Correct Answer

verified

Correct Answer

verified

Short Answer

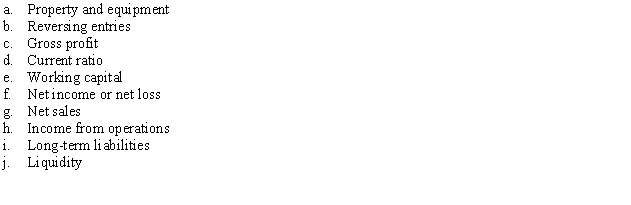

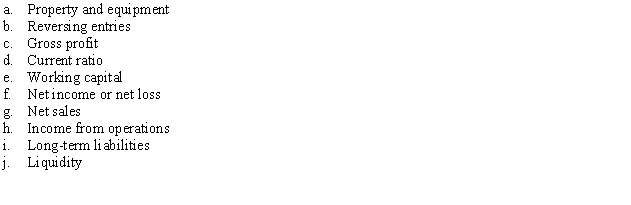

Match the terms below with the correct definitions.

-The classification that helps to identify which of the firm's debts are paid over a comparatively long period

-The classification that helps to identify which of the firm's debts are paid over a comparatively long period

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is NOT true about the Chart of Accounts?

A) The order of the chart of accounts is important.

B) The first digit in the account number helps identify and organize the accounts in the chart.

C) Income statement accounts are listed before balance sheet accounts.

D) None of the above are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Subclassifications of operating expenses are

A) Selling Expenses

B) General Expenses

C) Both A & B

D) Neither A or B

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A net loss will occur if revenues are

A) greater than expenses

B) less than expenses

C) equal to expenses

D) greater than Cost of Goods Sold

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Working Capital =

A) Current Assets - Long-Term Liabilities

B) Current Assets - Current Liabilities

C) Long Term Assets - Long Term Liabilities

D) Total Assets - Total Liabilities

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the terms below with the correct definitions.

-Excess of net sales over the cost of goods sold

-Excess of net sales over the cost of goods sold

Correct Answer

verified

Correct Answer

verified

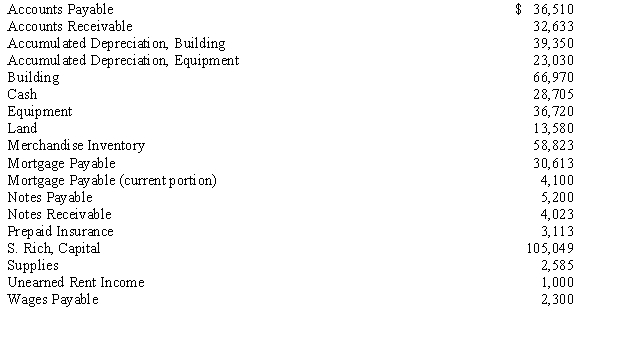

Essay

Selected account balances of Rich and Company as of December 31, the end of its fiscal year, are listed below in alphabetical order.

Instructions:

Based on the account balances above, prepare a classified balance sheet.

Instructions:

Based on the account balances above, prepare a classified balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Examples of current assets are

A) supplies capable of being used up within twelve months.

B) merchandise inventories convertible into cash within twelve months or less.

C) receivables convertible into cash within twelve months or less.

D) all of these.

E) none of these.

Correct Answer

verified

Correct Answer

verified

True/False

Immediately after a reversing entry to reverse the entry for accrued salaries has been posted, Salary Expense will have a credit balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reversing entry could be used if

A) there is an adjusting entry.

B) the adjusting entry increases an asset or liability account.

C) the adjusting entry account did not have a previous balance.

D) all of these were true.

E) none of these were true.

Correct Answer

verified

Correct Answer

verified

True/False

A reversing entry must be made for each adjusting entry.

Correct Answer

verified

Correct Answer

verified

Not Answered

Match the terms below with the correct definitions.

-The final figure on the income statement

-The final figure on the income statement

Correct Answer

verified

Correct Answer

verified

True/False

Reversing entries are journalized and posted before adjusting and closing entries are journalized and posted.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the terms below with the correct definitions.

-Portrays a firm's ability to pay its short-term debts

-Portrays a firm's ability to pay its short-term debts

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold may be computed by

A) adding beginning inventory and ending inventory together.

B) subtracting ending inventory from cost of goods available for sale.

C) subtracting beginning inventory from cost of goods available for sale.

D) adding beginning inventory to cost of goods available for sale.

E) subtracting beginning inventory from net purchases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What would be an appropriate account number for Unearned Revenues?

A) 12

B) 21

C) 32

D) 42

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming Net Sales are $180,000, Cost of Goods Sold is $79,000, Selling Expenses are $28,500, General Expenses are $22,800, and Interest Expense is $2,000, then Net Income is

A) $27,700.

B) $49,700.

C) $101,000.

D) $95,300.

E) $47,700.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the terms below with the correct definitions.

-Excess of gross profit over operating expenses

-Excess of gross profit over operating expenses

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT true about closing entries for a merchandising business?

A) The closing entries for a merchandise business have a different closing order than a service business.

B) Nominal Accounts are closed at the end of the fiscal period.

C) Temporary-equity accounts are closed at the end of the fiscal period.

D) None of the above are true.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 104

Related Exams