A) Sensitivity analysis as it is generally employed is incomplete in that it fails to consider the probability of occurrence of the key input variables.

B) In comparing two projects using sensitivity analysis,the one with the steeper lines would be considered less risky,because a small error in estimating a variable such as unit sales would produce only a small error in the project's NPV.

C) The primary advantage of simulation analysis over scenario analysis is that scenario analysis requires a relatively powerful computer,coupled with an efficient financial planning software package,whereas simulation analysis can be done efficiently using a PC with a spreadsheet program or even with just a calculator.

D) Sensitivity analysis is a type of risk analysis that considers both the sensitivity of NPV to changes in key input variables and the probability of occurrence of these variables' values.

E) As computer technology advances,simulation analysis becomes increasingly obsolete and thus less likely to be used than sensitivity analysis.

Correct Answer

verified

Correct Answer

verified

True/False

The primary advantage to immediately expensing depreciation rather than using straight-line depreciation is that with immediate expensing the present value of the tax savings provided by depreciation will be higher,other things held constant.

Correct Answer

verified

Correct Answer

verified

True/False

A firm that bases its capital budgeting decisions on either NPV or IRR will be more likely to accept a given project if it immediately expenses depreciation than if it uses straight-line depreciation,other things being equal.

Correct Answer

verified

Correct Answer

verified

True/False

We can identify the cash costs and cash inflows to a company that will result from a project.These could be called "direct inflows and outflows," and the net difference is the direct net cash flow.If there are other costs and benefits that do not flow from or to the firm,but to other parties,these are called externalities,and they need not be considered as a part of the capital budgeting analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

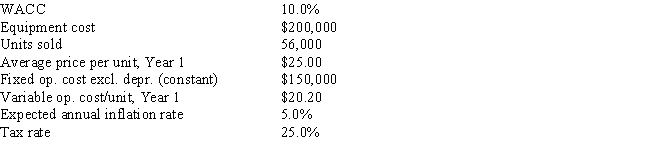

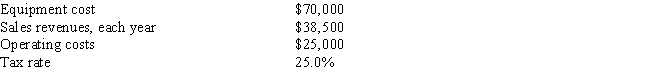

Desai Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.At the end of the project's life,the equipment would have no salvage value.No change in net operating working capital (NOWC) would be required for the project.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.What is the project's expected NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) $98,569

B) $68,303

C) $51,384

D) $95,434

E) $48,877

Correct Answer

verified

Correct Answer

verified

True/False

The primary advantage to immediately expensing depreciation rather than using straight-line depreciation is that with immediate expensing the total amount of depreciation that can be taken,assuming the asset is used for its full tax life,is greater.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

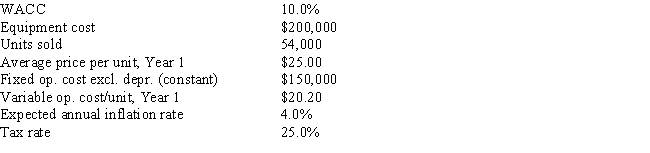

Poulsen Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years.Under the new tax law,the equipment for the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.At the end of the project's life,the equipment will have no salvage value.No change in net operating working capital (NOWC) would be required for the project.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate,but the CFO thinks an inflation adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made versus if it is not made? Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) $18,345

B) $12,621

C) $16,437

D) $15,409

E) $13,648

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dalrymple Inc.is considering production of a new product.In evaluating whether to go ahead with the project,which of the following items should NOT be explicitly considered when cash flows are estimated?

A) The company will produce the new product in a vacant building that was used to produce another product until last year.The building could be sold,leased to another company,or used in the future to produce another of the firm's products.

B) The project will utilize some equipment the company currently owns but is not now using.A used equipment dealer has offered to buy the equipment.

C) The company has spent and expensed for tax purposes $3 million on research related to the new product.These funds cannot be recovered,but the research may benefit other projects that might be proposed in the future.

D) The new product will cut into sales of some of the firm's other products.

E) If the project is accepted,the company must invest an additional $2 million in net operating working capital (NOWC) .However,all these funds will be recovered at the end of the project's life.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company,RMU Inc. ,is considering a new project whose data are shown below.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.What is the project's Year 1 cash flow?

A) $2,350

B) $4,345

C) $12,883

D) $1,063

E) $10,529

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currently,Powell Products has a beta of 1.0,and its sales and profits are positively correlated with the overall economy.The company estimates that a proposed new project would have a higher standard deviation and coefficient of variation than an average company project.Also,the new project's sales would be countercyclical in the sense that they would be high when the overall economy is down and low when the overall economy is strong.On the basis of this information,which of the following statements is CORRECT?

A) The proposed new project would have more stand-alone risk than the firm's typical project.

B) The proposed new project would increase the firm's corporate risk.

C) The proposed new project would increase the firm's market risk.

D) The proposed new project would not affect the firm's risk at all.

E) The proposed new project would have less stand-alone risk than the firm's typical project.

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Walker Publishing Company is considering bringing out a new finance text whose projected revenues include some revenues that will be taken away from another of Walker's books.The lost sales on the older book are a sunk cost and as such should not be considered in the analysis for the new book.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would NOT result in incremental cash flows and thus should NOT be included in the capital budgeting analysis for a new product?

A) Using some of the firm's high-quality factory floor space that is currently unused to produce the proposed new product.This space could be used for other products if it is not used for the project under consideration.

B) Revenues from an existing product would be lost as a result of customers switching to the new product.

