A) oil prices.

B) business taxes.

C) income tax rates.

D) investment spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve does not target both the money supply and an interest rate because

A) it would be too confusing to Wall Street and would disrupt the financial markets.

B) it would be too easy for Wall Street to determine what policy the Fed is following and this would destabilize the economy.

C) it would be illegal according to the Federal Reserve Act.

D) the Fed cannot achieve a target for both the money supply and an interest rate at the same time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The monetary policy target the Federal Reserve focuses primarily on today is

A) the unemployment rate.

B) M1.

C) the inflation rate.

D) the interest rate.

E) M2.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

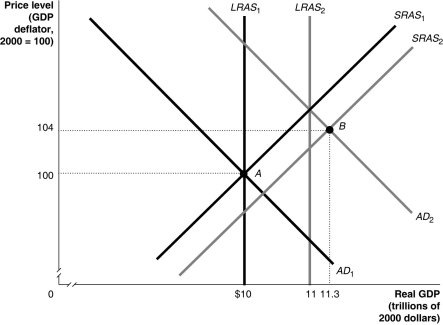

Figure 17-7  -Refer to Figure 17-7.In the dynamic AD-AS model,if the economy is at point A in year 1 and is expected to go to point B in year 2,the Federal Reserve would most likely

-Refer to Figure 17-7.In the dynamic AD-AS model,if the economy is at point A in year 1 and is expected to go to point B in year 2,the Federal Reserve would most likely

A) increase interest rates.

B) decrease interest rates.

C) not change interest rates.

D) increase the inflation rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By the 2000s,an important change in the mortgage market had occurred when ________ became significant participants in the secondary market for mortgages.

A) investment banks

B) Federal Reserve Banks

C) commercial banks

D) savings banks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed uses contractionary policy,

A) the price level rises higher than it would if the Fed did not pursue policy.

B) the price level rises less than it would if the Fed did not pursue policy.

C) it does not change the price level.

D) it causes inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

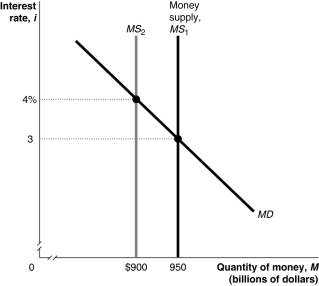

Figure 17-2  -Refer to Figure 17-2.In the figure above,when the money supply shifts from MS1 to MS2,at the interest rate of 3 percent households and firms will

-Refer to Figure 17-2.In the figure above,when the money supply shifts from MS1 to MS2,at the interest rate of 3 percent households and firms will

A) buy Treasury bills.

B) sell Treasury bills.

C) neither buy nor sell Treasury bills.

D) want to hold less money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve raises or lowers interest rates too late,it could result in a ________ policy that destabilizes the economy.

A) fiscal

B) budgetary

C) procyclical

D) countercylical

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From an initial long-run macroeconomic equilibrium,if the Federal Reserve anticipated that next year aggregate demand would grow significantly slower than long-run aggregate supply,then the Federal Reserve would most likely

A) decrease interest rates.

B) increase interest rates.

C) decrease income tax rates.

D) increase income tax rates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Federal Reserve System was established in 1913,its main policy goal was

A) encouraging strong economic growth.

B) promoting price stability.

C) preventing bank panics.

D) keeping employment high.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the countries that have adopted inflation targeting,the inflation rate has typically

A) increased.

B) decreased.

C) decreased to zero.

D) not changed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Toll Brothers,a residential home builder,did well during the recession in 2001 but did not do so well in 2007 after the housing bubble burst.The reason for this is

A) the Fed lowered interest rates in 2001 but raised interest rates in 2007 to help fight inflation.

B) the Fed lowered interest rates in 2001 but did not believe that cutting the interest rate in 2007 would be enough to revive the housing market.

C) the Fed raised interest rates in 2001 but did not believe that cutting the interest rate in 2007 would be enough to revive the housing market.

D) the Fed raised interest rates in 2001 but lowered interest rates in 2007 to revive the housing market.

E) the Fed raised interest rates in 2001 and raised interest rates in 2007 to help fight inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With a monetary growth rule as proposed by the monetarists,during a recession the rate of growth of the money supply would

A) decrease.

B) increase.

C) not change.

D) decrease or increase depending on economic conditions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

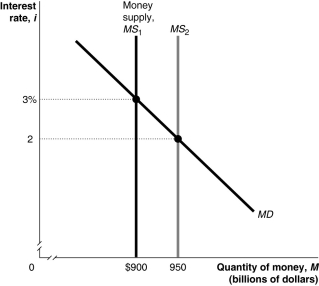

Figure 17-3  -Refer to Figure 17-3.In the figure above,when the money supply shifts from MS1 to MS2,at the interest rate of 3 percent households and firms will

-Refer to Figure 17-3.In the figure above,when the money supply shifts from MS1 to MS2,at the interest rate of 3 percent households and firms will

A) buy Treasury bills.

B) sell Treasury bills.

C) neither buy nor sell Treasury bills.

D) want to hold more money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

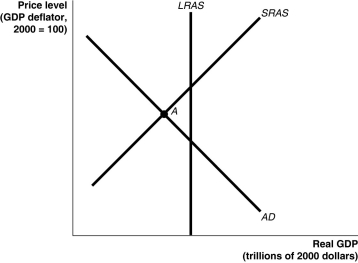

Figure 17-4  -Refer to Figure 17-4.In the figure above,if the economy is at point A,the appropriate monetary policy by the Federal Reserve would be to

-Refer to Figure 17-4.In the figure above,if the economy is at point A,the appropriate monetary policy by the Federal Reserve would be to

A) lower interest rates.

B) raise interest rates.

C) lower income taxes.

D) raise income taxes.

Correct Answer

verified

Correct Answer

verified

True/False

Inflation rates during the years 1979-1981 were the highest the United States has ever experienced during peacetime.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

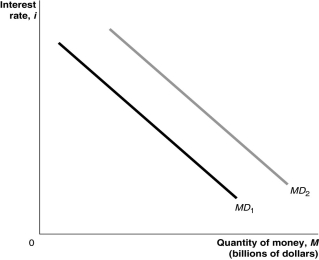

Figure 17-1  -Refer to Figure 17-1.In the figure,the money demand curve would move from MD1 to MD2 if

-Refer to Figure 17-1.In the figure,the money demand curve would move from MD1 to MD2 if

A) real GDP increased.

B) the price level decreased.

C) the interest rate increased.

D) the Federal Reserve sold Treasury securities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contractionary monetary policy to prevent real GDP from rising above potential real GDP would cause the inflation rate to be ________ and real GDP to be ________.

A) higher;higher

B) higher;lower

C) lower;higher

D) lower;lower

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation targeting refers to conducting ________ policy so as to commit the central bank to achieving a ________.

A) fiscal;publicly announced level of inflation

B) fiscal;zero inflation rate

C) monetary;publicly announced level of inflation

D) monetary;zero inflation rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2008,the Treasury and Federal Reserve took action to save large financial firms such as Bear Stearns and AIG from failing.Which of the following is one reason why these measures were taken?

A) The Emergency Economic Stabilization Act required the Fed and the Treasury to provide financial assistance to firms that participated in regular open market actions with the Fed.

B) The bankruptcy of a large financial firm would force the firm to sell its holdings of securities,which could cause other firms that hold these securities to also fail.

C) The Fed and the Treasury wanted to allow Freddie Mac and Fannie Mae more time to buy the firms before they went bankrupt.

D) The failure of these firms would have forced the Fed to increase interest rates,which could have led to a severe recession.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 145

Related Exams