1812.

D) "no new taxes" clause in the U.S. Constitution.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

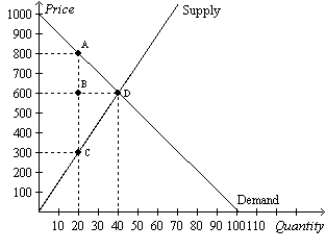

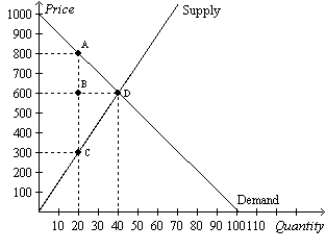

Figure 8-9

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-9. The loss of producer surplus as a result of the tax is

-Refer to Figure 8-9. The loss of producer surplus as a result of the tax is

A) $3,000.

B) $6,000.

C) $9,000.

D) $12,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $4 per unit is imposed on a good, and the tax causes the equilibrium quantity of the good to decrease from 2,000 units to 1,700 units. The tax decreases consumer surplus by $3,000 and decreases producer surplus by $4,400. The deadweight loss of the tax is

A) $200.

B) $400.

C) $600.

D) $1,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

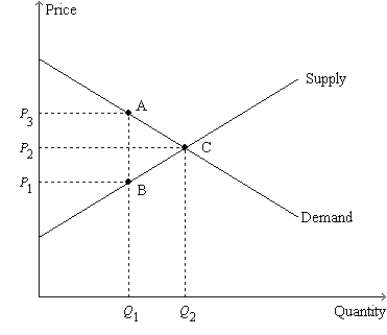

Figure 8-11  -Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

-Refer to Figure 8-11. Suppose Q1 = 4; Q2 = 7; P1 = $6; P2 = $8; and P3 = $10. Then, when the tax is imposed,

A) the government collects $28 in tax revenue.

B) producer surplus decreases by $13.

C) consumer surplus decreases by $11.

D) the deadweight loss amounts to $9.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

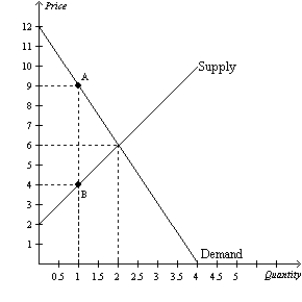

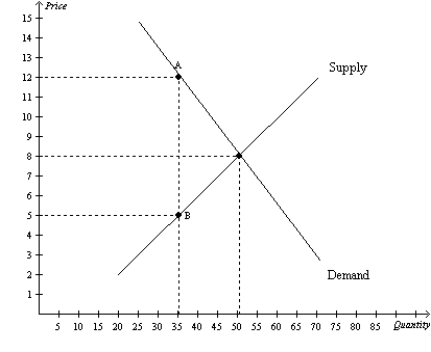

Figure 8-2

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-2. The amount of deadweight loss as a result of the tax is

-Refer to Figure 8-2. The amount of deadweight loss as a result of the tax is

A) $2.50.

B) $5.

C) $7.50.

D) $10.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

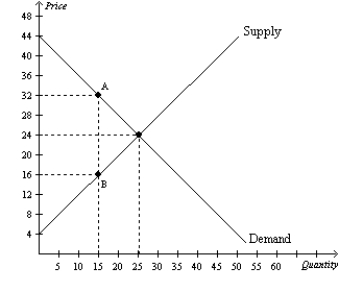

Figure 8-7

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-7. Which of the following statements summarizes the incidence of the tax?

-Refer to Figure 8-7. Which of the following statements summarizes the incidence of the tax?

A) For each unit of the good that is sold, buyers bear one-half of the tax burden, and sellers bear one-half of the tax burden.

B) For each unit of the good that is sold, buyers bear one-third of the tax burden, and sellers bear two-thirds of the tax burden.

C) For each unit of the good that is sold, buyers bear one-fourth of the tax burden, and sellers bear three-fourths of the tax burden.

D) For each unit of the good that is sold, buyers bear three-fourths of the tax burden, and sellers bear one-fourth of the tax burden.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

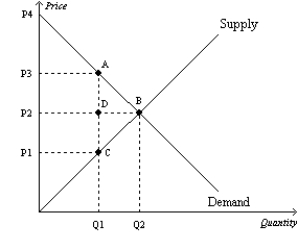

Figure 8-3

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-3. The per unit burden of the tax on buyers is

-Refer to Figure 8-3. The per unit burden of the tax on buyers is

A) P3 - P1.

B) P3 - P2.

C) P2 - P1.

D) P4 - P3.