C) Shipping and installation costs associated with a machine that would be used to produce the new product.

D) The cost of a study relating to the market for the new product that was completed last year.The results of this research were positive,and they led to the tentative decision to go ahead with the new product.The cost of the research was incurred and expensed for tax purposes last year.

E) It is learned that land the company owns and would use for the new project,if it is accepted,could be sold to another firm.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If an asset is sold for less than its book value at the end of a project's life,it will generate a loss for the firm,hence its terminal cash flow will be negative.

B) Only incremental cash flows are relevant in project analysis,the proper incremental cash flows are the reported accounting profits,and thus reported accounting income should be used as the basis for investor and managerial decisions.

C) It is unrealistic to believe that any increases in net operating working capital required at the start of an expansion project can be recovered at the project's completion.Operating working capital like inventory is almost always used up in operations.Thus,cash flows associated with operating working capital should be included only at the start of a project's life.

D) If equipment is expected to be sold for more than its book value at the end of a project's life,this will result in a profit.In this case,despite taxes on the profit,the end-of-project cash flow will be greater than if the asset had been sold at book value,other things held constant.

E) Changes in net operating working capital refer to changes in current assets and current liabilities,not to changes in long-term assets and liabilities,hence they should not be considered in a capital budgeting analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

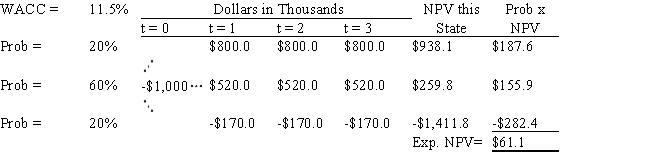

Aggarwal Enterprises is considering a new project that has an initial cash outflow of $1,000,000,and the CFO set up the following simple decision tree to show its three most-likely scenarios.The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so,but to obtain this abandonment option,it would have to make a payment to those parties.How much is the option to abandon worth (in thousands of dollars) to the firm? Do not round the intermediate calculations.

A) $59.7

B) $44.6

C) $58.1

D) $57.1

E) $51.9

Correct Answer

verified

Correct Answer

verified

Multiple Choice

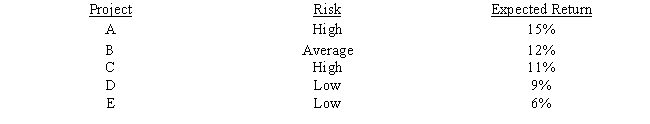

Langston Labs has an overall (composite) WACC of 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Langston evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

A) A and B

B) A,B,and C

C) A,B,and D

D) A,B,C,and D

E) A,B,C,D,and E

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following rules is CORRECT for capital budgeting analysis?

A) The interest paid on funds borrowed to finance a project must be included in estimates of the project's cash flows.

B) Only incremental cash flows,which are the cash flows that would result if a project is accepted,are relevant when making accept/reject decisions for capital budgeting projects.

C) Sunk costs are not included in the annual cash flows,but they must be deducted from the PV of the project's other costs when reaching the accept/reject decision.

D) A proposed project's estimated net income as determined by the firm's accountants,using generally accepted accounting principles (GAAP) ,is discounted at the WACC,and if the PV of this income stream exceeds the project's cost,the project should be accepted.

E) If a product is competitive with some of the firm's other products,this fact should be incorporated into the estimate of the relevant cash flows.However,if the new product is complementary to some of the firm's other products,this fact need not be reflected in the analysis.

Correct Answer

verified

Correct Answer

verified

True/False

Since the focus of capital budgeting is on cash flows rather than on net income,changes in noncash balance sheet accounts such as inventory are not included in a capital budgeting analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In a capital budgeting analysis where part of the funds used to finance the project would be raised as debt,failure to include interest expense as a cost when determining the project's cash flows will lead to an upward bias in the NPV.

B) In a capital budgeting analysis where part of the funds used to finance the project would be raised as debt,failure to include interest expense as a cost when determining the project's cash flows will lead to a downward bias in the NPV.

C) The existence of any type of "externality" will reduce the calculated NPV versus the NPV that would exist without the externality.

D) If one of the assets to be used by a potential project is already owned by the firm,and if that asset could be sold or leased to another firm if the new project were not undertaken,then the net proceeds that could be obtained should be charged as a cost to the project under consideration.

E) If one of the assets to be used by a potential project is already owned by the firm but is not being used,then any costs associated with that asset is a sunk cost and should be ignored.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An externality is a situation where a project would have an adverse effect on some other part of the firm's overall operations.If the project would have a favorable effect on other operations,then this is not an externality.

B) An example of an externality is a situation where a bank opens a new office,and that new office causes deposits in the bank's other offices to increase.

C) The NPV method automatically deals correctly with externalities,even if the externalities are not specifically identified,but the IRR method does not.This is another reason to favor the NPV.

D) Both the NPV and IRR methods deal correctly with externalities,even if the externalities are not specifically identified.However,the payback method does not.

E) Identifying an externality can never lead to an increase in the calculated NPV.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company,CSUS Inc. ,is considering a new project whose data are shown below.The required equipment has a 3-year tax life.Under the new law,the equipment used in the project is eligible for 100% bonus depreciation,so the equipment will be fully depreciated at t = 0.The equipment has no salvage value at the end of the project's life,and the project does not require any additional operating working capital.Revenues and operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow?

A) $8,707

B) $9,231

C) $10,125

D) $10,805

E) $9,756

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 73

Related Exams