Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash payments journal is used for transactions involving

A) credits to Cash, regardless of the offsetting debits.

B) credits to Cash but not affecting subsidiary ledgers.

C) a debit to Cash and credits to other accounts.

D) a debit to Cash and debits or credits to other balance sheet accounts.

E) a credit to Cash and a debit to income statement accounts.

Correct Answer

verified

Correct Answer

verified

True/False

Credit postings to the Accounts Receivable general ledger account come from the cash receipts journal and the general journal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A written promise to pay a specified amount at a specified time

A) Promise to Pay

B) Accrued Note

C) Promissory Note

D) Specified Note

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of discount to be recorded if the invoice is paid within the discount period on a purchase of goods having a list price of $1,600, subject to a trade discount of 25 percent with terms 2/10, n/30, is

A) $450.

B) $30.

C) $21.

D) $29.40.

E) $24.

Correct Answer

verified

Correct Answer

verified

True/False

A credit to an account in the accounts payable ledger would have been posted from the cash payments journal if special journals are used.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales Discounts would appear as a Debit column in which special journal

A) purchases journal.

B) general journal.

C) sales journal.

D) cash payments journal.

E) cash receipts journal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following journals has end-of-the-month postings?

A) Cash payments journal

B) Purchases journal

C) Sales journal

D) Cash receipts journal

E) All special journals have end-of-the-month postings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barnes Company purchased merchandise on account, $3,500, with terms 3/10, n/30. The entry required of Barnes Company to record the transaction in the cash payments journal, assuming payment is not made within the discount period, is

A) debit Accounts Payable, $3,500; credit Sales Discounts, $105; credit Cash, $3,395.

B) debit Accounts Payable, $3,500; credit Cash, $3,500.

C) debit Accounts Payable, $3,395; credit Cash, $3,395.

D) debit Accounts Payable, $3,500; credit Purchases Discounts, $105; credit Cash, $3,395.

E) credit Accounts Payable, $3,500; credit Cash, $3,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tyler Corporation bought office supplies for $125 cash. In what journal would this transaction be recorded?

A) Purchase Journal

B) Sales Journal

C) Cash Receipt Journal

D) Cash Payment Journal

Correct Answer

verified

Correct Answer

verified

True/False

In the cash receipts journal, the total amount in the Other Accounts column is posted at the end of the month.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT an advantage of the Cash Payment Journal?

A) Transactions are recorded on one line.

B) Transactions involving credits to cash are recorded in one place.

C) Special columns are not used in this journal.

D) The Cash credit side can be posted as one total.

Correct Answer

verified

Correct Answer

verified

True/False

Payment of merchandise purchased on account within the discount period is recorded in the cash payments journal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts normally has a credit balance?

A) Sales Discounts

B) Sales Returns and Allowances

C) Purchases Returns and Allowances

D) Purchases

E) Accounts Receivable

Correct Answer

verified

Correct Answer

verified

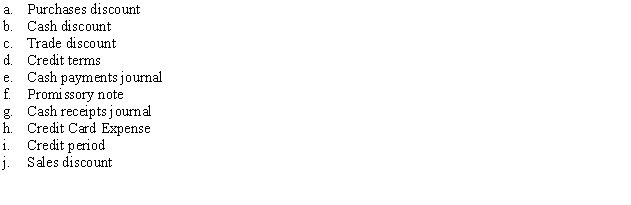

Short Answer

Match the terms below with the correct definitions.

-Agreement between seller and buyer on payment

-Agreement between seller and buyer on payment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts Payable would appear as a debit in

A) the cash payments journal.

B) the sales journal.

C) the purchases journal.

D) the cash receipts journal.

E) all the special journals.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales Discount is a ___________with a normal balance of __________.

A) Contra-Asset, DR

B) Contra-Revenue, DR

C) Revenue, CR

D) Liability, CR

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You will never find the following combination of accounts in a journal entry except

A) Accounts Receivable and Purchases.

B) Accounts Payable and Sales.

C) Sales Returns and Allowances and Accounts Payable.

D) Purchases Returns and Allowances and Accounts Payable.

E) Accounts Payable and Accounts Receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Credit card receipts, cash, checks, electronic funds transfers are all examples of source documents that would be recorded in the following journal:

A) Sales Journal

B) Purchase Journal

C) Cash Receipts Journal

D) General Journal

Correct Answer

verified

Correct Answer

verified

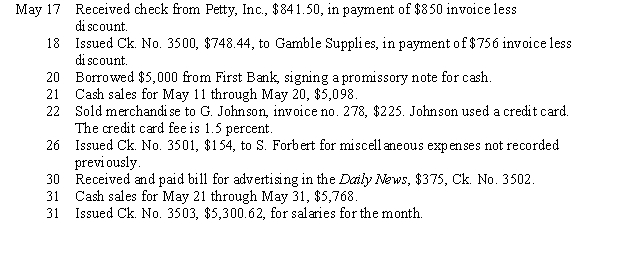

Essay

The following transactions were completed by Figureroa Supplies during the second half of May. Terms of sale are 1/10, n/30.

Instructions:

Record the transactions for the second half of May, using a cash receipts journal, page 13, or a cash payments journal, page 19.

Instructions:

Record the transactions for the second half of May, using a cash receipts journal, page 13, or a cash payments journal, page 19.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 106

Related Exams