Correct Answer

verified

Correct Answer

verified

True/False

Taxes on labor tend to encourage the elderly to retire early.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

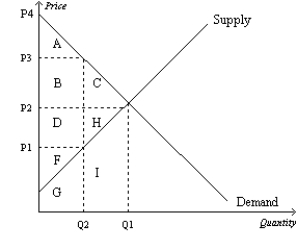

Figure 8-5

Suppose that the government imposes a tax of P3 - P1.  -Refer to Figure 8-5. The total surplus with the tax is represented by area

-Refer to Figure 8-5. The total surplus with the tax is represented by area

A) C+H.

B) A+B+C.

C) D+H+F.

D) A+B+D+F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

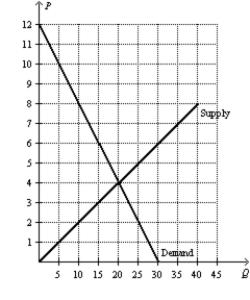

Figure 8-12  -Refer to Figure 8-12. Suppose a $3 per-unit tax is placed on this good. The per-unit burden of the tax on sellers is

-Refer to Figure 8-12. Suppose a $3 per-unit tax is placed on this good. The per-unit burden of the tax on sellers is

A) $1.

B) $2.

C) $3.

D) $4.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

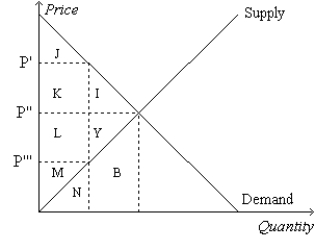

Figure 8-1  -Refer to Figure 8-1. Suppose the government imposes a tax of P' - P'''. The producer surplus after the tax is measured by the area

-Refer to Figure 8-1. Suppose the government imposes a tax of P' - P'''. The producer surplus after the tax is measured by the area

A) M.

B) L+M+N+Y+B.

C) L+M+Y.

D) J.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ideas is the most plausible?

A) Tax revenue is more likely to increase when a low tax rate is increased than when a high tax rate is increased.

B) Tax revenue is less likely to increase when a low tax rate is increased than when a high tax rate is increased.

C) Tax revenue is likely to increase by the same amount when a low tax rate is increased and when a high tax rate is increased.

D) Decreasing a tax rate can never increase tax revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the tax on a good is increased from $1 per unit to $4 per unit, the deadweight loss from the tax increases by a factor of

A) 5.

B) 9.

C) 16.

D) 24.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government increases the size of a tax by 20 percent. The deadweight loss from that tax

A) increases by 20 percent.

B) increases by more than 20 percent.

C) increases but by less than 20 percent.

D) decreases by 20 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-4

The vertical distance between points A and B represents a tax in the market.  -Refer to Figure 8-4. The tax results in a loss of producer surplus that amounts to

-Refer to Figure 8-4. The tax results in a loss of producer surplus that amounts to

A) $75.50.

B) $90.00.

C) $112.50.

D) $127.50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a tax of $0.10 per unit on a good creates a deadweight loss of $100. If the tax is increased to $0.25 per unit, the deadweight loss from the new tax would be

A) $200.

B) $250.

C) $475.

D) $625.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

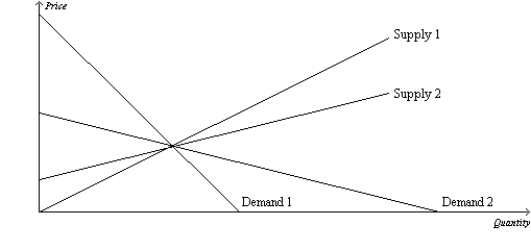

Figure 8-14  -Refer to Figure 8-14. Which of the following combinations will maximize the deadweight loss from a tax?

-Refer to Figure 8-14. Which of the following combinations will maximize the deadweight loss from a tax?

A) supply 1 and demand 1

B) supply 2 and demand 2

C) supply 1 and demand 2

D) supply 2 and demand 1

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following instances would the deadweight loss of the tax on cartons of cigarettes increase by a factor of 9?

A) The tax on cartons of cigarettes increases from $10 to $11.11.

B) The tax on cartons of cigarettes increases from $10 to $20.

C) The tax on cartons of cigarettes increases from $10 to $30.

D) The tax on cartons of cigarettes increases from $10 to $90.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 8-9

The vertical distance between points A and C represents a tax in the market.  -Refer to Figure 8-9. The loss of consumer surplus as a result of the tax is

-Refer to Figure 8-9. The loss of consumer surplus as a result of the tax is

A) $2,000.

B) $4,000.

C) $6,000.

D) $8,000.

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 514

Related Exams