Correct Answer

verified

Correct Answer

verified

Multiple Choice

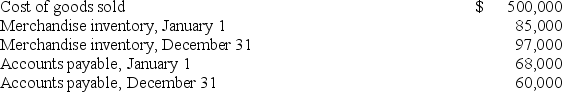

Use the following information about the current year's operations of a company to calculate the cash paid for merchandise.

A) $585,000.

B) $520,000.

C) $480,000.

D) $508,000.

E) $512,000.

Correct Answer

verified

Correct Answer

verified

True/False

On a spreadsheet used to prepare the operating activities section of the statement of cash flows, depreciation expense does not require an entry in the Analysis of Changes columns because it is a noncash item.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A machine with a cost of $130,000 and accumulated depreciation of $85,000 is sold for $40,000 cash. The total amount that should be reported in the operating section of the statement of cash flow as per indirect method is:

A) $17,000.

B) $4,000.

C) $57,000.

D) $21,000.

E) $5,000.

Correct Answer

verified

Correct Answer

verified

True/False

The payment of cash dividends never changes the balance of retained earnings.

Correct Answer

verified

Correct Answer

verified

True/False

Cash flow statements help users decide whether a company has enough cash to pay its debts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash flow on total assets ratio:

A) Is the same as return on assets.

B) Is the same as profit margin.

C) Can measure a company's ability to meet its obligations.

D) Is highly affected by accounting principles of income recognition and measurement.

E) Is average net assets divided by cash flows from operations.

Correct Answer

verified

Correct Answer

verified

True/False

Conversion of preferred stock to common stock is disclosed in the financing section of the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

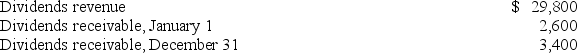

Use the following information to calculate cash received from dividends:

A) $26,400.

B) $29,000.

C) $29,800.

D) $30,600.

E) $32,400.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

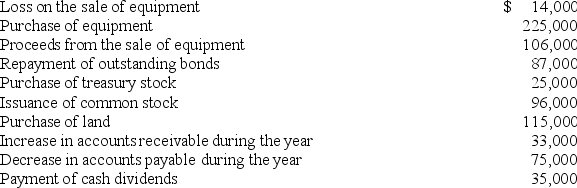

In preparing a company's statement of cash flows for the most recent year, the following information is available:  Net cash flows from investing activities for the year were:

Net cash flows from investing activities for the year were:

A) $234,000 of net cash used.

B) $120,000 of net cash provided.

C) $340,000 of net cash used.

D) $259,000 of net cash used.

E) $280,000 of net cash provided.

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation expense is not reported on a statement of cash flows prepared under the direct method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

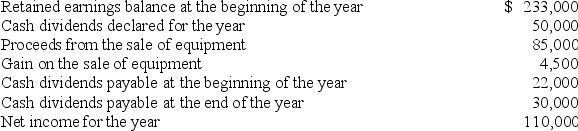

Barclays Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available:  The amount of cash paid for dividends was:

The amount of cash paid for dividends was:

A) $52,000.

B) $60,000.

C) $58,000.

D) $50,000.

E) $42,000.

Correct Answer

verified

Correct Answer

verified

True/False

Investing activities include: (a) the purchase and sale of long-term assets, (b) loaning money in return for notes receivable, and (c) the purchase and sale of short-term investments.

Correct Answer

verified

Correct Answer

verified

True/False

A cash equivalent must be readily convertible to a known amount of cash, and must be sufficiently close to its maturity so its market value is unaffected by interest rate changes.

Correct Answer

verified

True

Correct Answer

verified

True/False

Cash receipts and cash payments are classified as operating, investing, or financing activities on the statement of cash flows.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

A company had net cash flows from operations of $120,000, cash flows from financing of $330,000, total cash flows of $500,000, and average total assets of $2,500,000. The cash flow on total assets ratio equals:

A) 4.8%.

B) 5.0%.

C) 20.0%.

D) 20.8%.

E) 24.0%.

Correct Answer

verified

Correct Answer

verified

Matching

Match each of the following items with the appropriate definitions.

Correct Answer

Multiple Choice

Stormer Company reports the following amounts on its statement of cash flow: Net cash provided by operating activities was $28,000; net cash used in investing activities was $10,000 and net cash used in financing activities was $12,000. If the beginning cash balance is $5,000, what is the ending cash balance?

A) $55,000.

B) $45,000.

C) $31,000.

D) $6,000.

E) $11,000.

Correct Answer

verified

E

Correct Answer

verified

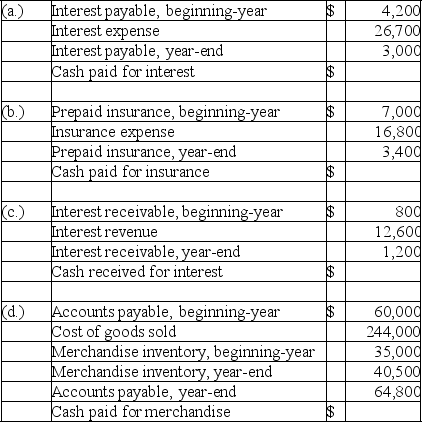

Essay

For each of the following independent cases, use the information provided to calculate the missing cash inflow or cash outflow using the direct method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from interest received on loans are reported in the statement of cash flows as part of:

A) Operating activities.

B) Financing activities.

C) Investing activities.

D) Noncash activities.

E) This is not reported in the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 240

Related Exams